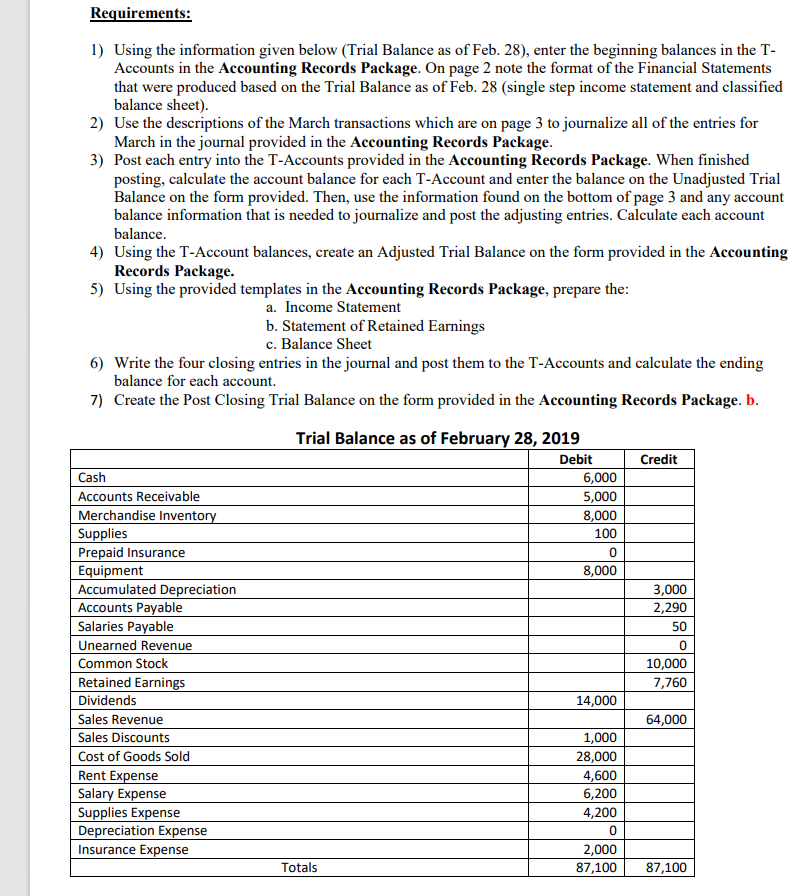

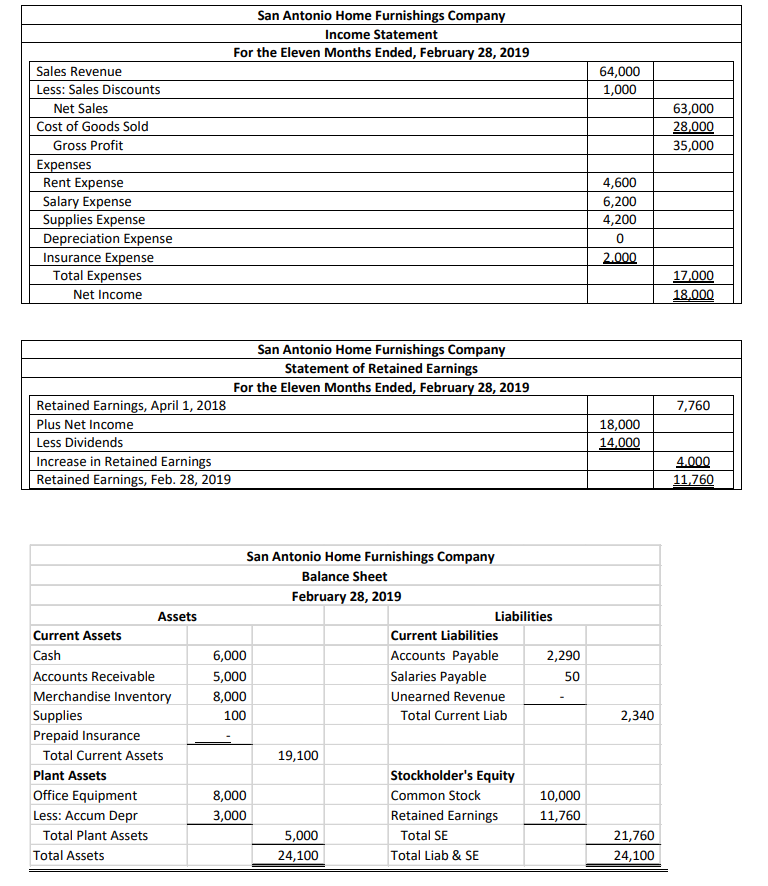

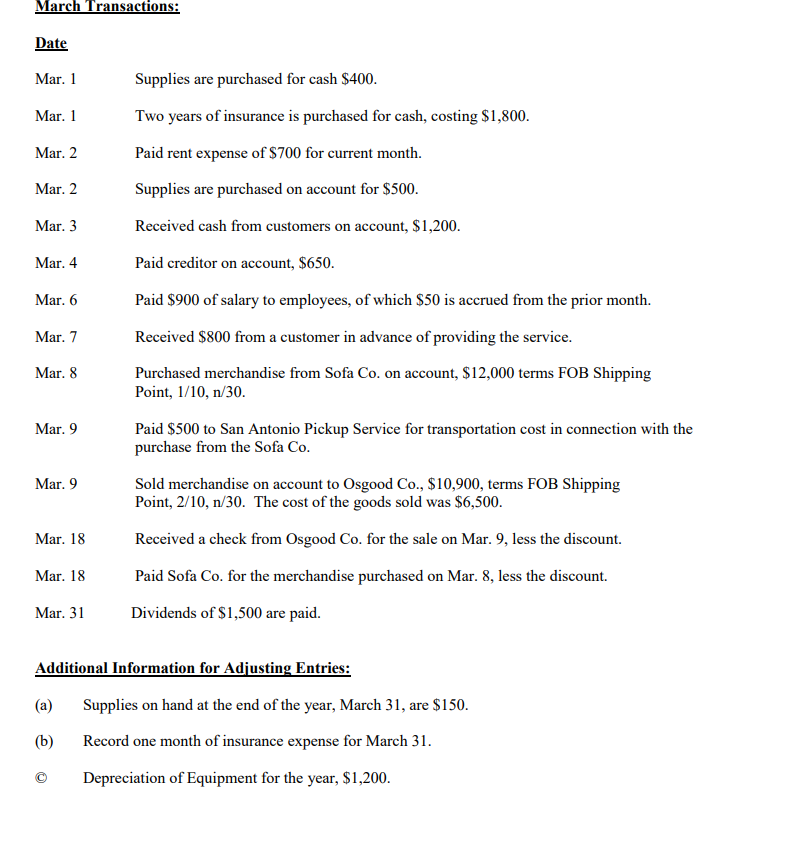

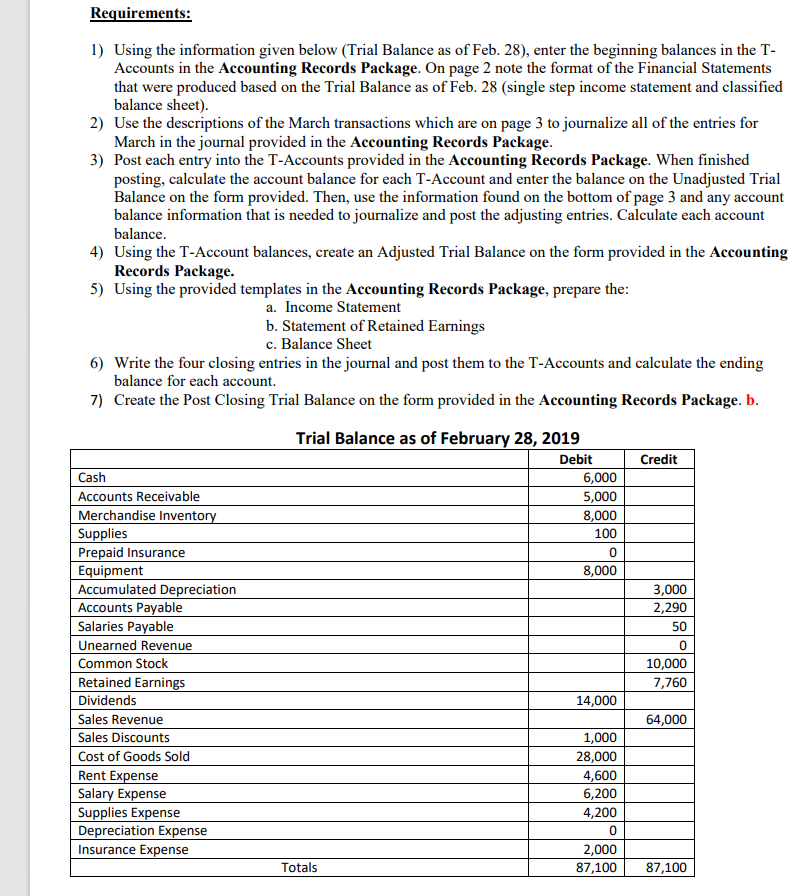

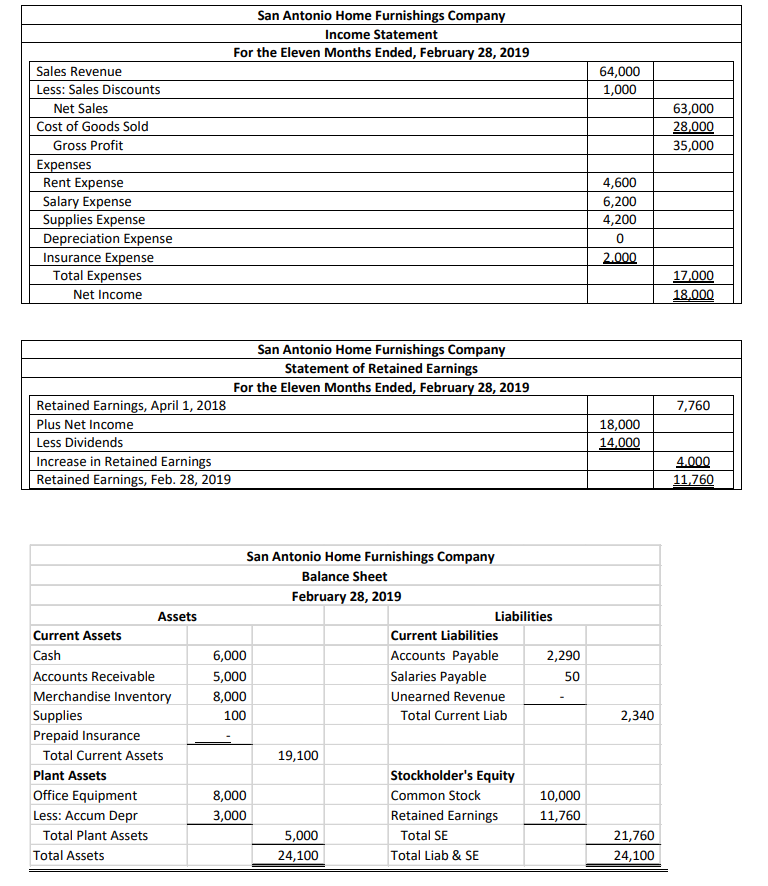

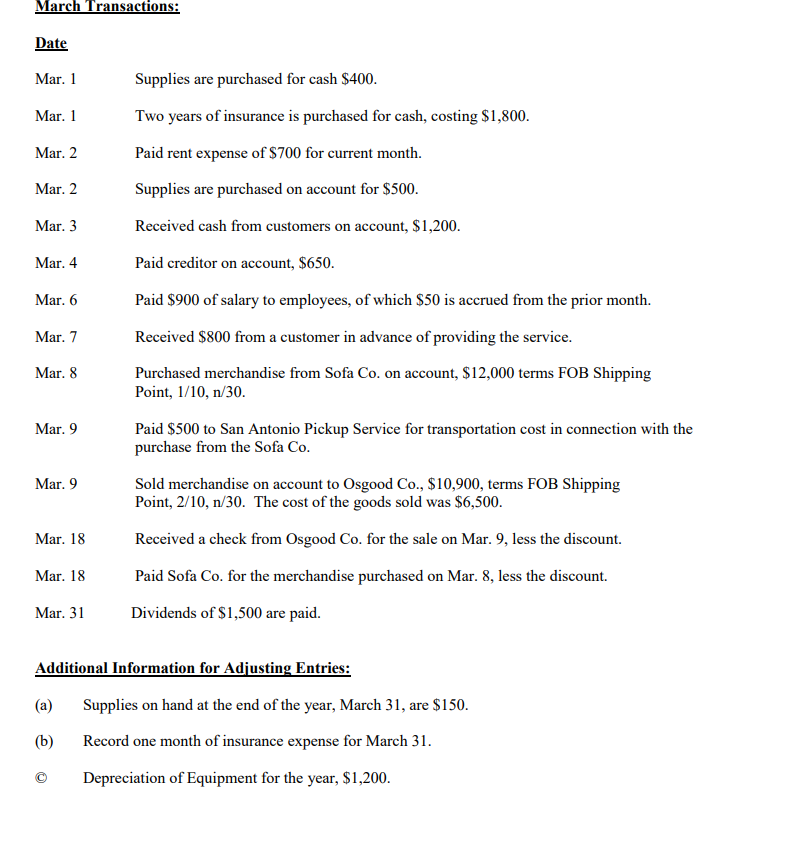

Requirements: 1) Using the information given below (Trial Balance as of Feb. 28), enter the beginning balances in the T- Accounts in the Accounting Records Package. On page 2 note the format of the Financial Statements that were produced based on the Trial Balance as of Feb. 28 (single step income statement and classified balance sheet). 2) Use the descriptions of the March transactions which are on page 3 to journalize all of the entries for March in the journal provided in the Accounting Records Package. 3) Post each entry into the T-Accounts provided in the Accounting Records Package. When finished posting, calculate the account balance for each T-Account and enter the balance on the Unadjusted Trial Balance on the form provided. Then, use the information found on the bottom of page 3 and any account balance information that is needed to journalize and post the adjusting entries. Calculate each account balance. 4) Using the T-Account balances, create an Adjusted Trial Balance on the form provided in the Accounting Records Package. 5) Using the provided templates in the Accounting Records Package, prepare the: a. Income Statement b. Statement of Retained Earnings c. Balance Sheet 6) Write the four closing entries in the journal and post them to the T-Accounts and calculate the ending balance for each account. 