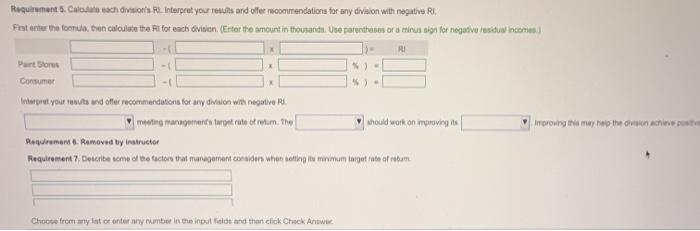

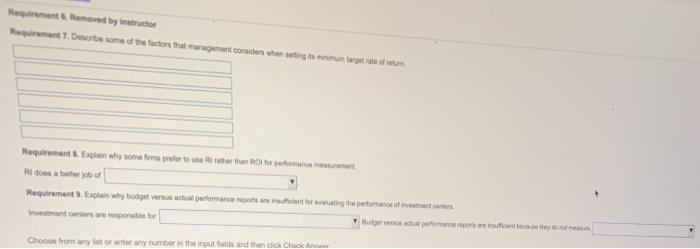

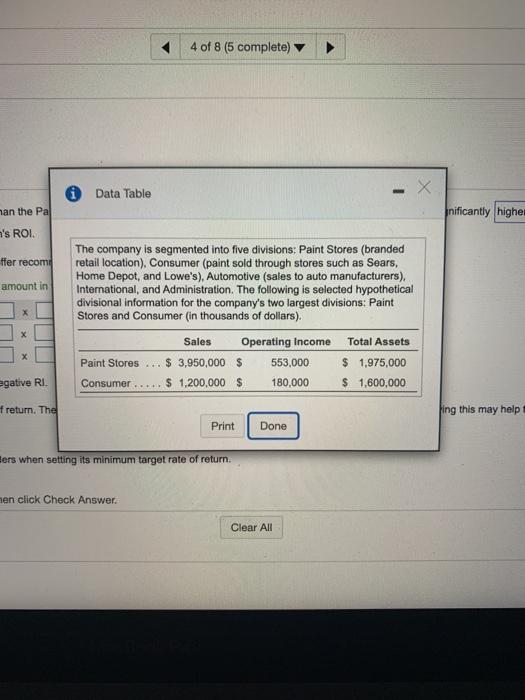

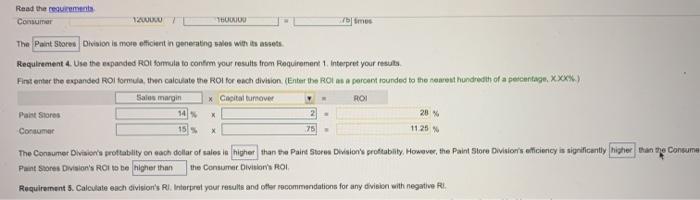

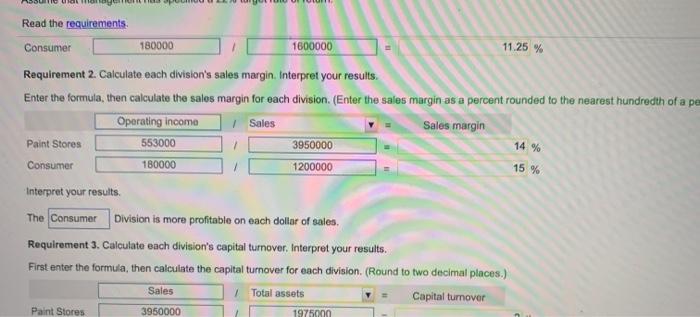

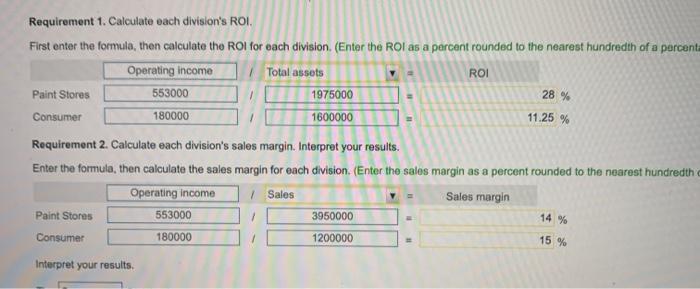

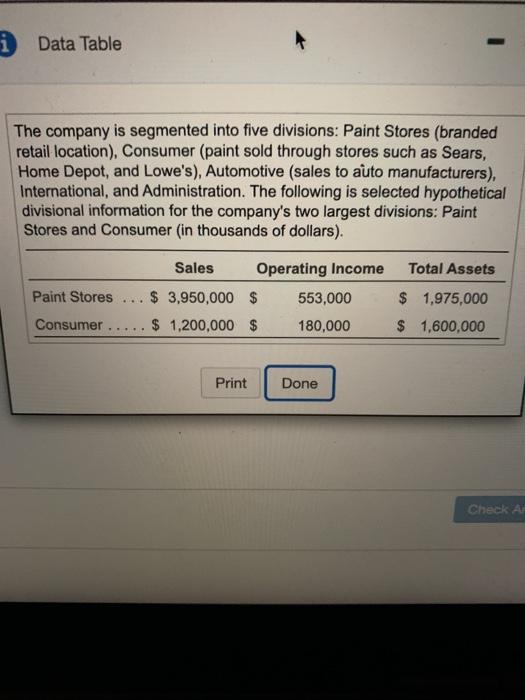

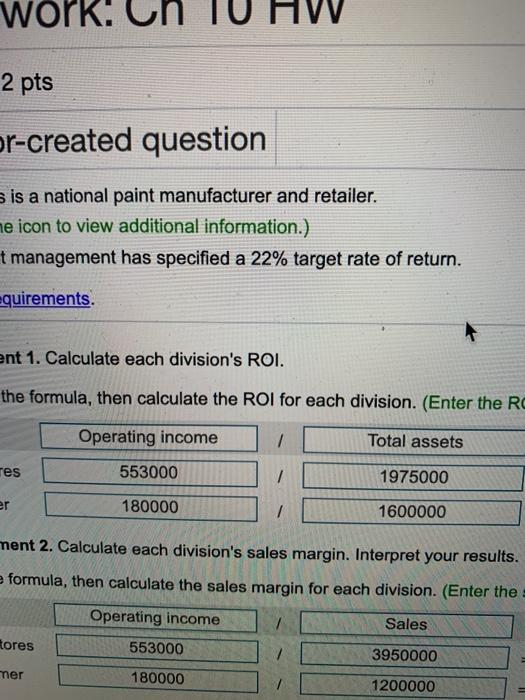

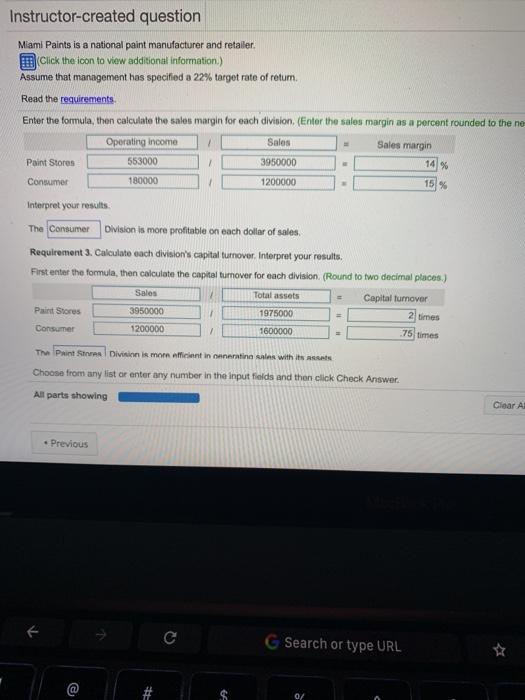

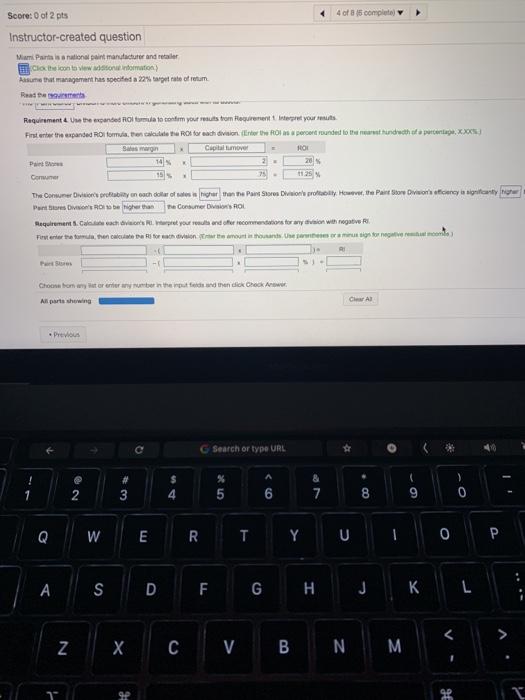

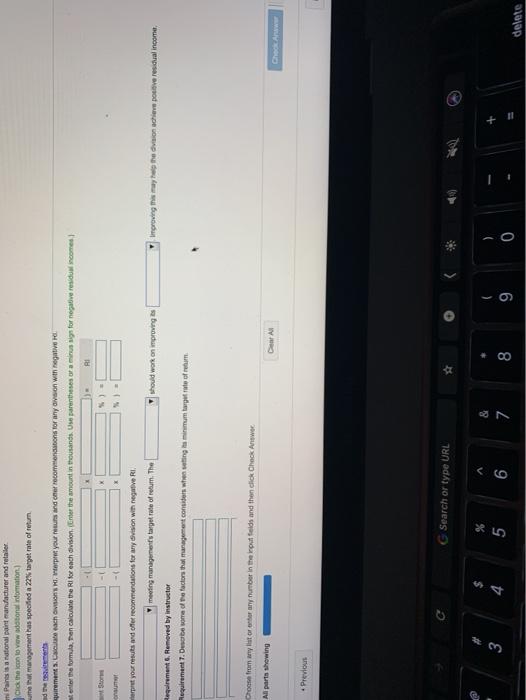

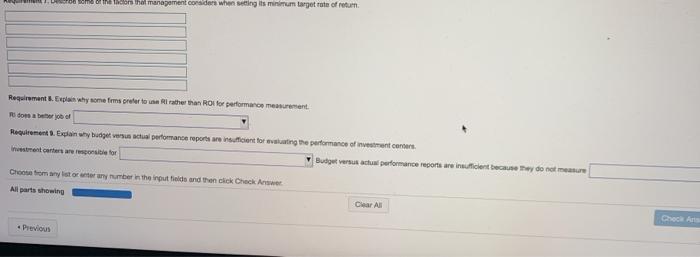

Requirements Casach divisi Interpret your results and offer recommendations for any division with negative RI Fest enter the foonuta. tion calculate the Ri for each vision (Enter the amount in thousands. Use parents of a rinus sign for negative residuw income Port Stores Consumer 5) - Improwing may help the Grenache post Interpret your mouwd offer recommendations for any division with negative RL meeting management troit rate of rotum The nould work on mproving is Requirement. Removed by Instructor Requirement 7, Describe como te tactors that management en when sorting to minimum target rate of retum Choose from any lat tontorary rumber in the input fide and then click Check Answer Ramoved by instructor Decree of the factors that management considers when writing to Roman Explan why some more than torno i dobro Requirement Expon why budet er mange per manos de interiors Investimentos eroporto Beve me they Choose from any trumber in the input de and 4 of 8 (5 complete) i Data Table man the Pal nificantly highe n's ROL, ffer recome amount in The company is segmented into five divisions: Paint Stores (branded retail location). Consumer (paint sold through stores such as Sears, Home Depot, and Lowe's), Automotive (sales to auto manufacturers), International, and Administration. The following is selected hypothetical divisional information for the company's two largest divisions: Paint Stores and Consumer (in thousands of dollars). Sales Operating Income Total Assets Paint Stores $ 3,950,000 $ 553,000 $ 1,975,000 Consumer .....$ 1,200,000 $ 180,000 $ 1,600,000 x egative Ri. freturn. The ing this may help Print Done ers when setting its minimum target rate of return. en click Check Answer. Clear All Read the recent Consumer 16000 Times The Paint Stores Dvinion is more officient in generating sales will be assets. Requirement 4. Use the expanded ROI fomula to confirm your results from Requirement 1. Interpret your results Fint enter the expanded ROI formula. then calculate the Rol for each division (Enter the Rot an a percent rounded to the nearest hundredth of a percentage, **** Sales margin x Capital turnover ROI Paint