Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requirement b (i). Assume that it is now early 2027 and you are preparing the adjusting entries for 2026. The accounting records indicate that,

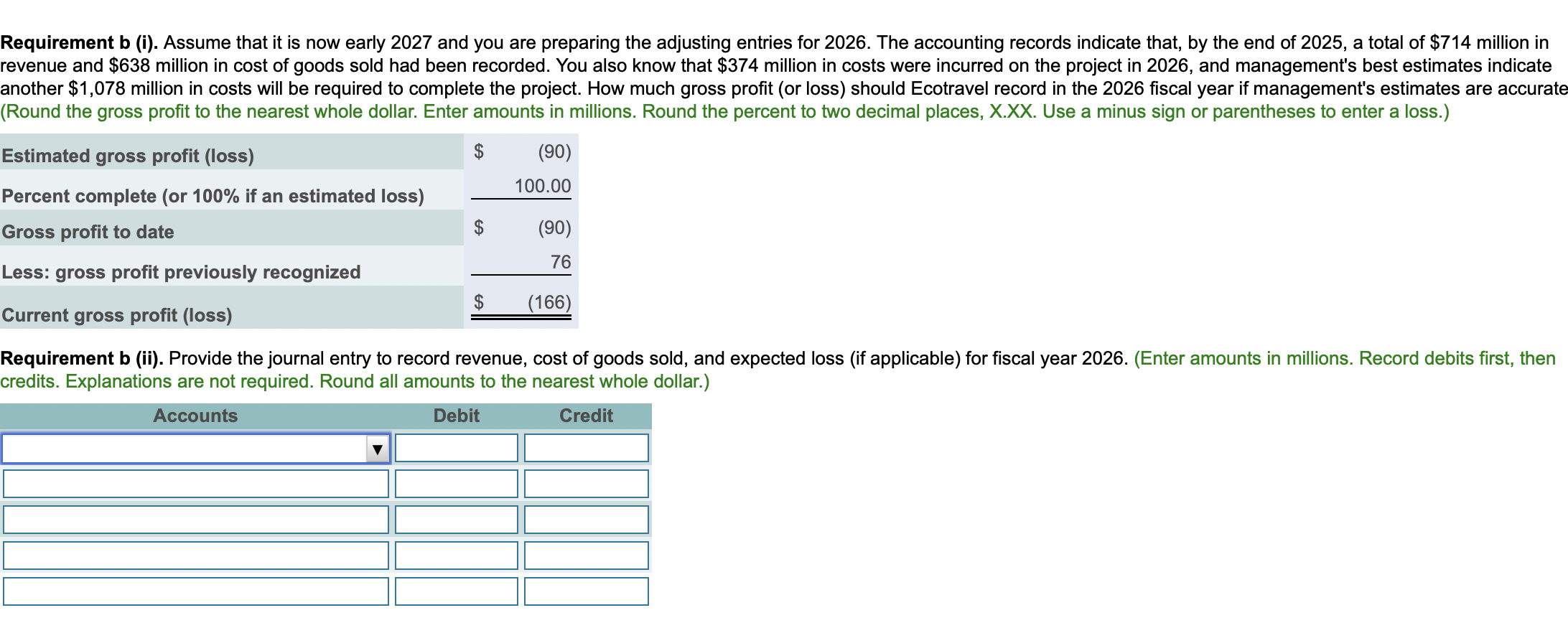

Requirement b (i). Assume that it is now early 2027 and you are preparing the adjusting entries for 2026. The accounting records indicate that, by the end of 2025, a total of $714 million in revenue and $638 million in cost of goods sold had been recorded. You also know that $374 million in costs were incurred on the project in 2026, and management's best estimates indicate another $1,078 million in costs will be required to complete the project. How much gross profit (or loss) should Ecotravel record in the 2026 fiscal year if management's estimates are accurate (Round the gross profit to the nearest whole dollar. Enter amounts in millions. Round the percent to two decimal places, X.XX. Use a minus sign or parentheses to enter a loss.) Estimated gross profit (loss) Percent complete (or 100% if an estimated loss) $ (90) 100.00 $ (90) Gross profit to date Less: gross profit previously recognized Current gross profit (loss) 76 (166) Requirement b (ii). Provide the journal entry to record revenue, cost of goods sold, and expected loss (if applicable) for fiscal year 2026. (Enter amounts in millions. Record debits first, then credits. Explanations are not required. Round all amounts to the nearest whole dollar.) Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started