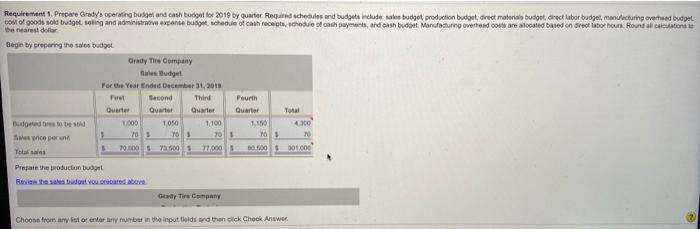

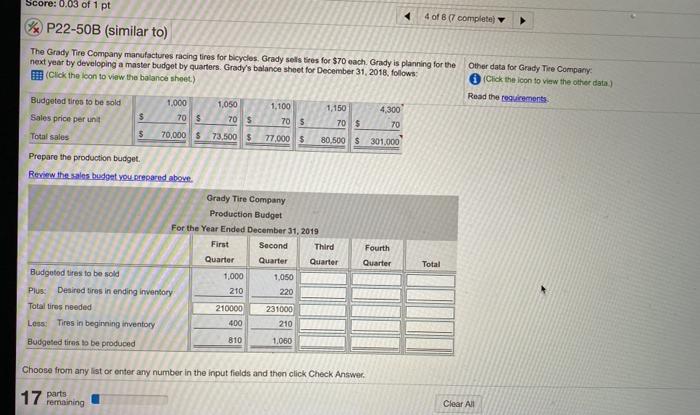

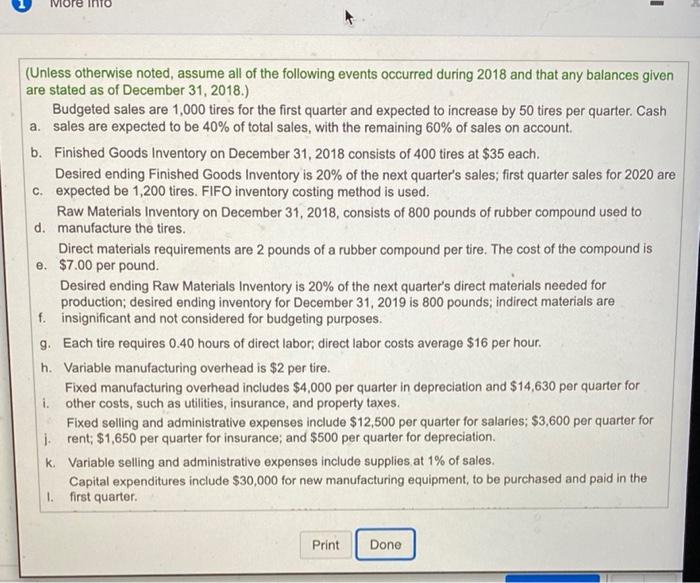

Requirement Property cortina budget and cash budget for 2019 by quarter Regard schedules and budget de les budget production budget direct materials budget, redtubor budget, menecturing overhead budpel post of goods sold budget saling and administra excente busy schedule of cash recheo coth payments, and cash budget Manufacturing overtred costs are located based on Grect bo hours Rount al cente hantar dollar Begin by preparing the sales budget Grady The Company Budget For the Year Ended December 31, 2013 Ft Second Third Fourth Quarter Quarter Qur Quarter Total Bileted to 1.000 1050 1.100 11 4300 we mice per und TOS 701 YO TO 70.000 37.500 17.000 000 30.000 Prepare the production but Besten the studovated above Gel Tire Company Choose from any store any number in the putted and then click Check Answer. Score: 0.03 of 1 pt 4 of 7 complete P22-50B (similar to) The Grady Tire Company manufactures racing tires for bicycles. Grady sets tres for $70 each. Grady is planning for the next year by developing a master budget by quarters. Grady's balance sheet for December 31, 2018, follows: (Click the icon to view the balance sheet.) Other data for Grady Tire Company Click the icon to view the other data) Read the requirements Budgeted tires to be sold Sales price per unit $ 1,000 1,050 70 $ 705 70,000 $ 73.500 $ 1,100 70 $ 77,000 $ 1,150 4,300 70 $ 70 80,500 $ 301,000 Total sales 3 Prepare the production budget Review the sales budget you prepared above Fourth Quarter Total Grady Tire Company Production Budget For the Year Ended December 31, 2019 First Second Third Quarter Quarter Quarter Budgeted tires to be sold 1.000 1,050 Plus Desired tires in ending inventory 210 220 Total tiros needed 210000 231000 Less Tires in beginning inventory 400 210 810 1.060 Budgeted tires to be produced Choose from any list or enter any number in the input fields and then click Check Answer 17 parts remaining Clear All More into - (Unless otherwise noted, assume all of the following events occurred during 2018 and that any balances given are stated as of December 31, 2018.) Budgeted sales are 1,000 tires for the first quarter and expected to increase by 50 tires per quarter. Cash a. sales are expected to be 40% of total sales, with the remaining 60% of sales on account. b. Finished Goods Inventory on December 31, 2018 consists of 400 tires at $35 each. Desired ending Finished Goods Inventory is 20% of the next quarter's sales; first quarter sales for 2020 are C. expected be 1,200 tires. FIFO inventory costing method is used. Raw Materials Inventory on December 31, 2018, consists of 800 pounds of rubber compound used to d. manufacture the tires. Direct materials requirements are 2 pounds of a rubber compound per tire. The cost of the compound is e. $7.00 per pound. Desired ending Raw Materials Inventory is 20% of the next quarter's direct materials needed for production; desired ending inventory for December 31, 2019 is 800 pounds; indirect materials are f. insignificant and not considered for budgeting purposes. g. Each tire requires 0.40 hours of direct labor; direct labor costs average $16 per hour. h. Variable manufacturing overhead is $2 per tire. Fixed manufacturing overhead includes $4,000 per quarter in depreciation and $14,630 per quarter for i. other costs, such as utilities, insurance, and property taxes. Fixed selling and administrative expenses include $12,500 per quarter for salaries; $3,600 per quarter for i rent; $1,650 per quarter for insurance; and $500 per quarter for depreciation. k. Variable selling and administrative expenses include supplies at 1% of sales. Capital expenditures include $30,000 for new manufacturing equipment, to be purchased and paid in the I first quarter. Print Done