7) Create the Post Closing Trial Balance on the form provided in the Accounting Records Package. b. Credit Trial Balance as of February 28, 2019 Debit 6,000 5,000 8,000 100 0 8,000 Cash Accounts Receivable Merchandise Inventory Supplies Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Salaries Payable Unearned Revenue Common Stock Retained Earnings Dividends Sales Revenue Sales Discounts Cost of Goods Sold Rent Expense Salary Expense Supplies Expense Depreciation Expense Insurance Expense 3,000 2,290 50 0 10,000 7,760 14,000 64,000 1,000 28,000 4,600 6,200 4,200 0 2,000 87,100 Totals 87,100 San Antonio Home Furnishings Company Income Statement For the Eleven Months Ended, February 28, 2019 64,000 1,000 63,000 28,000 35,000 Sales Revenue Less: Sales Discounts Net Sales Cost of Goods Sold Gross Profit Expenses Rent Expense Salary Expense Supplies Expense Depreciation Expense Insurance Expense Total Expenses Net Income 4,600 6,200 4,200 2.000 17,000 18,000 7,760 San Antonio Home Furnishings Company Statement of Retained Earnings For the Eleven Months Ended, February 28, 2019 Retained Earnings, April 1, 2018 Plus Net Income Less Dividends Increase in Retained Earnings Retained Earnings, Feb. 28, 2019 18,000 14,000 4.000 11.760 San Antonio Home Furnishings Company Balance Sheet February 28, 2019 Liabilities Current Liabilities 6,000 Accounts Payable 2,290 5,000 Salaries Payable 50 8,000 Unearned Revenue 100 Total Current Liab 2,340 Assets Current Assets Cash Accounts Receivable Merchandise Inventory Supplies Prepaid Insurance Total Current Assets Plant Assets Office Equipment Less: Accum Depr Total Plant Assets Total Assets 19,100 8,000 3,000 Stockholder's Equity Common Stock Retained Earnings Total SE Total Liab & SE 10,000 11,760 5,000 24,100 21,760 24,100 March Transactions: Date Mar. 1 Mar. 1 Supplies are purchased for cash $400. Two years of insurance is purchased for cash, costing $1,800. Paid rent expense of $700 for current month. Supplies are purchased on account for $500. Mar. 2 Mar. 2 