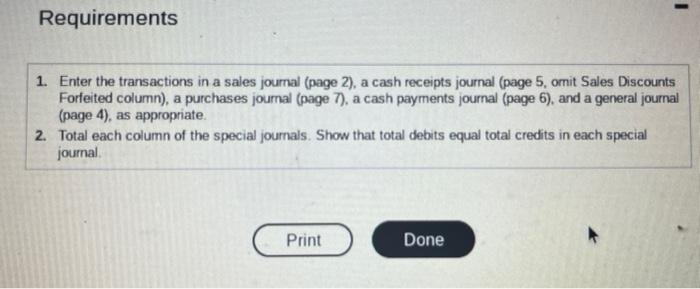

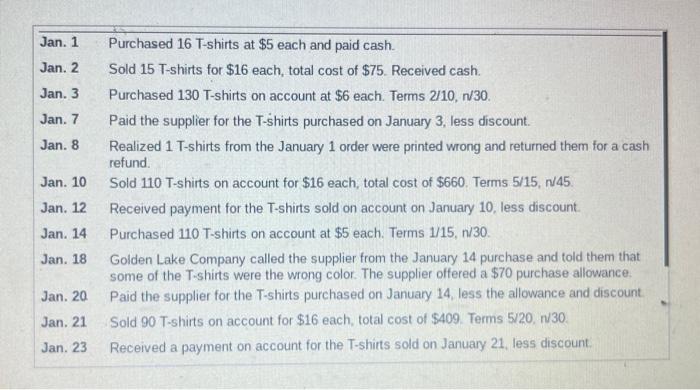

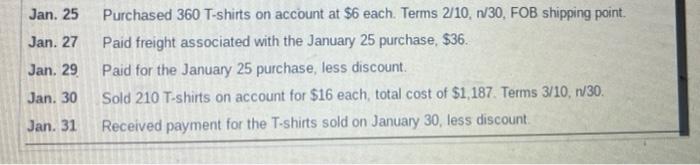

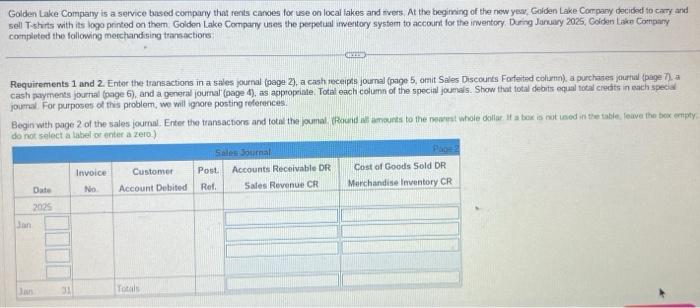

Requirements 1. Enter the transactions in a sales journal (page 2), a cash receipts journal (page 5, omit Sales Discounts Forfeited column), a purchases journal (page 7), a cash payments journal (page 6), and a general journal (page 4), as appropriate. 2. Total each column of the special journals. Show that total debits equal total credits in each special joumal. Jan. 1 Purchased 16 T-shirts at $5 each and paid cash. Jan. 2 Sold 15 T-shirts for $16 each, total cost of $75. Received cash. Jan. 3 Purchased 130 T-shirts on account at $6 each. Terms 2/10,N/30. Jan. 7 Paid the supplier for the T-shirts purchased on January 3, less discount. Jan. 8 Realized 1 T-shirts from the January 1 order were printed wrong and returned them for a cash refund. Jan. 10 Sold 110 T-shirts on account for $16 each, total cost of $660. Terms 5/15, n/45. Jan. 12 Received payment for the T-shirts sold on account on January 10, less discount. Jan. 14 Purchased 110 T-shirts on account at $5 each. Terms 1/15,n/30. Jan. 18 Golden Lake Company called the supplier from the January 14 purchase and told them that some of the T-shirts were the wrong color. The supplier offered a $70 purchase allowance. Jan. 20 Paid the supplier for the T-shirts purchased on January 14, less the allowance and discount. Jan. 21 Sold 90 T-shirts on account for $16 each, total cost of \$409. Terms 5/20, n/30. Jan. 23 Received a payment on account for the T-shitts sold on January 21, less discount. Jan. 25 Purchased 360 T-shirts on account at $6 each. Terms 2/10,n/30, FOB shipping point. Jan. 27 Paid freight associated with the January 25 purchase, $36. Jan. 29. Paid for the January 25 purchase, less discount. Jan. 30 Sold 210 T-shirts on account for $16 each, total cost of $1,187. Terms 3/10,n/30. Jan. 31 Received payment for the T-shirts sold on January 30 , less discount. Golden Lake Company is a service based compary that rents canoes for use on local lakes and svers. At the begiming of the new year, Golden Lake Compary decided to cary and sell T-shirts with its logo printed on them. Golden Lake Company uses the perpetual irwentory system to account for the inventory, During Jaruily 2025 , Goidan Lakn Cornpary comploted the following merchandising traneactions Requirements 1 and 2 . Enter the transactions in a sales journal (paga 2), a cash receipts journal (page 5, omit Sales Discounts Forfeited column), a purchares journal (page 7. a cash payments jpurtal (page 6), and a peneral joumal (gage 4), as appropriale. Total each column of the special joumais. Show that total debits equal total credits in each specal joumal. For purposes of this problem, we will ignore posting references. Requirements 1. Enter the transactions in a sales journal (page 2), a cash receipts journal (page 5, omit Sales Discounts Forfeited column), a purchases journal (page 7), a cash payments journal (page 6), and a general journal (page 4), as appropriate. 