Stores 14 28% Consumer 155 The Consumer Division prottability on each dollar of sales is higher than to Paint Stores Dion's profitabilly. However, the Paint Store Division's officiency is significantly higher than the consume Paint Shores Division's ROI to be higher than the Consumer Division's ROI Requirements. Calculate each division's RI. Interpret your results and offer recommendations for any division with negative RI X X 1125 Read the requirements Consumer 180000 1600000 11.25 % 15 % Requirement 2. Calculate each division's sales margin. Interpret your results. Enter the formula, then calculate the sales margin for each division (Enter the sales margin as a percent rounded to the nearest hundredth of a pe Operating income Sales Sales margin Paint Stores 553000 3950000 14 % Consumer 180000 1200000 Interpret your results. The Consumer Division is more profitable on each dollar of sales. Requirement 3. Calculate each division's capital turnover. Interpret your results. First enter the formula, then calculate the capital turnover for each division. (Round to two decimal places.) Sales Total assets Capital turnover 3950000 1 Paint Stores 1975000 Requirement 1. Calculate each division's ROI. First enter the formula, then calculate the ROI for each division (Enter the ROI as a percent rounded to the nearest hundredth of a percent Operating income Total assets ROI Paint Stores 553000 1975000 Consumer 180000 1600000 28 % 11.25 % Requirement 2. Calculate each division's sales margin. Interpret your results. Enter the formula, then calculate the sales margin for each division (Enter the sales margin as a percent rounded to the nearest hundredth Operating income 1 Sales Sales margin Paint Stores 553000 3950000 14 % Consumer 180000 1200000 15 % Interpret your results, i Data Table The company is segmented into five divisions: Paint Stores (branded retail location), Consumer (paint sold through stores such as Sears, Home Depot, and Lowe's), Automotive (sales to auto manufacturers), International, and Administration. The following is selected hypothetical divisional information for the company's two largest divisions: Paint Stores and Consumer (in thousands of dollars). Total Assets Paint Stores Sales Operating Income $ 3,950,000 $ 553,000 $ 1,200,000 $ 180,000 $ 1,975,000 Consumer. $ 1,600,000 Print Done Check A work. Un 2 pts or-created question s is a national paint manufacturer and retailer. me icon to view additional information.) t management has specified a 22% target rate of return. equirements. ent 1. Calculate each division's ROI. the formula, then calculate the ROI for each division. (Enter the RC