Mar. 3 Received cash from customers on account, $1,200. Mar. 4 Paid creditor on account, $650. Mar. 6 Mar. 7 Paid $900 of salary to employees, of which $50 is accrued from the prior month. Received $800 from a customer in advance of providing the service. Purchased merchandise from Sofa Co. on account, $12,000 terms FOB Shipping Point, 1/10, n/30. Mar. 8 Mar. 9 Mar. 9 Paid $500 to San Antonio Pickup Service for transportation cost in connection with the purchase from the Sofa Co. Sold merchandise on account to Osgood Co., $10,900, terms FOB Shipping Point, 2/10, n/30. The cost of the goods sold was $6,500. Received a check from Osgood Co. for the sale on Mar. 9, less the discount. Paid Sofa Co. for the merchandise purchased on Mar. 8, less the discount. Dividends of $1,500 are paid. Mar. 18 Mar. 18 Mar. 31 Additional Information for Adjusting Entries: (a) (b) Supplies on hand at the end of the year, March 31, are $150. Record one month of insurance expense for March 31. Depreciation of Equipment for the year, $1,200. Requirements: 1) Using the information given below (Trial Balance as of Feb. 28), enter the beginning balances in the T- Accounts in the Accounting Records Package. On page 2 note the format of the Financial Statements that were produced based on the Trial Balance as of Feb. 28 (single step income statement and classified balance sheet). 2) Use the descriptions of the March transactions which are on page 3 to journalize all of the entries for March in the journal provided in the Accounting Records Package. 3) Post each entry into the T-Accounts provided in the Accounting Records Package. When finished posting, calculate the account balance for each T-Account and enter the balance on the Unadjusted Trial Balance on the form provided. Then, use the information found on the bottom of page 3 and any account balance information that is needed to journalize and post the adjusting entries. Calculate each account balance. 