Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requirements 1. Prepare The Tasty Ice Cream Shoppe's June income statement using a traditional format. 2. Prepare The Tasty Ice Cream Shoppe's June income

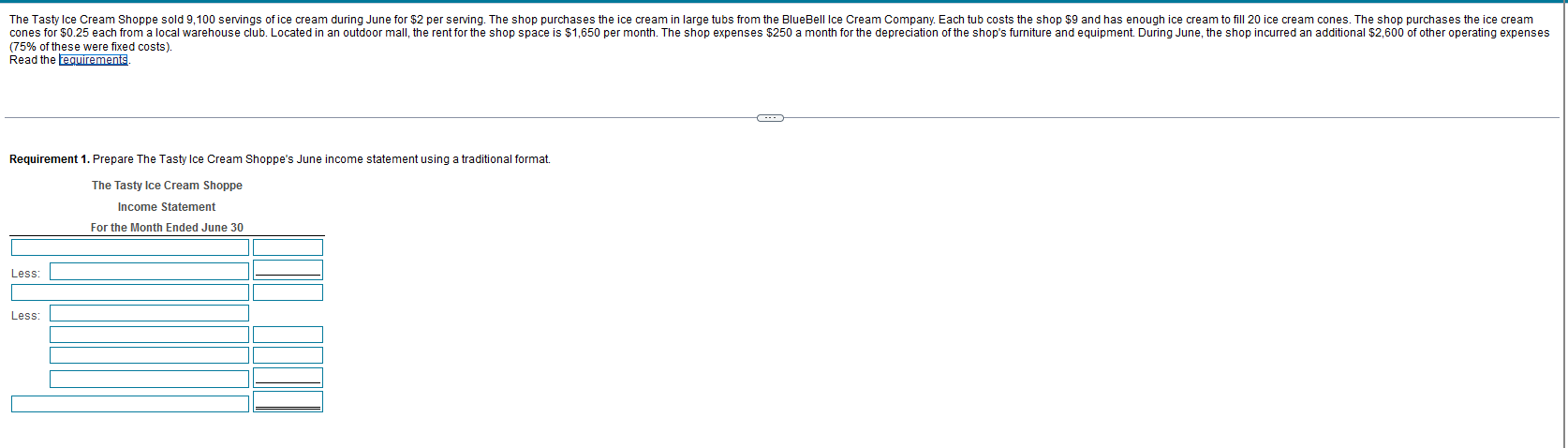

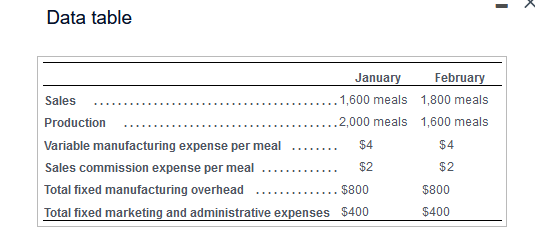

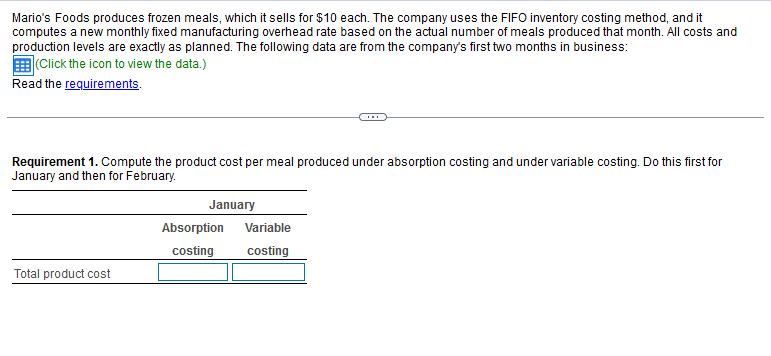

Requirements 1. Prepare The Tasty Ice Cream Shoppe's June income statement using a traditional format. 2. Prepare The Tasty Ice Cream Shoppe's June income statement using a contribution margin format. The Tasty Ice Cream Shoppe sold 9,100 servings of ice cream during June for $2 per serving. The shop purchases the ice cream in large tubs from the BlueBell Ice Cream Company. Each tub costs the shop $9 and has enough ice cream to fill 20 ice cream cones. The shop purchases the ice cream cones for $0.25 each from a local warehouse club. Located in an outdoor mall, the rent for the shop space is $1,650 per month. The shop expenses $250 a month for the depreciation of the shop's furniture and equipment. During June, the shop incurred an additional $2,600 of other operating expenses (75% of these were fixed costs). Read the requirements. Requirement 1. Prepare The Tasty Ice Cream Shoppe's June income statement using a traditional format. The Tasty Ice Cream Shoppe Income Statement For the Month Ended June 30 Less: Less: Data table January February 1,600 meals 1,800 meals Sales Production Variable manufacturing expense per meal Sales commission expense per meal Total fixed manufacturing overhead Total fixed marketing and administrative expenses $400 .2,000 meals 1,600 meals $4 $4 $2 $2 $800 $800 $400 Mario's Foods produces frozen meals, which it sells for $10 each. The company uses the FIFO inventory costing method, and it computes a new monthly fixed manufacturing overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. The following data are from the company's first two months in business: (Click the icon to view the data.) Read the requirements. Requirement 1. Compute the product cost per meal produced under absorption costing and under variable costing. Do this first for January and then for February. January Absorption Variable costing costing Total product cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started