Requirements 1,2,3

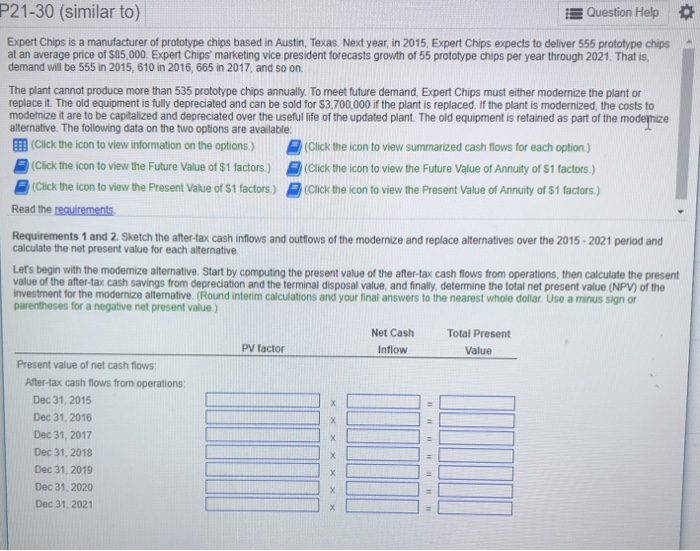

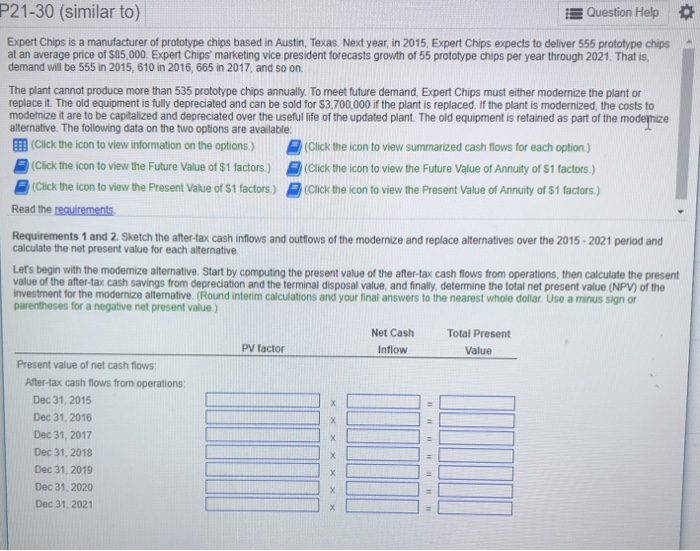

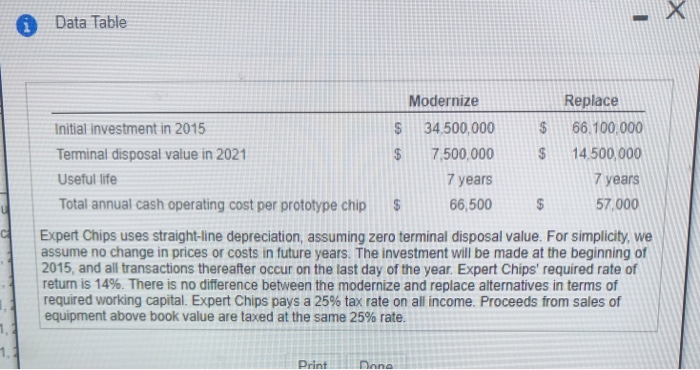

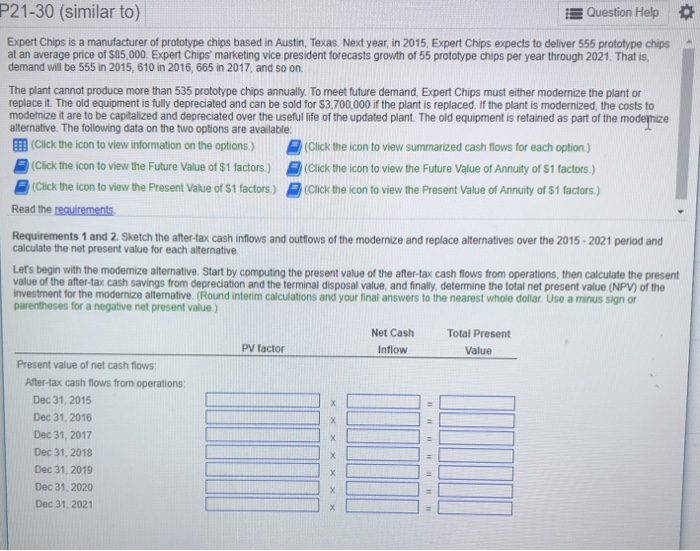

P21-30 (similar to) E Question Help Expert Chips is a manufacturer of prototype chips based in Austin, Texas Next year, in 2015, Expert Chips expects to deliver 555 prototype chips at an average price of $85,000 Expert Chips marketing vice president forecasts growth of 55 prototype chips per year through 2021. That is demand will be 555 in 2015, 610 in 2016, 665 in 2017, and so on The plant cannot produce more than 535 prototype chips annually. To meet future demand, Expert Chips must either modemize the plant or replace it. The old equipment is fully depreciated and can be sold for $3,700,000 if the plant is replaced. If the plant is modernized, the costs to modenize it are to be capitalized and depreciated over the useful life of the updated plant. The old equipment is retained as part of the alternative. The following data on the two options are available ?(Click the ico n to view i formation on the options Click he con to view summarized cash flows for each option (Click the icon to view the Future Value of $1 factors.) (Cick the icon to view the Future Value of Annuity of $1 factors,) (Click the icon to view the Present Value of $1 factors.)Cick the icon to view the Present Value of Annuity of $1 factors.) Read the requirements Requirements 1 and 2. Sketch the after-tax cash inflows and outflows of the modernize and replace alternatives over the 2015-2021 period and calculate the net present value for each alternative Let's begin with the modemize alternative. Start by computing the present value of the after-tax cash flows trom operations, then calculate the present value of the after-tax cash savings from depreciation and the terminal disposal value, and finaly, determine the total net present value (NPV) of the investment for the modernize alternative. (Round interim calculations and your final answers to the nearest whole dollar. Use a minus sign or parentheses for a negative net present value) Net Cash Inflow Total Present Value PV factor Present value of net cash flows: After-tax cash flows from operations Dec 31, 2015 Dec 31, 2016 Dec 31, 2017 Dec 31, 2018 Dec 31, 2019 Dec 31, 2020 Dec 31, 2021