4) Using the T-Account balances, create an Adjusted Trial Balance on the form provided in the Accounting Records Package. 5) Using the provided templates in the Accounting Records Package, prepare the: a. Income Statement b. Statement of Retained Earnings c. Balance Sheet 6) Write the four closing entries in the journal and post them to the T-Accounts and calculate the ending balance for each account. 7) Create the Post Closing Trial Balance on the form provided in the Accounting Records Package. b. Credit Trial Balance as of February 28, 2019 Debit 6,000 5,000 8,000 100 0 8,000 Cash Accounts Receivable Merchandise Inventory Supplies Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Salaries Payable Unearned Revenue Common Stock Retained Earnings Dividends Sales Revenue Sales Discounts Cost of Goods Sold Rent Expense Salary Expense Supplies Expense Depreciation Expense Insurance Expense 3,000 2,290 50 0 10,000 7,760 14,000 64,000 1,000 28,000 4,600 6,200 4,200 0 2,000 87,100 Totals 87,100 San Antonio Home Furnishings Company Income Statement For the Eleven Months Ended, February 28, 2019 64,000 1,000 63,000 28,000 35,000 Sales Revenue Less: Sales Discounts Net Sales Cost of Goods Sold Gross Profit Expenses Rent Expense Salary Expense Supplies Expense Depreciation Expense Insurance Expense Total Expenses Net Income 4,600 6,200 4,200 2.000 17,000 18,000 7,760 San Antonio Home Furnishings Company Statement of Retained Earnings For the Eleven Months Ended, February 28, 2019 Retained Earnings, April 1, 2018 Plus Net Income Less Dividends Increase in Retained Earnings Retained Earnings, Feb. 28, 2019 18,000 14,000 4.000 11.760 San