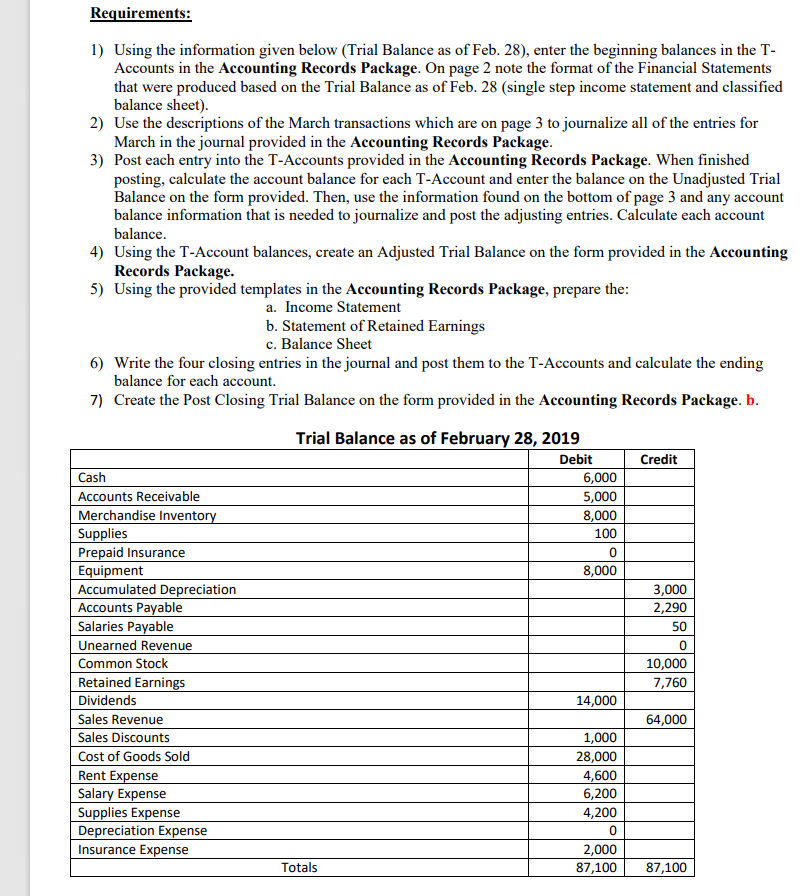

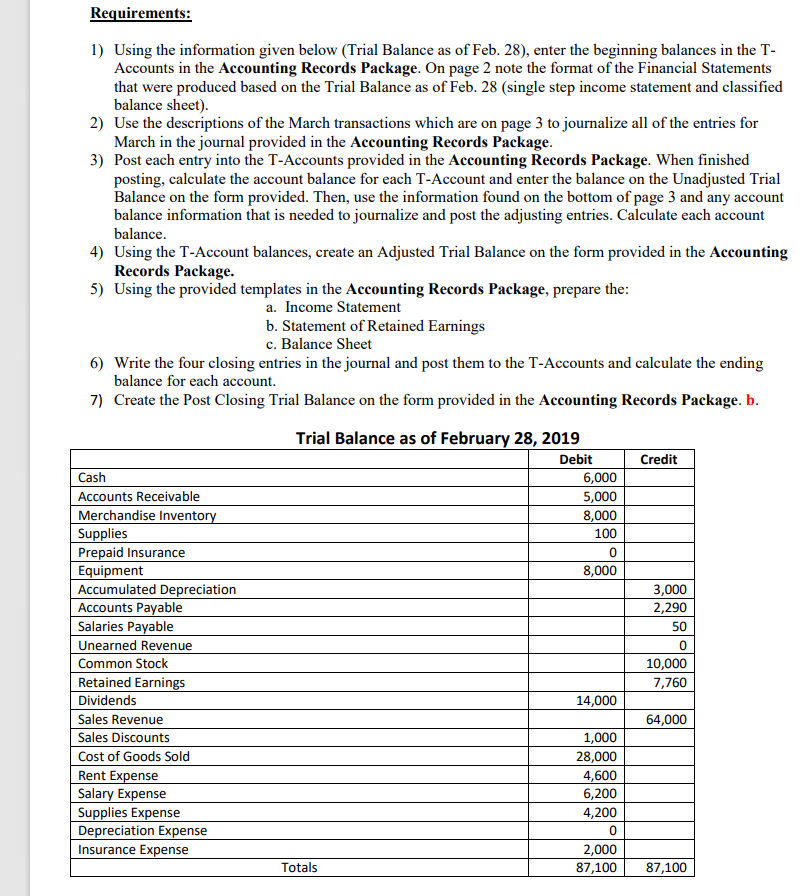

Requirements: 1) Using the information given below (Trial Balance as of Feb. 28), enter the beginning balances in the T- Accounts in the Accounting Records Package. On page 2 note the format of the Financial Statements that were produced based on the Trial Balance as of Feb. 28 (single step income statement and classified balance sheet). 2) Use the descriptions of the March transactions which are on page 3 to journalize all of the entries for March in the journal provided in the Accounting Records Package. 3) Post each entry into the T-Accounts provided in the Accounting Records Package. When finished posting, calculate the account balance for each T-Account and enter the balance on the Unadjusted Trial Balance on the form provided. Then, use the information found on the bottom of page 3 and any account balance information that is needed to journalize and post the adjusting entries. Calculate each account balance. 4) Using the T-Account balances, create an Adjusted Trial Balance on the form provided in the Accounting Records Package. 5) Using the provided templates in the Accounting Records Package, prepare the: a. Income Statement b. Statement of Retained Earnings c. Balance Sheet 6) Write the four closing entries in the journal and post them to the T-Accounts and calculate the ending balance for each account. 7) Create the Post Closing Trial Balance on the form provided in the Accounting Records Package. b. Credit Trial Balance as of February 28, 2019 Debit 6,000 5,000 8,000 100 0 8,000 Cash Accounts Receivable Merchandise Inventory Supplies Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Salaries Payable Unearned Revenue Common Stock Retained Earnings Dividends Sales Revenue Sales Discounts Cost of Goods Sold Rent Expense Salary Expense Supplies Expense Depreciation Expense Insurance Expense 3,000 2,290 50 0 10,000 7,760 14,000 64,000 1,000 28,000 4,600 