Requirements 5-8

Requirements 1-4 are already done in my last questions

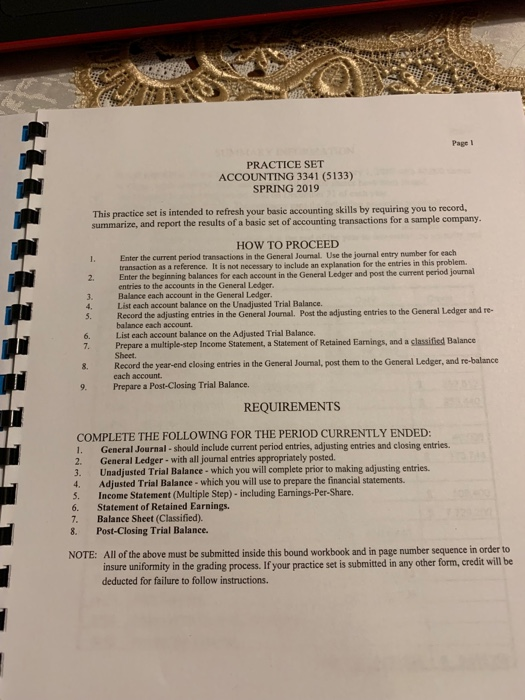

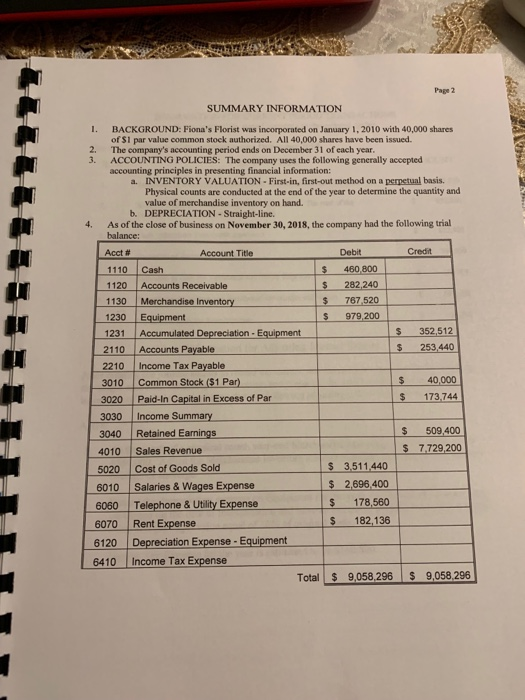

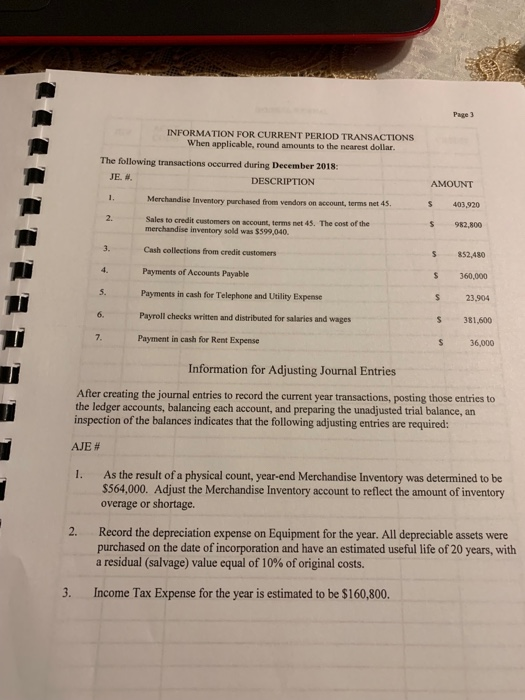

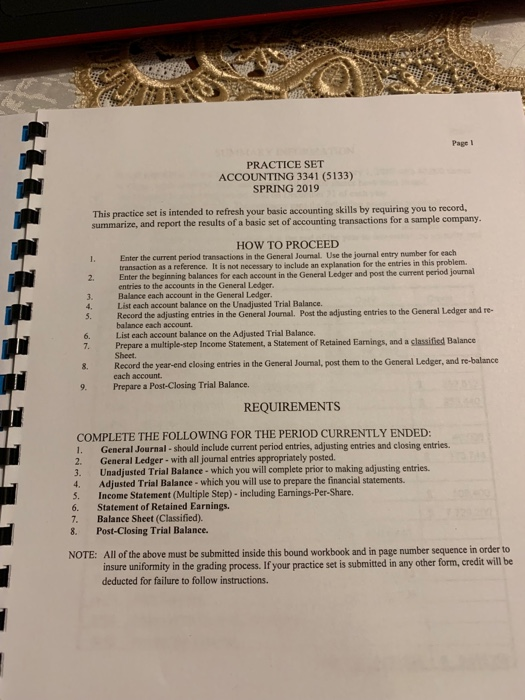

Page l PRACTICE SET ACCOUNTING 3341 (5133) SPRING 2019 This practice set is intended to refresh your basic accounting skills by requiring you to record summarize, and report the results of a basic set of accounting transactions for a sample company. HOW TO PROCEED Enter the current period transactions in the General Jounal. Use the journal entry number for each Enter the beginning balances as a reference. It is not necessary to include an explanation for the entries in this problem suntin the General Ledgr and pot the current period jourmal 2. rsiathe C Balance each account in the General Ledger List each account balance on the Unadjusted Trial Balance. Record the adjusting entries in the General Journal. Post the adjusting entries to the General Ledger and re- balance each account List each account balance on the Adjusted Trial Balance. 4. 5. 6. 7. Prepare a multiple-step Income Statement, a Statement of Retained Earnings, and a classified Balance 8. Record the year-end closing entries in the General Journal, post them to the General Ledger, and re-balance 9. Prepare a Post-Closing Trial Balance Sheet. each account REQUIREMENTS COMPLETE THE FOLLOWING FOR THE PERIOD CURRENTLY ENDED 1. General Journal -should include current period entries, adjusting entries and closing entries. 2. General Ledger- with all journal entries appropriately posted. 3. Unadjusted Trial Balance- which you will complete prior to making adjusting entries. 4. Adjusted Trial Balance- which you will use to prepare the financial statements. 5. Income Statement (Multiple Step)- including Earnings-Per-Share. 6. Statement of Retained Earnings. 7. Balance Sheet (Classified). 8. Post-Closing Trial Balance. All of the above must be submitted inside this bound workbook and in page number sequence in order to insure uniformity in the grading process.If your practice set is submitted in any other form, credit will be deducted for failure to follow instructions NOTE: Page 2 SUMMARY INFORMATION 1. BACKGROUND: Fiona's Florist was incorporated on January 1, 2010 with 40,000 shares of S1 par value common stock authorized. All 40,000 shares have been issued. 