2. Total each column of the special journals. Show that total debits equal total credits in each special joumal. Jan. 1 Purchased 16 T-shirts at $5 each and paid cash. Jan. 2 Sold 15 T-shirts for $16 each, total cost of $75. Received cash. Jan. 3 Purchased 130 T-shirts on account at $6 each. Terms 2/10,N/30. Jan. 7 Paid the supplier for the T-shirts purchased on January 3, less discount. Jan. 8 Realized 1 T-shirts from the January 1 order were printed wrong and returned them for a cash refund. Jan. 10 Sold 110 T-shirts on account for $16 each, total cost of $660. Terms 5/15, n/45. Jan. 12 Received payment for the T-shirts sold on account on January 10, less discount. Jan. 14 Purchased 110 T-shirts on account at $5 each. Terms 1/15,n/30. Jan. 18 Golden Lake Company called the supplier from the January 14 purchase and told them that some of the T-shirts were the wrong color. The supplier offered a $70 purchase allowance. Jan. 20 Paid the supplier for the T-shirts purchased on January 14, less the allowance and discount. Jan. 21 Sold 90 T-shirts on account for $16 each, total cost of \$409. Terms 5/20, n/30. Jan. 23 Received a payment on account for the T-shitts sold on January 21, less discount. Jan. 25 Purchased 360 T-shirts on account at $6 each. Terms 2/10,n/30, FOB shipping point. Jan. 27 Paid freight associated with the January 25 purchase, $36. Jan. 29. Paid for the January 25 purchase, less discount. Jan. 30 Sold 210 T-shirts on account for $16 each, total cost of $1,187. Terms 3/10,n/30. Jan. 31 Received payment for the T-shirts sold on January 30 , less discount. Golden Lake Company is a service based compary that rents canoes for use on local lakes and svers. At the begiming of the new year, Golden Lake Compary decided to cary and sell T-shirts with its logo printed on them. Golden Lake Company uses the perpetual irwentory system to account for the inventory, During Jaruily 2025 , Goidan Lakn Cornpary comploted the following merchandising traneactions Requirements 1 and 2 . Enter the transactions in a sales journal (paga 2), a cash receipts journal (page 5, omit Sales Discounts Forfeited column), a purchares journal (page 7. a cash payments jpurtal (page 6), and a peneral joumal (gage 4), as appropriale. Total each column of the special joumais. Show that total debits equal total credits in each specal joumal. For purposes of this problem, we will ignore posting references