Answered step by step

Verified Expert Solution

Question

1 Approved Answer

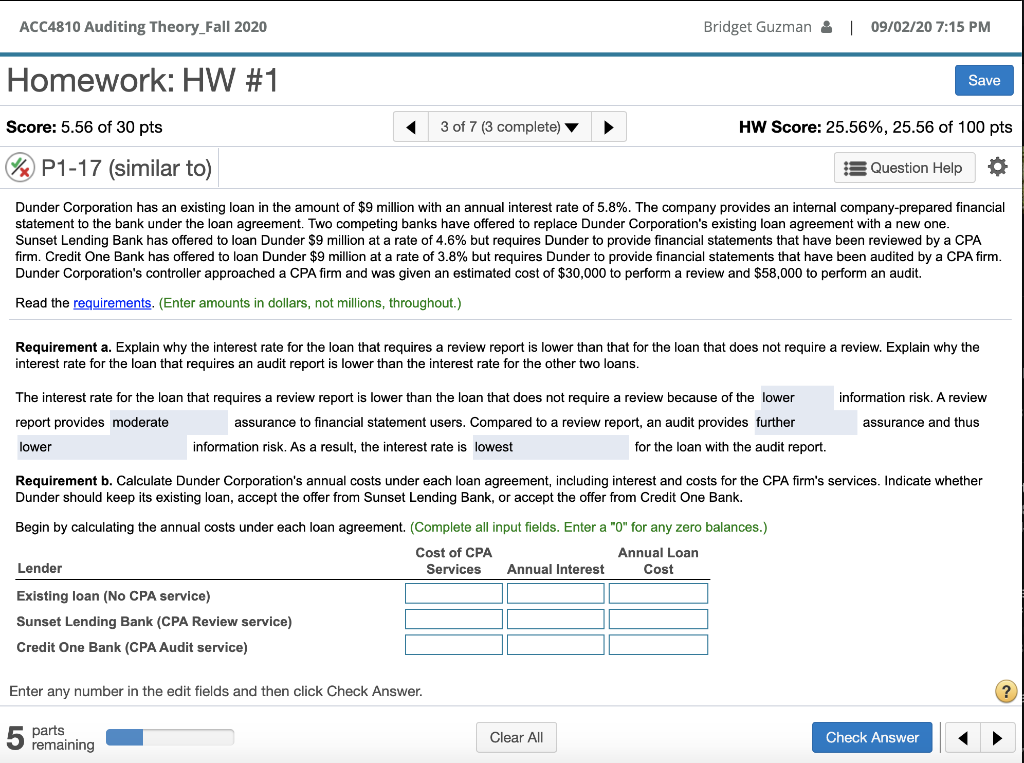

Requirement B i need help with. ACC4810 Auditing Theory_Fall 2020 Bridget Guzman & | 09/02/20 7:15 PM Homework: HW #1 Save Score: 5.56 of 30

Requirement B i need help with.

ACC4810 Auditing Theory_Fall 2020 Bridget Guzman & | 09/02/20 7:15 PM Homework: HW #1 Save Score: 5.56 of 30 pts 3 of 7 (3 complete) HW Score: 25.56%, 25.56 of 100 pts AP1-17 (similar to) 8 Question Help Dunder Corporation has an existing loan in the amount of $9 million with an annual interest rate of 5.8%. The company provides an internal company-prepared financial statement to the bank under the loan agreement. Two competing banks have offered to replace Dunder Corporation's existing loan agreement with new one. Sunset Lending Bank has offered to loan Dunder $9 million at a rate of 4.6% but requires Dunder to provide financial statements that have been reviewed by a CPA firm. Credit One Bank has offered to loan Dunder $9 million at a rate of 3.8% but requires Dunder to provide financial statements that have been audited by a CPA firm Dunder Corporation's controller approached a CPA firm and was given an estimated cost of $30,000 to perform a review and $58,000 to perform an audit. Read the requirements. (Enter amounts in dollars, not millions, throughout.) Requirement a. Explain why the interest rate for the loan that requires a review report is lower than that for the loan that does not require a review. Explain why the interest rate for the loan that requires an audit report is lower than the interest rate for the other two loans. information risk. A review The interest rate for the loan that requires a review report is lower than the loan that does not require a review because of the lower report provides moderate assurance to financial statement users. Compared to a review report, an audit provides further lower information risk. As a result, the interest rate is lowest for the loan with the audit report. assurance and thus Requirement b. Calculate Dunder Corporation's annual costs under each loan agreement, including interest and costs for the CPA firm's services. Indicate whether Dunder should keep its existing loan, accept the offer from Sunset Lending Bank, or accept the offer from Credit One Bank. Begin by calculating the annual costs under each loan agreement. (Complete all input fields. Enter a "0" for any zero balances.) Cost of CPA Annual Loan Lender Services Annual Interest Cost Existing loan (No CPA service) Sunset Lending Bank (CPA Review service) Credit One Bank (CPA Audit service) Enter any number in the edit fields and then click Check Answer. parts remaining Clear All CheckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started