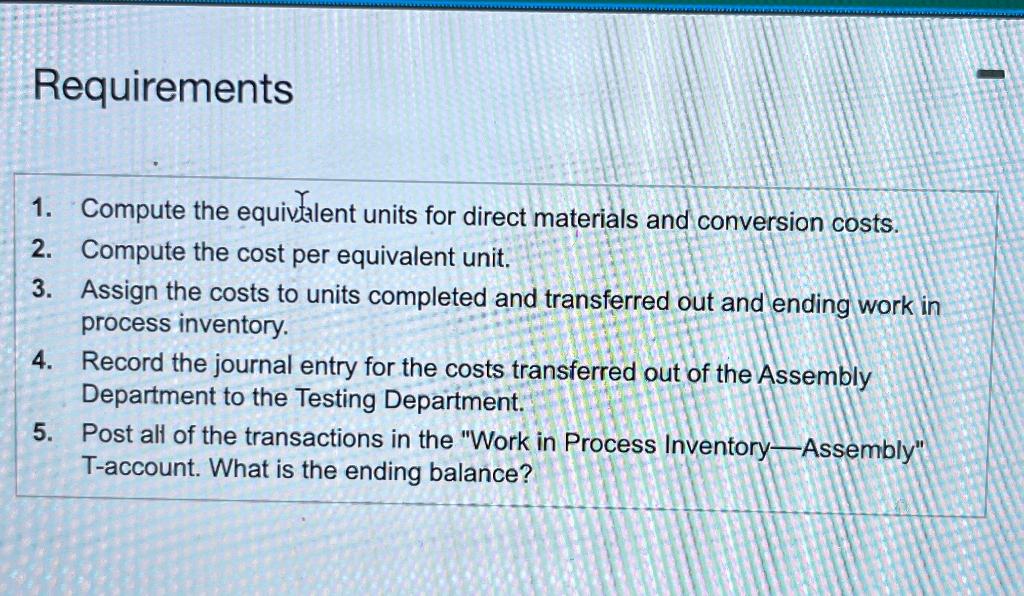

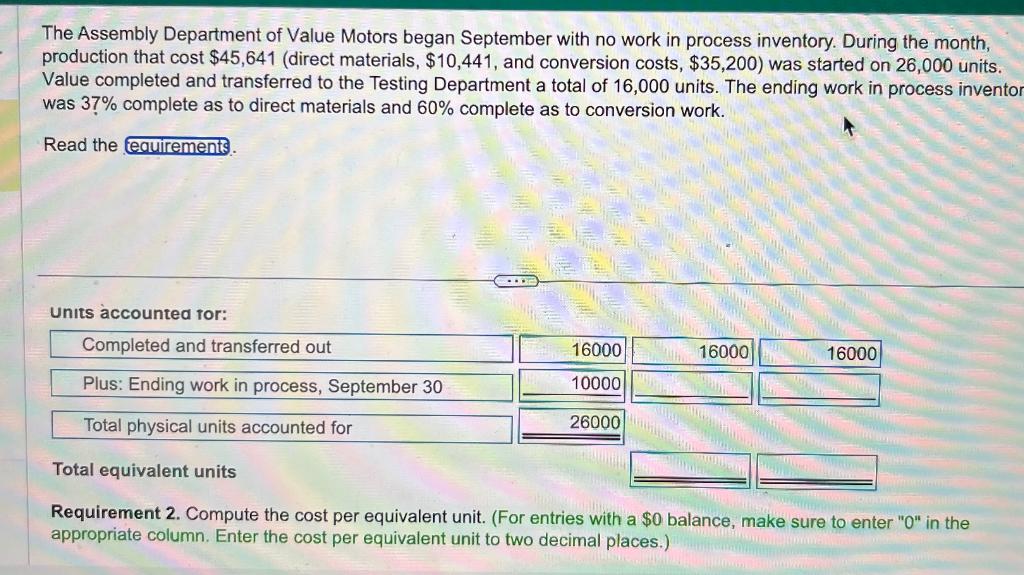

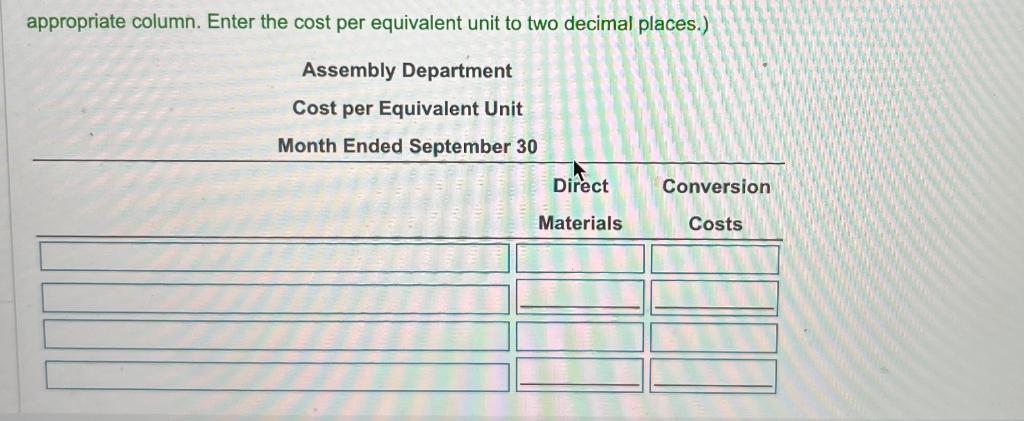

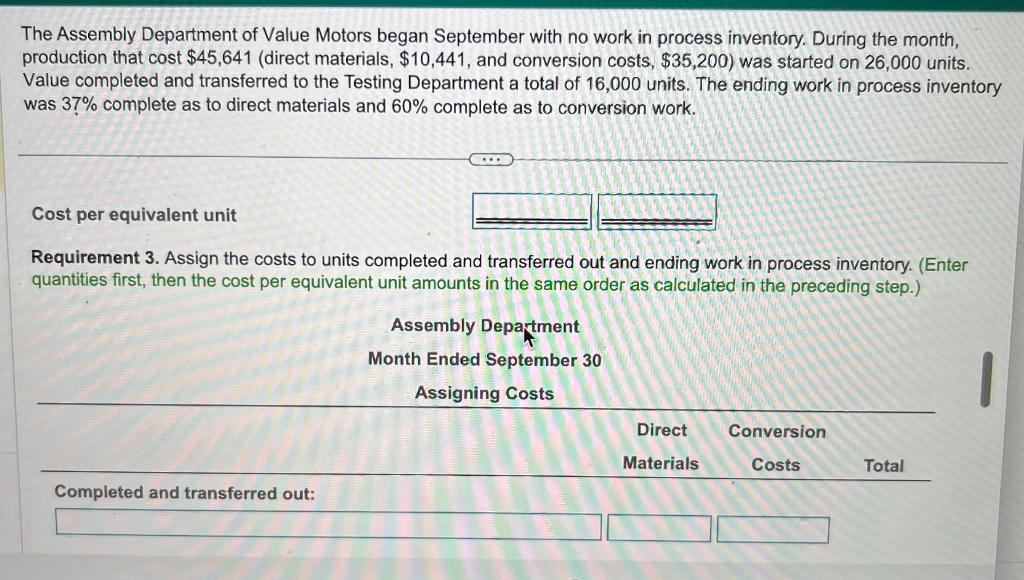

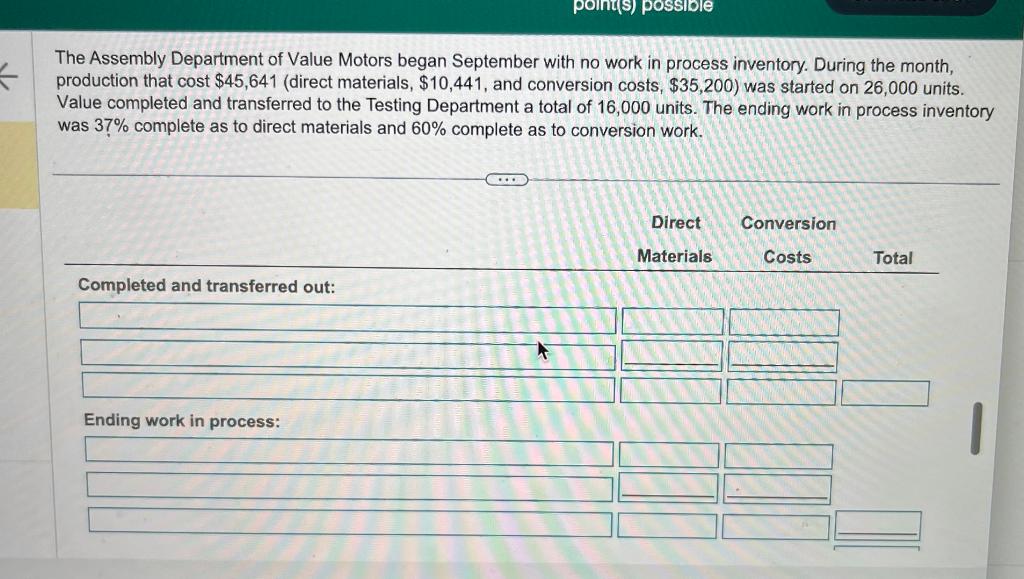

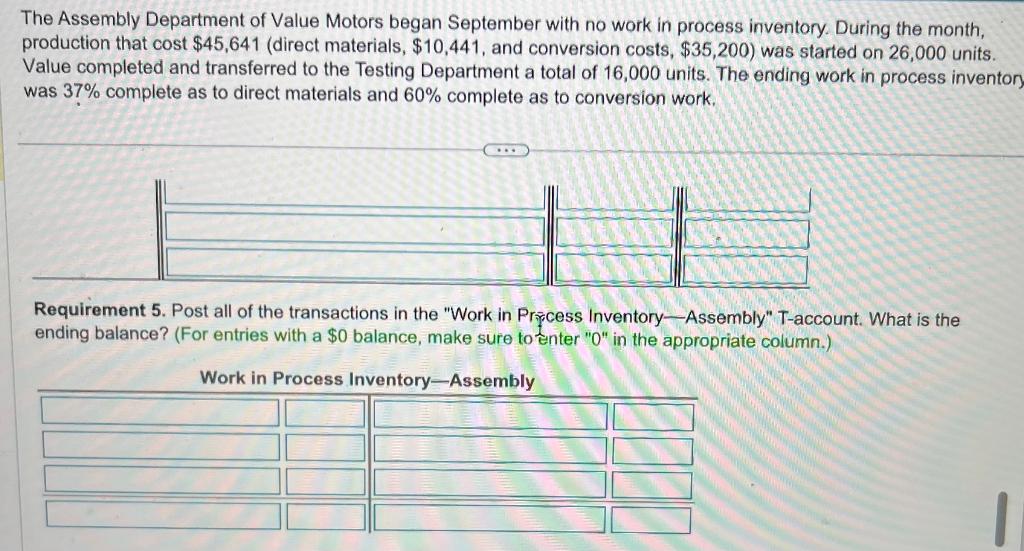

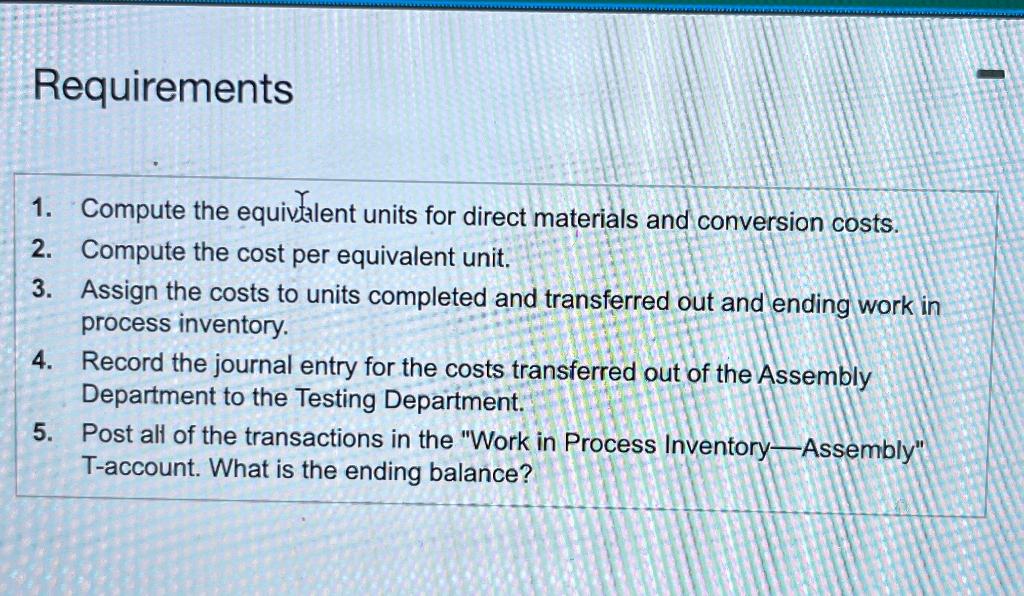

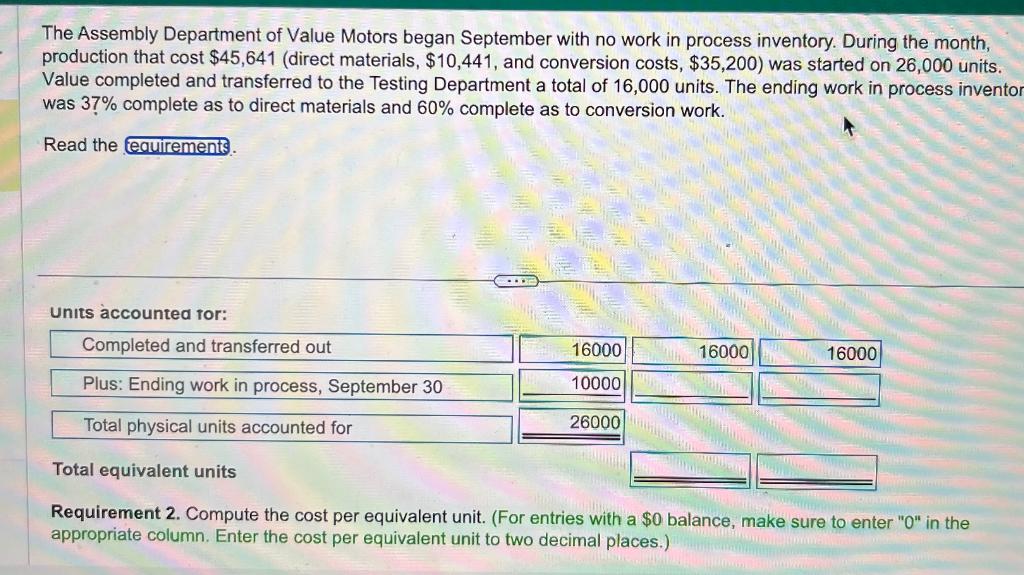

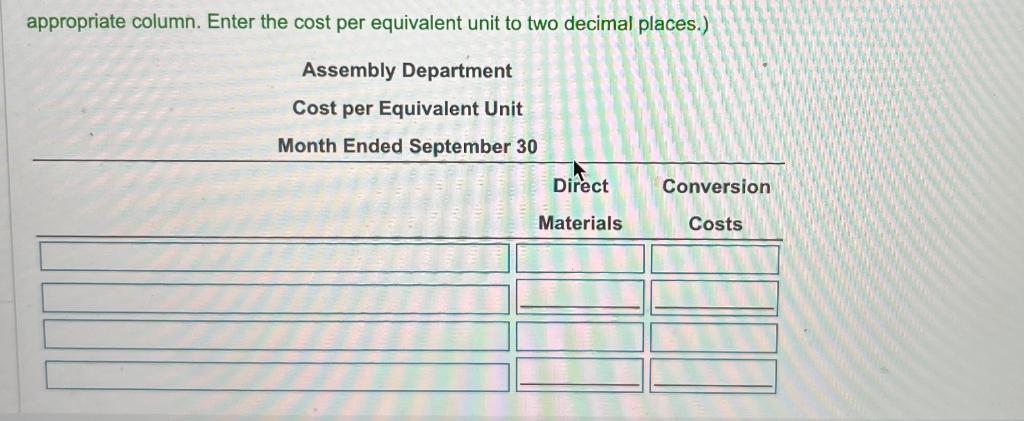

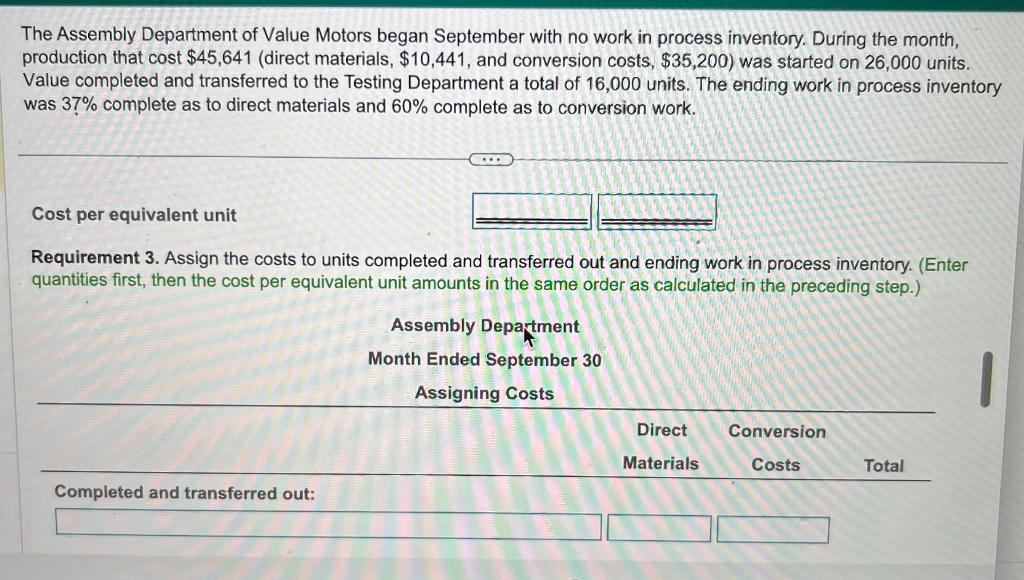

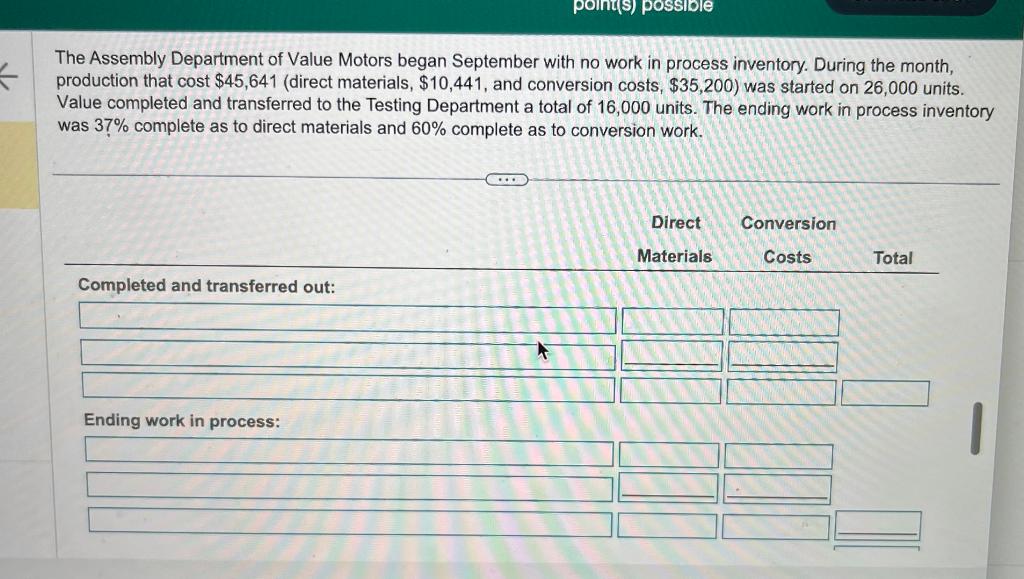

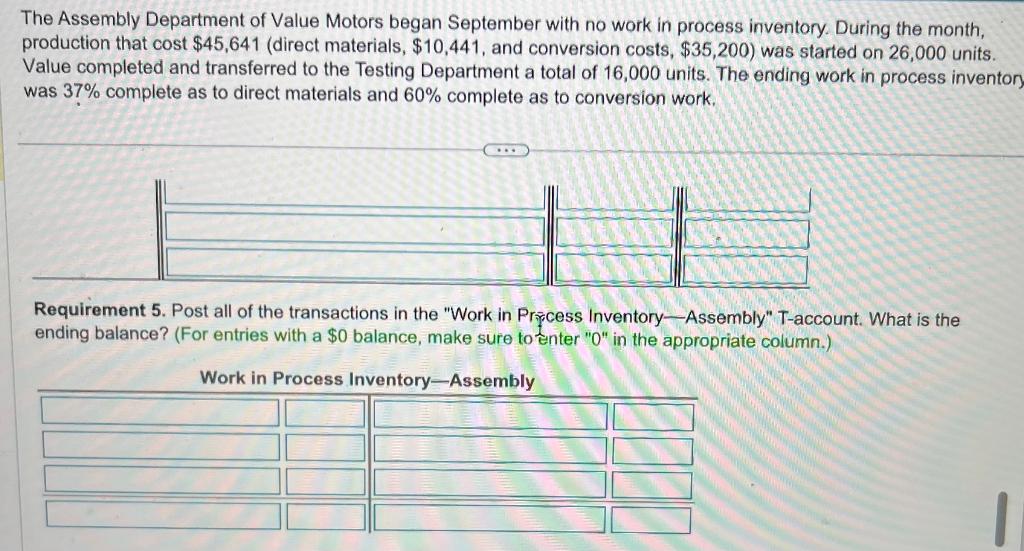