2. The company's accounting period ends on December 31 of each year 3. ACCOUNTING POLICIES: The company uses the following generally accepted accounting principles in presenting financial information: INVENTORY VALUATION- First-in, first-out method on a perpetual basis. Physical counts are conducted at the end of the year to determine the quantity and value of merchandise inventory on hand. a. b. DEPRECIATION-Straight-line. 4. As of the close of business on November 30, 2018, the company had the following trial balance: Acct # 1110 Cash 1120 Accounts Receivable 1130 Merchandise Inventory 1230 Equipment 1231 Accumulated Depreciation-Equipment 2110 Accounts Payable 2210 Income Tax Payable 3010 Common Stock ($1 Par) Account Title Debit Credit $ 460 800 $ 282,240 767,520 S 979,200 352,512 $ 253,440 $ 40,000 3020 Paid-in Capital in Excess of Par $ 173,744 3030 Income Summary 3040 Retained Earnings 4010 Sales Revenue 5020 Cost of Goods Sold $ 509,400 s 7.729,200 6010 Salaries& Wages Expense 6060 Telephone & Utility Expense 6070 Rent Expense 6120 Depreciation Expense-Equipment 6410 Income Tax Expense $ 3,511440 2,696,400 $ 178,560 S 182,136 Total $ 9,058,296 9,058,296 Page 3 INFORMATION FOR CURRENT PERIOD TRANSACTIONS When applicable, round amounts to the nearest dollar. The following transactions occurred during December 2018: JE. #. DESCRIPTION AMOUNT S 403,920 $ 982,800 S 852,480 S 360,000 Iventory purchased from vendors on account, terms net 45 2. Sales to credit customers on account, terms net 45 The cost of the merchandise inventory sold was $599,040. Cash collections from credit customers Payments of Accounts Payable Payments in cash for Telephone and Utility Expense 3. 23,904 S 381,600 S 36,000 5. 6. Payroll checks written and distributed for salaries and wages Payment in cash for Rent Expense Information for Adjusting Journal Entries After creating the journal entries to record the current year transactions, posting those entries to the ledger accounts, balancing each account, and preparing the unadjusted trial balance, an inspection of the balances indicates that the following adjusting entries are required: AJE # 1. As the result of a physical count, year-end Merchandise Inventory was determined to be $564,000. Adjust the Merchandise Inventory account to reflect the amount of inventory overage or shortage. 2. Record the depreciation expense on Equipment for the year. All depreciable assets were purchased on the date of incorporation and have an estimated useful life of 20 years, with a residual (salvage) value equal of 10% of original costs. 3. Income Tax Expense for the year is estimated to be $160,800