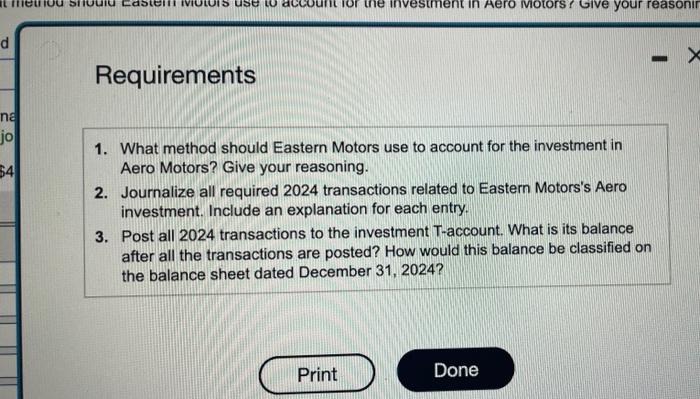

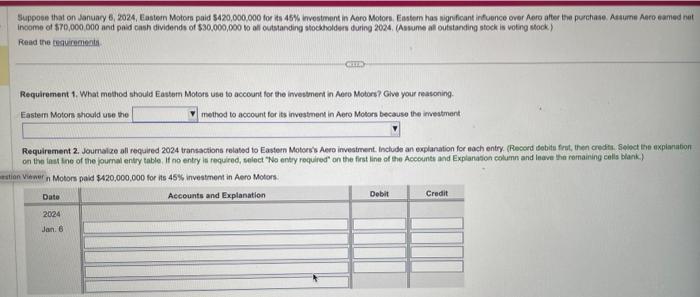

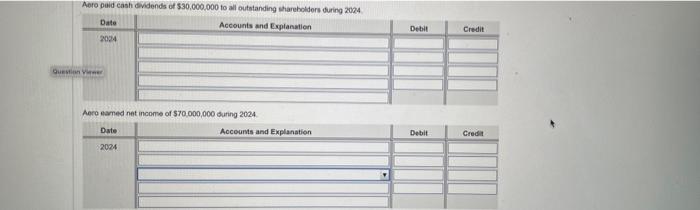

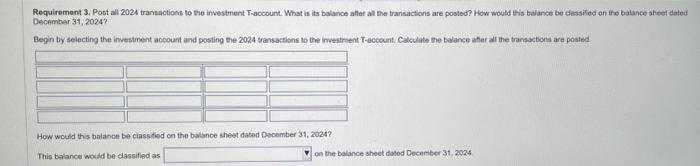

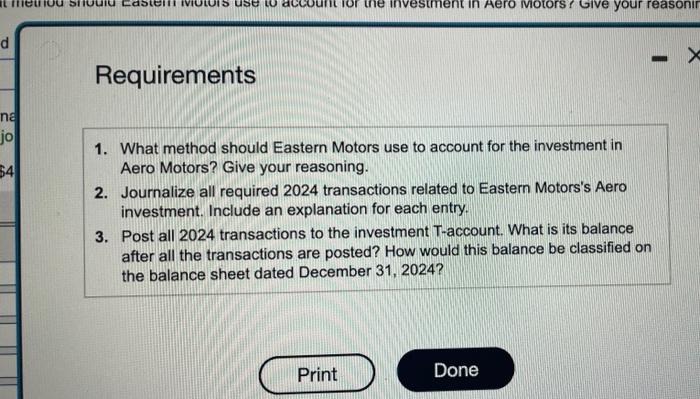

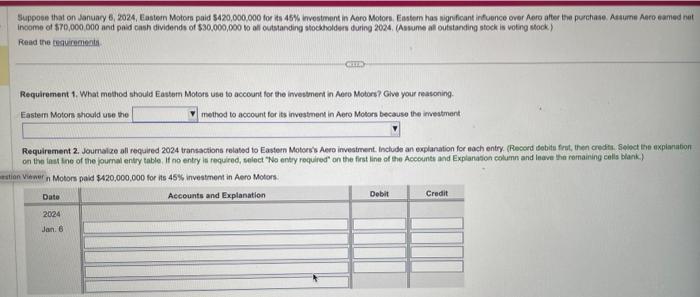

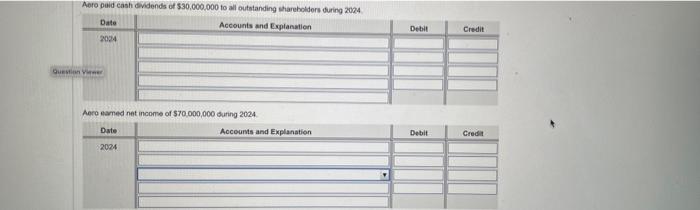

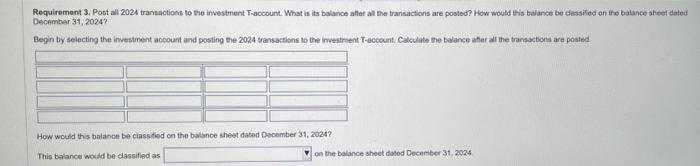

Requirements 1. What method should Eastern Motors use to account for the investment in Aero Motors? Give your reasoning. 2. Journalize all required 2024 transactions related to Eastern Motors's Aero investment. Include an explanation for each entry. 3. Post all 2024 transactions to the investment T-account. What is its balance after all the transactions are posted? How would this balance be classified on the balance sheet dated December 31,2024 ? Suppose that on Januacy 6, 2024, Eastem Motors paid 5420,000.000 tor is 45% invostment in Aoro Motors. Eastem has nonficant intuence ever Aoro atter the purchase. Askume Aero eamed net inoome of $70,000,000 and paid cash dividende of $30,000,000t all outstanding stochholders during 2004. (Assume all outstanding stock is votng stock) Read the tequiremeats Requirement 1. What method should Eastem Motors use to account for the investert in Aoro Motors? Give your reatoning. Eastem Motors should use the method to account for its investmen in Aero Moton because the investment on the inut tine of the joumal enty table. If no entry is required, seloet "To enty required" on the first line of the Accounts and Explanation column and leave the remaining cells blank.) atien Vitner n Motors paid $420.000.000 for is 45% inveatmem in Aero Motors. Aere eamed net income of 570.000,000 during 2024 Requirement 3. Post all 2024 trankactions to the investment T-account. What is its balance ahler al the transactions are posted? How would this balance be dassiked on the balance aheef dated Decembeer 31, 2024? Begin by selecting the investment acooumt and posting the 2024 transactions to the imeitrent T-eccount. Calculate the balance ather all the transactons are posted. How would this balance be ciassitied on the balance sheet dased December 31, 2024? This balance wobld be classifled as on the balance sheet dosod Decenter 31,2024 Requirements 1. What method should Eastern Motors use to account for the investment in Aero Motors? Give your reasoning. 