Answered step by step

Verified Expert Solution

Question

1 Approved Answer

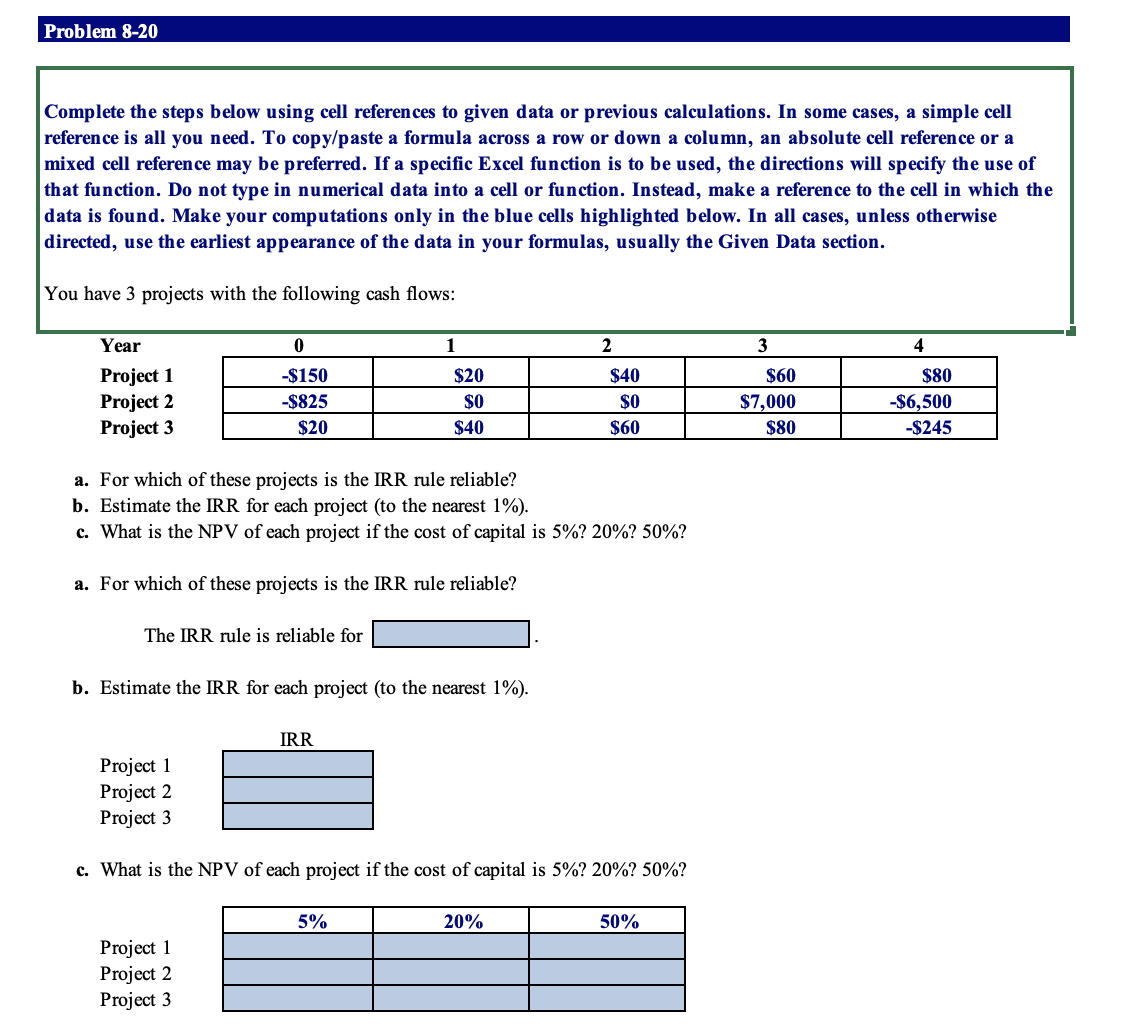

Requirements 1. Start Excel completed. 2. In cell E 15 , select from the dropdown for which of the projects the IRR rule is reliable

| Requirements | |||||||

| 1. | Start Excel completed. | ||||||

| 2. | In cell E15, select from the dropdown for which of the projects the IRR rule is reliable (1 pt.). | ||||||

| 3. | In cell D20, by using cell references and the function IRR, calculate the internal rate of return for Project 1 (1 pt.). | ||||||

| Note: Do not enter any value for the Guess argument of the function IRR. | |||||||

| 4. | To calculate the IRR for projects 2 and 3, copy cell D20 and paste it onto cells D21:D22 (1 pt.). | ||||||

| 5. | In cell D27, by using cell references and the function NPV, calculate the net present value of Project 1 if the cost of capital is 5% (1 pt.). | ||||||

| 6. | To calculate the net present values of projects 2 and 3 if the cost of capital is 5%, copy cell D27 and paste it onto cells D28:D29. To calculate the net present values of each project if the cost of capital is 20% and 50% respectively, copy cell D27 and paste it onto cells E27:F29 (1 pt.). | ||||||

| 7. | Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed. | ||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started