Antonio Home Furnishings Company Balance Sheet February 28, 2019 Liabilities Current Liabilities 6,000 Accounts Payable 2,290 5,000 Salaries Payable 50 8,000 Unearned Revenue 100 Total Current Liab 2,340 Assets Current Assets Cash Accounts Receivable Merchandise Inventory Supplies Prepaid Insurance Total Current Assets Plant Assets Office Equipment Less: Accum Depr Total Plant Assets Total Assets 19,100 8,000 3,000 Stockholder's Equity Common Stock Retained Earnings Total SE Total Liab & SE 10,000 11,760 5,000 24,100 21,760 24,100 March Transactions: Date Mar. 1 Mar. 1 Supplies are purchased for cash $400. Two years of insurance is purchased for cash, costing $1,800. Paid rent expense of $700 for current month. Supplies are purchased on account for $500. Mar. 2 Mar. 2 Mar. 3 Received cash from customers on account, $1,200. Mar. 4 Paid creditor on account, $650. Mar. 6 Mar. 7 Paid $900 of salary to employees, of which $50 is accrued from the prior month. Received $800 from a customer in advance of providing the service. Purchased merchandise from Sofa Co. on account, $12,000 terms FOB Shipping Point, 1/10, n/30. Mar. 8 Mar. 9 Mar. 9 Paid $500 to San Antonio Pickup Service for transportation cost in connection with the purchase from the Sofa Co. Sold merchandise on account to Osgood Co., $10,900, terms FOB Shipping Point, 2/10, n/30. The cost of the goods sold was $6,500. Received a check from Osgood Co. for the sale on Mar. 9, less the discount. Paid Sofa Co. for the merchandise purchased on Mar. 8, less the discount. Dividends of $1,500 are paid. Mar. 18 Mar. 18 Mar. 31 Additional Information for Adjusting Entries: (a) (b) Supplies on hand at the end of the year, March 31, are $150. Record one month of insurance expense for March 31. Depreciation of Equipment for the year, $1,200