Question

Requirements: (20 points) a. Prepare BASF SE consolidated statement of comprehensive income for the year ended 30th of June, 2016. Assuming applicable corporate income tax

Requirements: (20 points)

a. Prepare BASF SE consolidated statement of comprehensive income for the year ended 30th of June, 2016. Assuming applicable corporate income tax of 11.23 percent and 30 percent for BASF SE and Koninklijke DSM N.V respectively. 15 points

b. Record the related Journal entries at the consolidated level in the accounting equation.

Consolidation Steps:

*Record Acquisition

1. Revaluation of Assets

2. Split Retained Earnings/Revaluation Reserve

3. Calculate NCI

4. Calculate and Record Goodwill or Negative Goodwill

5. Calculate and Record Impairment loss on Acquisition

6. Eliminate Inter-Company Sales/balances.

7. Eliminate Un-realized profit on inventory.

8. Non-Controlling Interest share of Subs Profit

Beginning Consolidated Retained Earnings:

Beginning Consolidated Retained Earnings = Parents Beginning RE+% of Subs Post Acquisition Beginning RE-Unrealized Profit in Inventory Total Impairment Loss.

Ending Consolidated Retained Earnings:

Ending Consolidated Retained Earnings = Parent's Ending RE+% of Subs Post Acquisition RE - Unrealized Profit in Inventory - Total Impairment Loss.

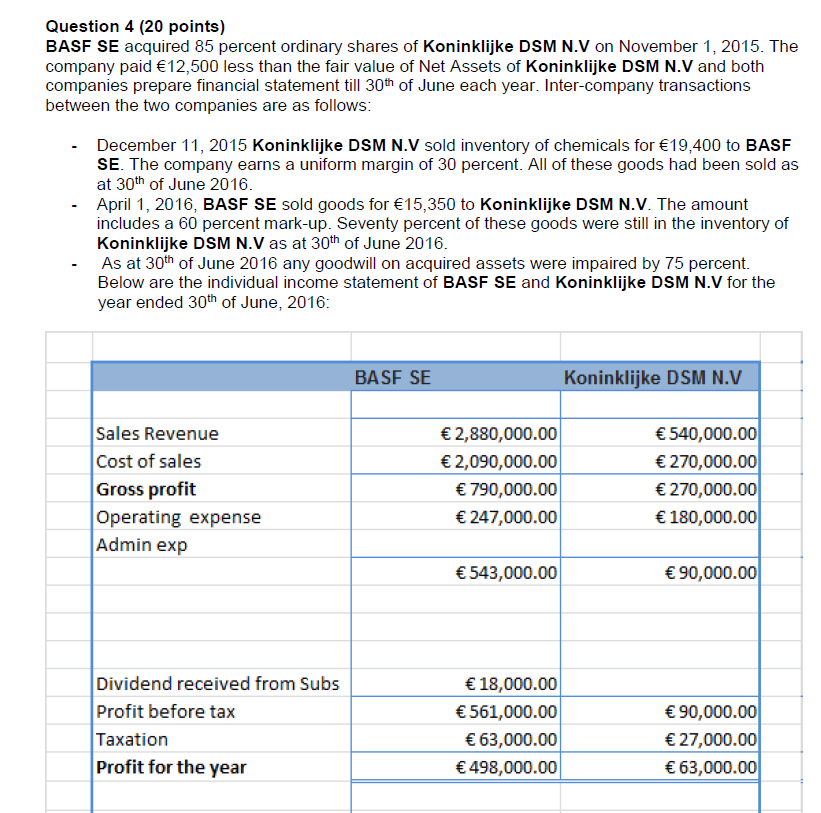

Question 4 (20 points) BASF SE acquired 85 percent ordinary shares of Koninklijke DSM N.V on November 1, 2015. The company paid 12,500 less than the fair value of Net Assets of Koninklijke DSM N.V and both companies prepare financial statement till 30th of June each year. Inter-company transactions between the two companies are as follows: December 11, 2015 Koninklijke DSM N.V sold inventory of chemicals for 19,400 to BASF SE. The company earns a uniform margin of 30 percent. All of these goods had been sold as at 30th of June 2016. April 1, 2016, BASF SE sold goods for 15,350 to Koninklijke DSM N.V. The amount includes a 60 percent mark-up. Seventy percent of these goods were still in the inventory of Koninklijke DSM N.V as at 30th of June 2016. As at 30th of June 2016 any goodwill on acquired assets were impaired by 75 percent. Below are the individual income statement of BASF SE and Koninklijke DSM N.V for the year ended 30th of June, 2016: BASE SE Koninklijke DSM N.V Sales Revenue Cost of sales Gross profit Operating expense Admin exp 2,880,000.00 2,090,000.00 790,000.00 247,000.00 540,000.00 270,000.00 270,000.00 180,000.00 543,000.00 90,000.00 Dividend received from Subs Profit before tax Taxation Profit for the year 18,000.00 561,000.00 63,000.00 498,000.00 90,000.00 27,000.00 63,000.00 Question 4 (20 points) BASF SE acquired 85 percent ordinary shares of Koninklijke DSM N.V on November 1, 2015. The company paid 12,500 less than the fair value of Net Assets of Koninklijke DSM N.V and both companies prepare financial statement till 30th of June each year. Inter-company transactions between the two companies are as follows: December 11, 2015 Koninklijke DSM N.V sold inventory of chemicals for 19,400 to BASF SE. The company earns a uniform margin of 30 percent. All of these goods had been sold as at 30th of June 2016. April 1, 2016, BASF SE sold goods for 15,350 to Koninklijke DSM N.V. The amount includes a 60 percent mark-up. Seventy percent of these goods were still in the inventory of Koninklijke DSM N.V as at 30th of June 2016. As at 30th of June 2016 any goodwill on acquired assets were impaired by 75 percent. Below are the individual income statement of BASF SE and Koninklijke DSM N.V for the year ended 30th of June, 2016: BASE SE Koninklijke DSM N.V Sales Revenue Cost of sales Gross profit Operating expense Admin exp 2,880,000.00 2,090,000.00 790,000.00 247,000.00 540,000.00 270,000.00 270,000.00 180,000.00 543,000.00 90,000.00 Dividend received from Subs Profit before tax Taxation Profit for the year 18,000.00 561,000.00 63,000.00 498,000.00 90,000.00 27,000.00 63,000.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started