Answered step by step

Verified Expert Solution

Question

1 Approved Answer

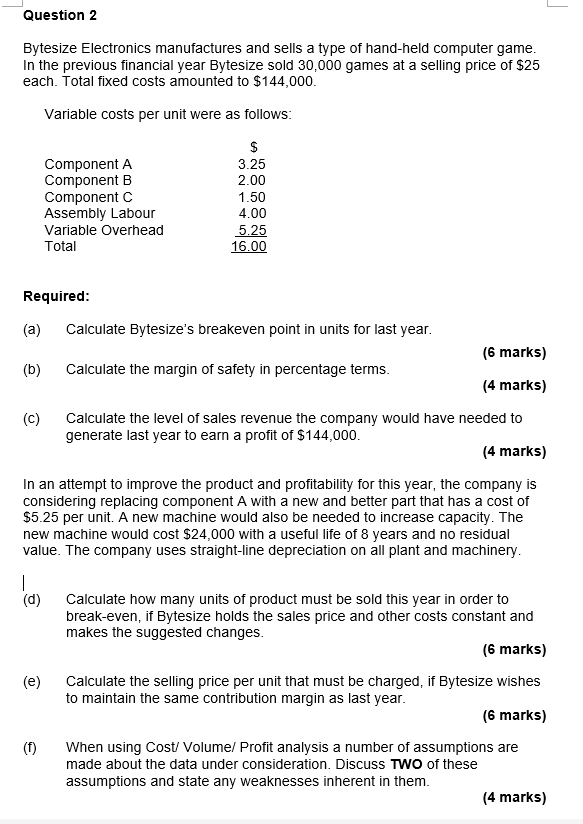

Question 2 Bytesize Electronics manufactures and sells a type of hand-held computer game. In the previous financial year Bytesize sold 30,000 games at a

Question 2 Bytesize Electronics manufactures and sells a type of hand-held computer game. In the previous financial year Bytesize sold 30,000 games at a selling price of $25 each. Total fixed costs amounted to $144,000. Variable costs per unit were as follows: $ Component A 3.25 Component B 2.00 Component C 1.50 Assembly Labour 4.00 Variable Overhead 5.25 Total 16.00 Required: (a) Calculate Bytesize's breakeven point in units for last year. (b) Calculate the margin of safety in percentage terms. (6 marks) (4 marks) | (c) Calculate the level of sales revenue the company would have needed to generate last year to earn a profit of $144,000. (4 marks) In an attempt to improve the product and profitability for this year, the company is considering replacing component A with a new and better part that has a cost of $5.25 per unit. A new machine would also be needed to increase capacity. The new machine would cost $24,000 with a useful life of 8 years and no residual value. The company uses straight-line depreciation on all plant and machinery. (d) (e) Calculate how many units of product must be sold this year in order to break-even, if Bytesize holds the sales price and other costs constant and makes the suggested changes. (6 marks) Calculate the selling price per unit that must be charged, if Bytesize wishes to maintain the same contribution margin as last year. (6 marks) (f) When using Cost/Volume/ Profit analysis a number of assumptions are made about the data under consideration. Discuss TWO of these assumptions and state any weaknesses inherent in them. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started