6,200 4,200 0 2,000 87,100 Totals 87,100 Requirements: 1) Using the information given below (Trial Balance as of Feb. 28), enter the beginning balances in the T- Accounts in the Accounting Records Package. On page 2 note the format of the Financial Statements that were produced based on the Trial Balance as of Feb. 28 (single step income statement and classified balance sheet). 2) Use the descriptions of the March transactions which are on page 3 to journalize all of the entries for March in the journal provided in the Accounting Records Package. 3) Post each entry into the T-Accounts provided in the Accounting Records Package. When finished posting, calculate the account balance for each T-Account and enter the balance on the Unadjusted Trial Balance on the form provided. Then, use the information found on the bottom of page 3 and any account balance information that is needed to journalize and post the adjusting entries. Calculate each account balance. 4) Using the T-Account balances, create an Adjusted Trial Balance on the form provided in the Accounting Records Package. 5) Using the provided templates in the Accounting Records Package, prepare the: a. Income Statement b. Statement of Retained Earnings c. Balance Sheet 6) Write the four closing entries in the journal and post them to the T-Accounts and calculate the ending balance for each account. 7) Create the Post Closing Trial Balance on the form provided in the Accounting Records Package. b. Credit Trial Balance as of February 28, 2019 Debit 6,000 5,000 8,000 100 0 8,000 Cash Accounts Receivable Merchandise Inventory Supplies Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Salaries Payable Unearned Revenue Common Stock Retained Earnings Dividends Sales Revenue Sales Discounts Cost of Goods Sold Rent Expense Salary Expense Supplies Expense Depreciation Expense Insurance Expense 3,000 2,290 50 0 10,000 7,760 14,000 64,000 1,000 28,000 4,600 6,200 4,200 0 2,000 87,100 Totals 87,100