Answered step by step

Verified Expert Solution

Question

1 Approved Answer

REQUIREMENTS: 1. Prepare Journal Entries in the General Journal and post to the General Ledger. 2. Prepare adjusting entries in the General Journal and

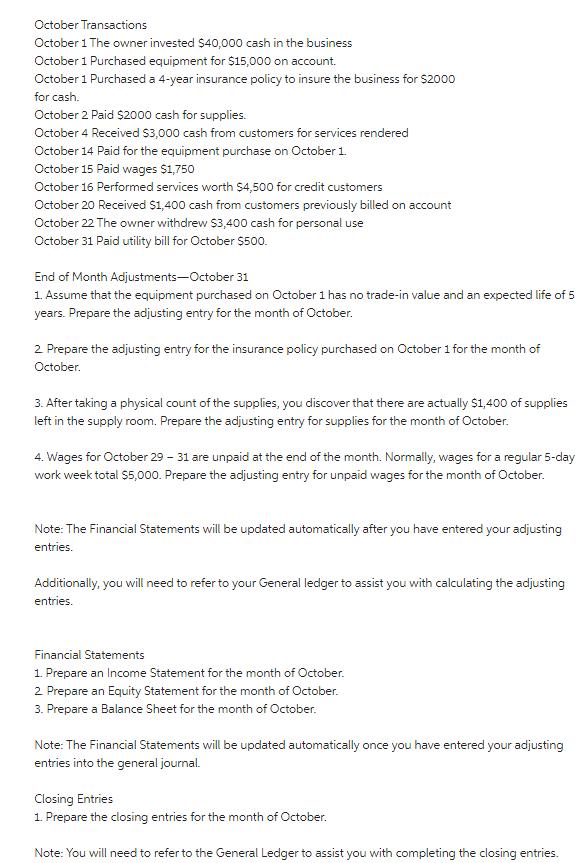

REQUIREMENTS: 1. Prepare Journal Entries in the General Journal and post to the General Ledger. 2. Prepare adjusting entries in the General Journal and post to the General Ledger. 3. Prepare an Income Statement, Equity Statement, and Balance Sheet 4. Prepare closing entries in the General Journal for the month of October. Note: If you are using the Journal Forms provided in Excel, you will only need to enter your transactions in the journal. The General Ledger and the Financial Statements will be updated once you enter your answers into the journal. You should enter your transactions in the green-colored cells. You should not change or alter any other part of the spreadsheet as formulas from the General Ledger and Financial Statements are linked to the journal. If you are completing this project manually, then I suggest that you use T-accounts as your General Ledger. For each transaction below, record journal entries in proper format before you post to the ledger. Use the following accounts: Cash, Accounts Payable, Accounts Receivable, Equipment, Supplies, Capital, Drawing, Repair Revenue, Prepaid Insurance, Wages Expense, Utilities Expense, Depreciation Expense, Accumulated Depreciation, Insurance Expense, Supplies Expense, Wages Payable Note: These Accounts are already set up for you in the Chart of Accounts in the Excel Document that has been provided. October Transactions October 1 The owner invested $40,000 cash in the business October 1 Purchased equipment for $15,000 on account. October 1 Purchased a 4-year insurance policy to insure the business for $2000 for cash. October 2 Paid $2000 cash for supplies. October 4 Received $3,000 cash from customers for services rendered October 14 Paid for the equipment purchase on October 1. October 15 Paid wages $1,750 October 16 Performed services worth $4,500 for credit customers October 20 Received $1,400 cash from customers previously billed on account October 22 The owner withdrew $3,400 cash for personal use October 31 Paid utility bill for October $500. End of Month Adjustments-October 31 1. Assume that the equipment purchased on October 1 has no trade-in value and an expected life of 5 years. Prepare the adjusting entry for the month of October. 2. Prepare the adjusting entry for the insurance policy purchased on October 1 for the month of October. 3. After taking a physical count of the supplies, you discover that there are actually $1,400 of supplies left in the supply room. Prepare the adjusting entry for supplies for the month of October. 4. Wages for October 29 - 31 are unpaid at the end of the month. Normally, wages for a regular 5-day work week total $5,000. Prepare the adjusting entry for unpaid wages for the month of October. Note: The Financial Statements will be updated automatically after you have entered your adjusting entries. Additionally, you will need to refer to your General ledger to assist you with calculating the adjusting entries. Financial Statements 1. Prepare an Income Statement for the month of October. 2. Prepare an Equity Statement for the month of October. 3. Prepare a Balance Sheet for the month of October. Note: The Financial Statements will be updated automatically once you have entered your adjusting entries into the general journal. Closing Entries 1. Prepare the closing entries for the month of October. Note: You will need to refer to the General Ledger to assist you with completing the closing entries.

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started