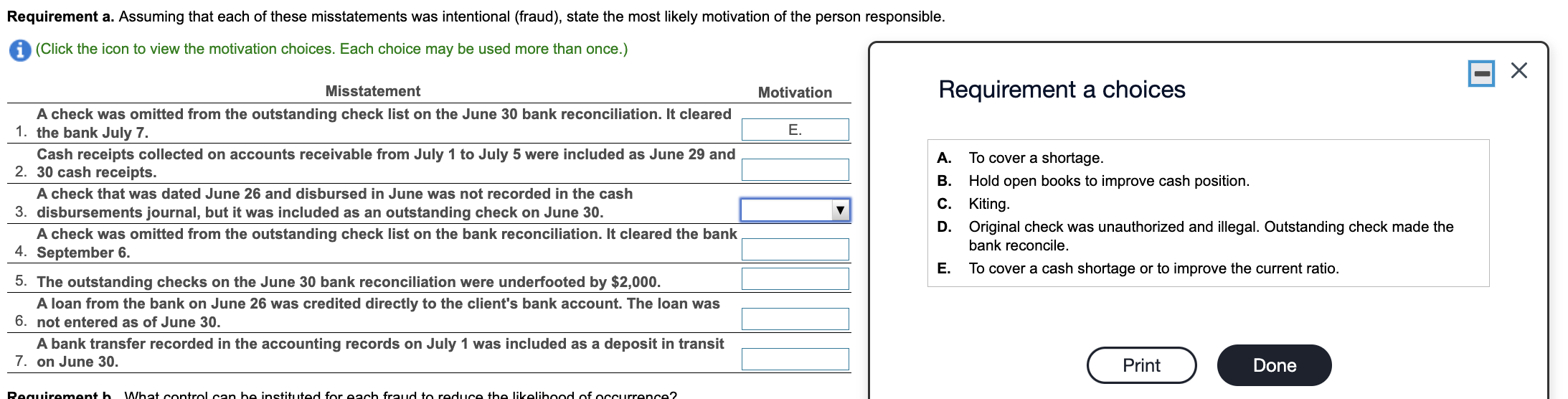

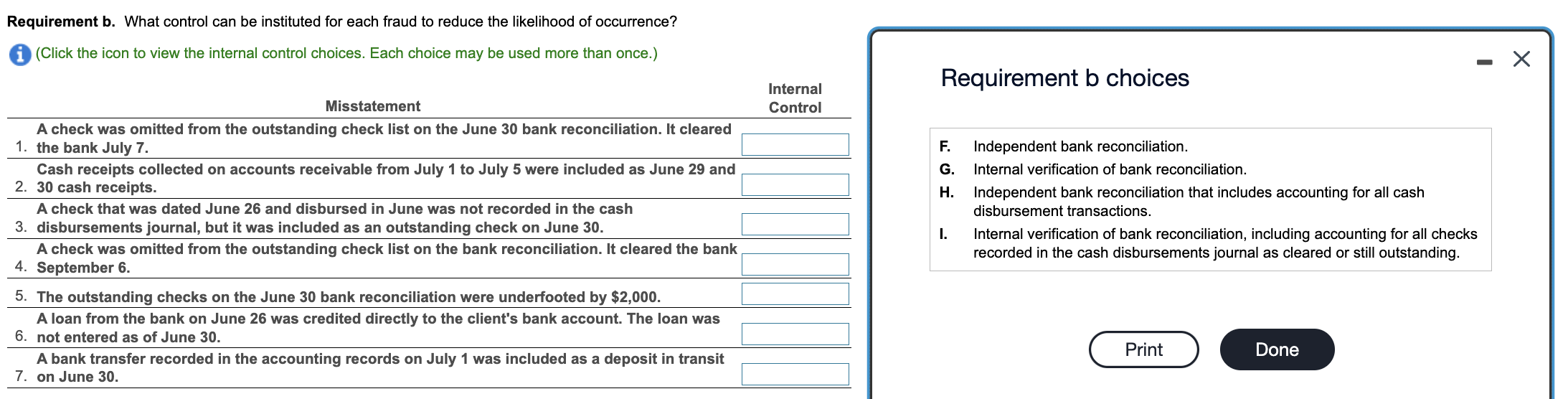

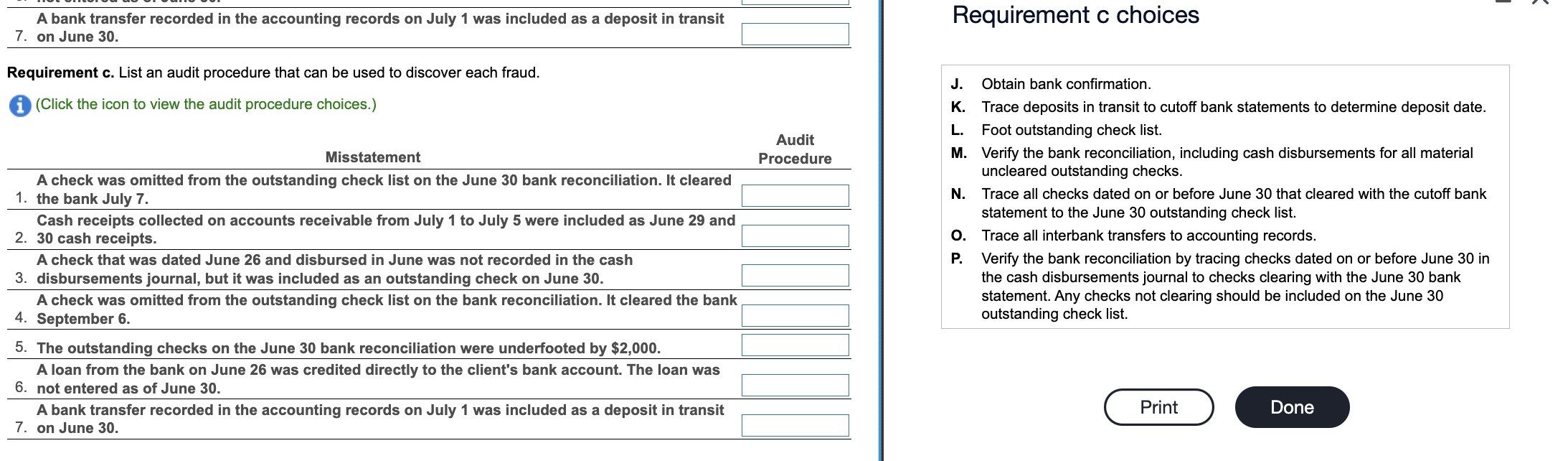

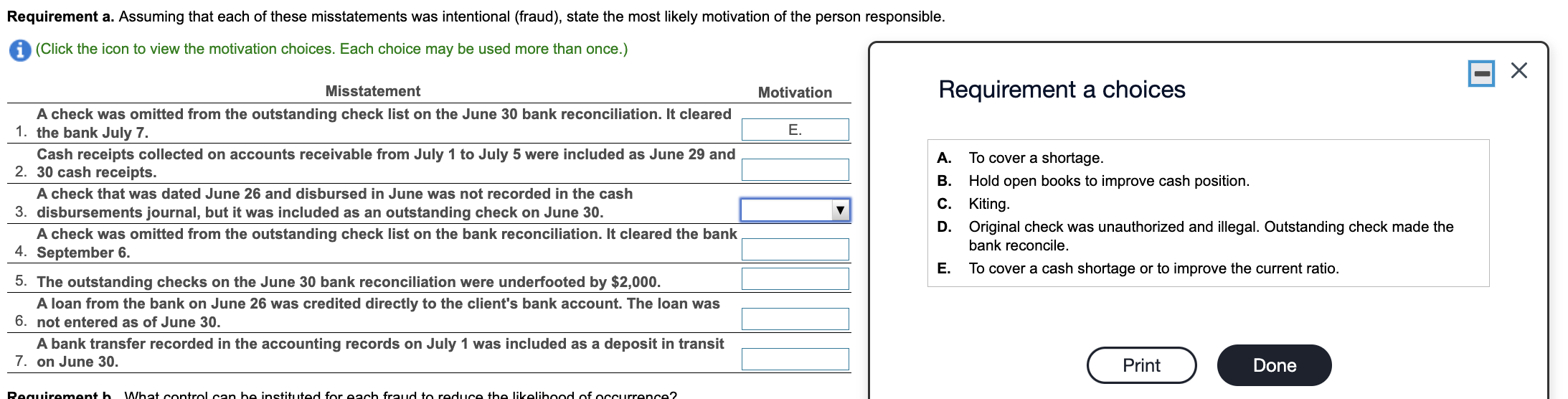

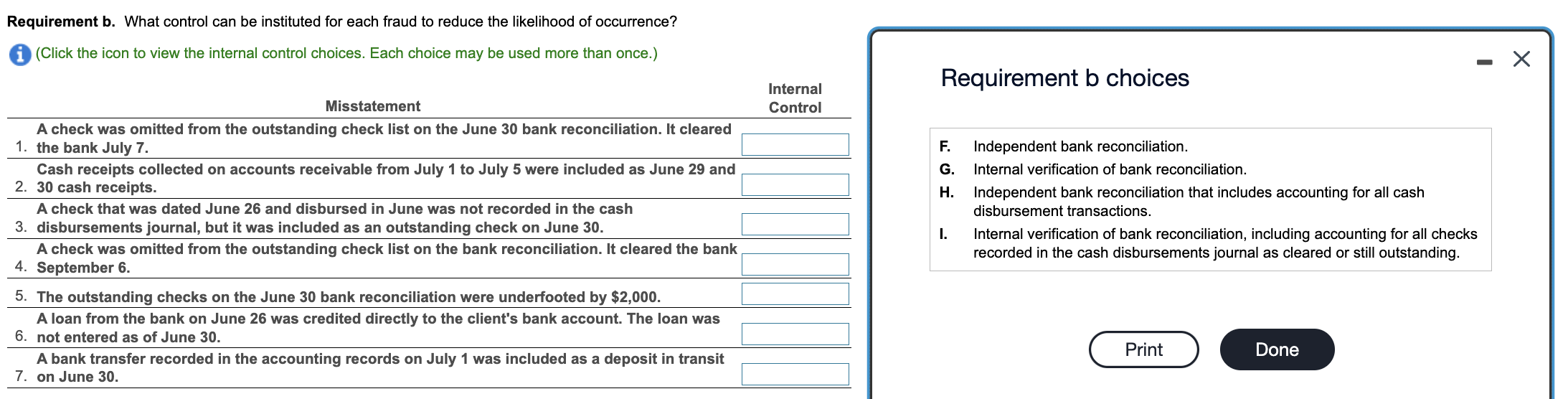

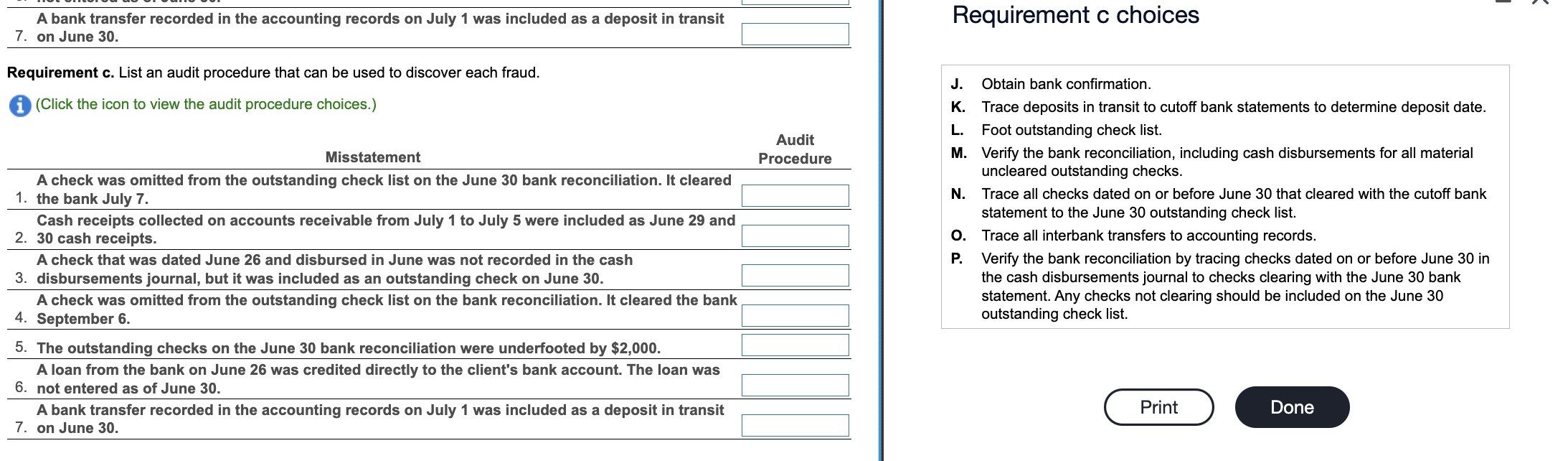

Requirement a choices A. To cover a shortage. B. Hold open books to improve cash position. C. Kiting. D. Original check was unauthorized and illegal. Outstanding check made the bank reconcile. E. To cover a cash shortage or to improve the current ratio. Requirement b. What control can be instituted for each fraud to reduce the likelihood of occurrence? (Click the icon to view the internal control choices. Each choice may be used more than once.) Requirement b choices F. Independent bank reconciliation. G. Internal verification of bank reconciliation. H. Independent bank reconciliation that includes accounting for all cash disbursement transactions. I. Internal verification of bank reconciliation, including accounting for all checks recorded in the cash disbursements journal as cleared or still outstanding. A bank transfer recorded in the accounting records on July 1 was included as a deposit in transit Requirement c choices 7. on June 30. Requirement c. List an audit procedure that can be used to discover each fraud. J. Obtain bank confirmation. (Click the