Operating income Total assets res 553000 1975000 er 180000 1 1600000 ment 2. Calculate each division's sales margin. Interpret your results. e formula, then calculate the sales margin for each division. (Enter the Operating income Sales kores 553000 3950000 mer 180000 1200000 Instructor-created question Miami Paints is a national paint manufacturer and retailer. Click the icon to view additional information) Assume that management has specified a 22% target rate of retum Read the requirements Enter the formula, then calculate the sales margin for each division (Enter the sales margin as a percent rounded to the ne Operating income Sales Sales margin Paint Stores 553000 3950000 Consumer 180000 1200000 15% 7 14% Interpret your results The Consumer Division is more profitable on each dollar of sales. Requirement 3. Calculato each division's capital turnover. Interpret your results. First enter the formula, then calculate the capital turnover for each division (Round to two decimal places.) Sales Total assets Capital tumover Paint Shores 3950000 1975000 2 times Consumer 1200000 1600000 = 75 times = = The Paint Store Division in more efficient in onerating sales with its AS Choose from any list or enter any number in the input fields and then click Check Answer. All parts showing Clear A Previous G Search or type URL @ 4 of 15 complet Score: 0 of 2 pts Instructor-created question Mari Partais a nationalent manufacturer and retailer colecontowane normation Asunt management has specified 22% rate of retum Read the Requirement. Use the expanded Roommate com your results from Heurenent interpret your results First enter the expanded Roommate all the Roach division (ie the ROI percent rounded to the undredth of a paga, XX Capitalumo ROS 14 Corner 75 11:25 The Consumer Direttably on each dollar of migrare e Pune Store Divine prototyw, the part owe Dwon' forney ignty Nepal Punte Di Roberthane Consumer ROL Requirement achet your results and the recommendations for any union wth rogative First enter the menu for visione mentionem formato RI Chocometer enterary bethaufenden die Choo Answer All parts showing Previous C Search or type URL # 3 % 5 C 9 2 4 6 7 Q W E R I. | UNG | OP S DF G H JK N x | C | NM 1" 92 Paints is a national paint manufacturer and retailer Click the icon to view detonal Information) who the management has specified a 22 target rate of return dements uirements, ac achawion, repet your mums and cnet recommendations for any awon with negative tenter the formula. Then calculate the Rifor each division. Ce the amount in thousands Usparenthesesoraming for negative residuo come! RI Stor Out x Improving maydonchieve