Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requirement: What is the MAXIMUM whole number (i.e., no part shares or fractional shares) of Y CS that may be issued by AltaCo to OntCo

Requirement:

What is the MAXIMUM whole number (i.e., no part shares or fractional shares) of Y CS that may be issued by AltaCo to OntCo without creating association between the two corporations, pursuant to subsection 256(1) of the ITA? The numerical answer alone is sufficient. No reasons are required

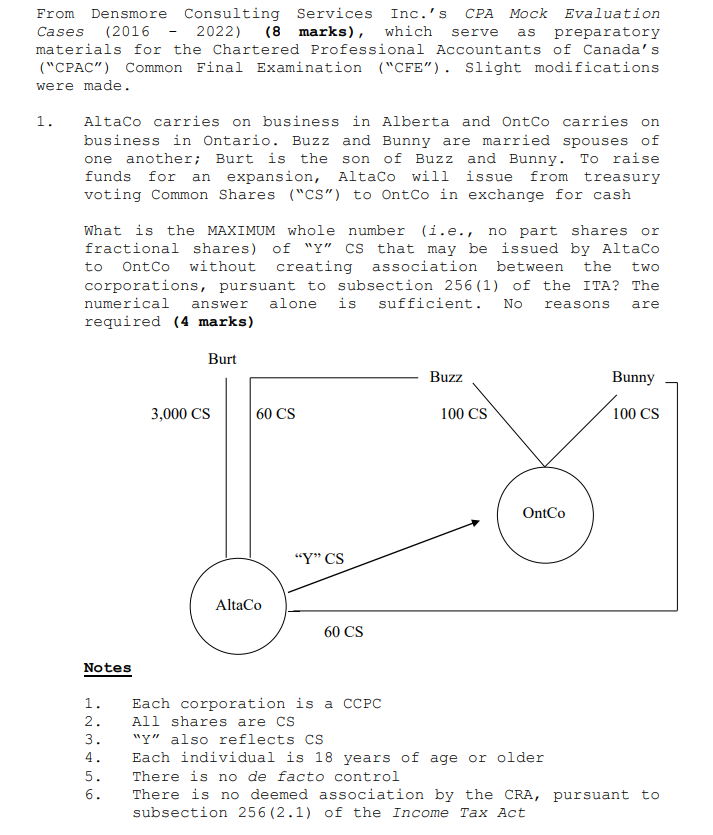

From Densmore Consulting Services Inc.'s CPA Mock Evaluation Cases (2016 - 2022) (8 marks), which serve as preparatory materials for the Chartered Professional Accountants of Canada's ("CPAC") Common Final Examination ("CFE"). Slight modifications were made. 1. AltaCo carries on business in Alberta and OntCo carries on business in Ontario. Buzz and Bunny are married spouses of one another; Burt is the son of Buzz and Bunny. To raise funds for an expansion, AltaCo will issue from treasury voting Common Shares ("CS") to OntCo in exchange for cash What is the MAXIMUM whole number (i.e., no part shares or fractional shares) of " Y " CS that may be issued by AltaCo to ontco without creating association between the two corporations, pursuant to subsection 256 (1) of the ITA? The numerical answer alone is sufficient. No reasons are required (4 marks) Notes 1. Each corporation is a CCPC 2. All shares are CS 3. " Y " also reflects CS 4. Each individual is 18 years of age or older 5. There is no de facto control 6. There is no deemed association by the CRA, pursuant to subsection 256(2.1) of the Income Tax ActStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started