Answered step by step

Verified Expert Solution

Question

1 Approved Answer

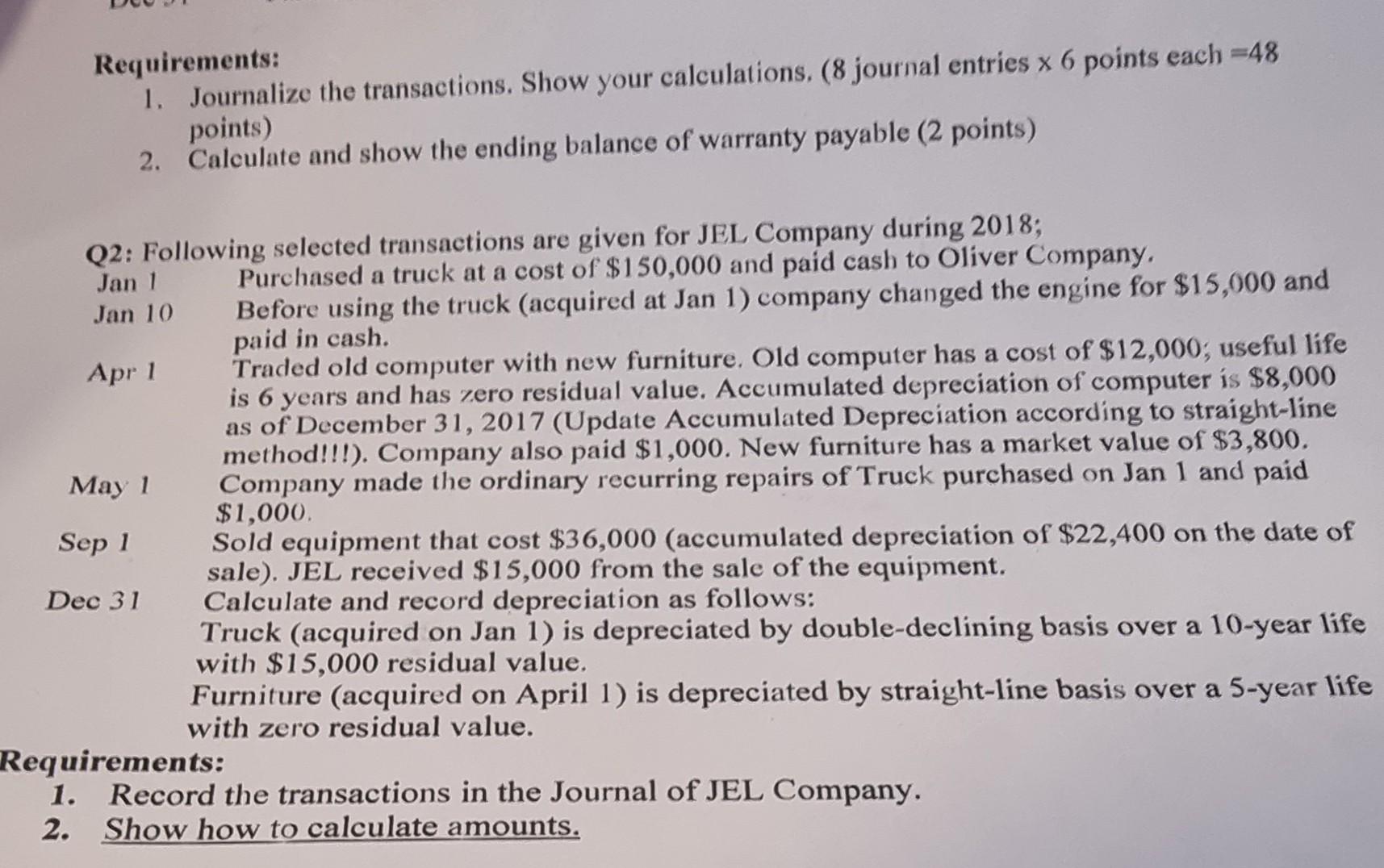

Requirements: 1. Journalize the transactions. Show your calculations, ( 8 journal entries 6 points each =48 points) 2. Calculate and show the ending balance of

Requirements: 1. Journalize the transactions. Show your calculations, ( 8 journal entries 6 points each =48 points) 2. Calculate and show the ending balance of warranty payable ( 2 points) Q2: Following selected transactions are given for JEL Company during 2018; Jan 1 Purchased a truck at a cost of $150,000 and paid cash to Oliver Company. Jan 10 Before using the truck (acquired at Jan 1) company changed the engine for $15,000 and A paid in cash. Traded old computer with new furniture. Old computer has a cost of $12,000; useful life is 6 years and has zero residual value. Accumulated depreciation of computer is $8,000 as of December 31, 2017 (Update Accumulated Depreciation according to straight-line method!!!). Company also paid $1,000. New furniture has a market value of $3,800. May 1 Company made the ordinary recurring repairs of Truck purchased on Jan 1 and paid Sep 1$1,000 Sold equipment that cost $36,000 (accumulated depreciation of $22,400 on the date of sale). JEL received $15,000 from the sale of the equipment. Dec 31 Calculate and record depreciation as follows: Truck (acquired on Jan 1) is depreciated by double-declining basis over a 10-year life with $15,000 residual value. Furniture (acquired on April 1) is depreciated by straight-line basis over a 5-year life with zero residual value. equirements: 1. Record the transactions in the Journal of JEL Company. 2. Show how to calculate amounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started