Requirements 1. Compute the equivetlent units for direct materials and conversion costs. 2. Compute the cost per equivalent unit. 3. Assign the costs to units completed and transferred out and ending work in process inventory. 4. Record the journal entry for the costs transferred out of the Assembly Department to the Testing Department. 5. Post all of the transactions in the "Work in Process Inventory-Assembly" T-account. What is the ending balance? The Assembly Department of Value Motors began September with no work in process inventory. During the month, production that cost $45,641 (direct materials, $10,441, and conversion costs, $35,200 ) was started on 26,000 units. Value completed and transferred to the Testing Department a total of 16,000 units. The ending work in process inventor was 37% complete as to direct materials and 60% complete as to conversion work. Read the Requirement 2. Compute the cost per equivalent unit. (For entries with a $0 balance, make sure to enter "0" in the appropriate column. Enter the cost per equivalent unit to two decimal places.) appropriate column. Enter the cost per equivalent unit to two decimal places.) The Assembly Department of Value Motors began September with no work in process inventory. During the month, production that cost $45,641 (direct materials, $10,441, and conversion costs, $35,200 ) was started on 26,000 units. Value completed and transferred to the Testing Department a total of 16,000 units. The ending work in process inventory was 37% complete as to direct materials and 60% complete as to conversion work. Requirement 3. Assign the costs to units completed and transferred out and ending work in process inventory. (Enter quantities first, then the cost per equivalent unit amounts in the same order as calculated in the preceding step.) The Assembly Department of Value Motors began September with no work in process inventory. During the month, production that cost $45,641 (direct materials, $10,441, and conversion costs, $35,200 ) was started on 26,000 units. Value completed and transferred to the Testing Department a total of 16,000 units. The ending work in process inventory was 37% complete as to direct materials and 60% complete as to conversion work. The Assembly Department of Value Motors began September with no work in process inventory. During the month, production that cost $45,641 (direct materials, $10,441, and conversion costs, $35,200 ) was started on 26,000 units. Value completed and transferred to the Testing Department a total of 16,000 units. The ending work in process invento was 37% complete as to direct materials and 60% complete as to conversion work. Requirement 5. Post all of the transactions in the "Work in Priscess Inventory-Assembly" T-account. What is the ending balance? (For entries with a $0 balance, make sure to enter "0" in the appropriate column.)