pouve residual income repet your rests and offer recommendations for any division with negative RI. meeting management' target rate of rebum. The should work on improving Requirements. Removed by instructor Requirement 7. Descreme de factors that management considers when ting timmtare te ofre Choose from my order any number in the routes and then click Check Answer All parts showing Cear All Previous Search or type URL A 3 4 5 6 7 00 9 0 Il delete om the management considers when ting its minimum Large rate of return Requirements. Explain why some fm refer to sell rather than ROI for performance measurement Fodor ber of Requirement.clan why budget a chual pertomance reports are not for stating the performance of investment centers. stretchers were for Budget versus actual performance reports are insuficient de nome Choose from any list orter any number in the input fields and then click Checker All parts showing Clear All Check Art Previous Requirements Casach divisi Interpret your results and offer recommendations for any division with negative RI Fest enter the foonuta. tion calculate the Ri for each vision (Enter the amount in thousands. Use parents of a rinus sign for negative residuw income Port Stores Consumer 5) - Improwing may help the Grenache post Interpret your mouwd offer recommendations for any division with negative RL meeting management troit rate of rotum The nould work on mproving is Requirement. Removed by Instructor Requirement 7, Describe como te tactors that management en when sorting to minimum target rate of retum Choose from any lat tontorary rumber in the input fide and then click Check Answer Ramoved by instructor Decree of the factors that management considers when writing to Roman Explan why some more than torno i dobro Requirement Expon why budet er mange per manos de interiors Investimentos eroporto Beve me they Choose from any trumber in the input de and 4 of 8 (5 complete) i Data Table man the Pal nificantly highe n's ROL, ffer recome amount in The company is segmented into five divisions: Paint Stores (branded retail location). Consumer (paint sold through stores such as Sears, Home Depot, and Lowe's), Automotive (sales to auto manufacturers), International, and Administration. The following is selected hypothetical divisional information for the company's two largest divisions: Paint Stores and Consumer (in thousands of dollars). Sales Operating Income Total Assets Paint Stores $ 3,950,000 $ 553,000 $ 1,975,000 Consumer .....