2. Journalize all required 2024 transactions related to Eastern Motors's Aero investment. Include an explanation for each entry. 3. Post all 2024 transactions to the investment T-account. What is its balance after all the transactions are posted? How would this balance be classified on the balance sheet dated December 31,2024 ? Suppose that on Januacy 6, 2024, Eastem Motors paid 5420,000.000 tor is 45% invostment in Aoro Motors. Eastem has nonficant intuence ever Aoro atter the purchase. Askume Aero eamed net inoome of $70,000,000 and paid cash dividende of $30,000,000t all outstanding stochholders during 2004. (Assume all outstanding stock is votng stock) Read the tequiremeats Requirement 1. What method should Eastem Motors use to account for the investert in Aoro Motors? Give your reatoning. Eastem Motors should use the method to account for its investmen in Aero Moton because the investment on the inut tine of the joumal enty table. If no entry is required, seloet "To enty required" on the first line of the Accounts and Explanation column and leave the remaining cells blank.) atien Vitner n Motors paid $420.000.000 for is 45% inveatmem in Aero Motors. Aere eamed net income of 570.000,000 during 2024 Requirement 3. Post all 2024 trankactions to the investment T-account. What is its balance ahler al the transactions are posted? How would this balance be dassiked on the balance aheef dated Decembeer 31, 2024? Begin by selecting the investment acooumt and posting the 2024 transactions to the imeitrent T-eccount. Calculate the balance ather all the transactons are posted. How would this balance be ciassitied on the balance sheet dased December 31, 2024? This balance wobld be classifled as on the balance sheet dosod Decenter 31,2024