icon to view the audit procedure choices.) K. Trace deposits in transit to cutoff bank statements to determine deposit date. L. Foot outstanding check list. M. Verify the bank reconciliation, including cash disbursements for all material uncleared outstanding checks. 1. the bank July 7. N. Trace all checks dated on or before June 30 that cleared with the cutoff bank Cash receipts collected on accounts receivable from July 1 to July 5 were included as June 29 and statement to the June 30 outstanding check list. 2. 30 cash receipts. O. Trace all interbank transfers to accounting records. A check that was dated June 26 and disbursed in June was not recorded in the cash P. Verify the bank reconciliation by tracing checks dated on or before June 30 in 3. disbursements journal, but it was included as an outstanding check on June 30. the cash disbursements journal to checks clearing with the June 30 bank A check was omitted from the outstanding check list on the bank reconciliation. It cleared the bank statement. Any checks not clearing should be included on the June 30 4. September 6 . outstanding check list. 5. The outstanding checks on the June 30 bank reconciliation were underfooted by $2,000. A loan from the bank on June 26 was credited directly to the client's bank account. The loan was 6. not entered as of June 30 . A bank transfer recorded in the accounting records on July 1 was included as a deposit in transit 7. on June 30. Requirement a choices A. To cover a shortage. B. Hold open books to improve cash position. C. Kiting. D. Original check was unauthorized and illegal. Outstanding check made the bank reconcile. E. To cover a cash shortage or to improve the current ratio. Requirement b. What control can be instituted for each fraud to reduce the likelihood of occurrence? (Click the icon to view the internal control choices. Each choice may be used more than once.) Requirement b choices F. Independent bank reconciliation. G. Internal verification of bank reconciliation. H. Independent bank reconciliation that includes accounting for all cash disbursement transactions. I. Internal verification of bank reconciliation, including accounting for all checks recorded in the cash disbursements journal as cleared or still outstanding. A bank transfer recorded in the accounting records on July 1 was included as a deposit in transit Requirement c choices 7. on June 30. Requirement c. List an audit procedure that can be used to discover each fraud. J. Obtain bank confirmation. (Click the icon to view the audit procedure choices.) K. Trace deposits in transit to cutoff bank statements to determine deposit date. L. Foot outstanding check list. M. Verify the bank reconciliation, including cash disbursements for all material uncleared outstanding checks. 1. the bank July 7. N. Trace all checks dated on or before June 30 that cleared with the cutoff bank Cash receipts collected on accounts receivable from July 1 to July 5 were included as June 29 and statement to the June 30 outstanding check list. 2. 30 cash receipts. O. Trace all interbank transfers to accounting records. A check that was dated June 26 and disbursed in June was not recorded in the cash P. Verify the bank reconciliation by tracing checks dated on or before June 30 in 3. disbursements journal, but it was included as an outstanding check on June 30. the cash disbursements journal to checks clearing with the June 30 bank A check was omitted from the outstanding check list on the bank reconciliation. It cleared the bank statement. Any checks not clearing should be included on the June 30 4. September 6 . outstanding check list. 5. The outstanding checks on the June 30 bank reconciliation were underfooted by $2,000. A loan from the bank on June 26 was credited directly to the client's bank account. The loan was 6. not entered as of June 30 . A bank transfer recorded in the accounting records on July 1 was included as a deposit in transit 7. on June 30