$ 1,200,000 $ 180,000 $ 1,600,000 x egative Ri. freturn. The ing this may help Print Done ers when setting its minimum target rate of return. en click Check Answer. Clear All Read the recent Consumer 16000 Times The Paint Stores Dvinion is more officient in generating sales will be assets. Requirement 4. Use the expanded ROI fomula to confirm your results from Requirement 1. Interpret your results Fint enter the expanded ROI formula. then calculate the Rol for each division (Enter the Rot an a percent rounded to the nearest hundredth of a percentage, **** Sales margin x Capital turnover ROI Paint Stores 14 28% Consumer 155 The Consumer Division prottability on each dollar of sales is higher than to Paint Stores Dion's profitabilly. However, the Paint Store Division's officiency is significantly higher than the consume Paint Shores Division's ROI to be higher than the Consumer Division's ROI Requirements. Calculate each division's RI. Interpret your results and offer recommendations for any division with negative RI X X 1125 Read the requirements Consumer 180000 1600000 11.25 % 15 % Requirement 2. Calculate each division's sales margin. Interpret your results. Enter the formula, then calculate the sales margin for each division (Enter the sales margin as a percent rounded to the nearest hundredth of a pe Operating income Sales Sales margin Paint Stores 553000 3950000 14 % Consumer 180000 1200000 Interpret your results. The Consumer Division is more profitable on each dollar of sales. Requirement 3. Calculate each division's capital turnover. Interpret your results. First enter the formula, then calculate the capital turnover for each division. (Round to two decimal places.) Sales Total assets Capital turnover 3950000 1 Paint Stores 1975000 Requirement 1. Calculate each division's ROI. First enter the formula, then calculate the ROI for each division (Enter the ROI as a percent rounded to the nearest hundredth of a percent Operating income Total assets ROI Paint Stores 553000 1975000 Consumer 180000 1600000 28 % 11.25 % Requirement 2. Calculate each division's sales margin. Interpret your results. Enter the formula, then calculate the sales margin for each division (Enter the sales margin as a percent rounded to the nearest hundredth Operating income 1 Sales Sales margin Paint Stores 553000 3950000 14 % Consumer 180000 1200000 15 % Interpret your results, i Data Table The company is segmented into five divisions: Paint Stores (branded retail location), Consumer (paint sold through stores such as Sears, Home Depot, and Lowe's), Automotive (sales to auto manufacturers), International, and Administration. The following is selected hypothetical divisional information for the company's two largest divisions: Paint Stores and Consumer (in thousands of dollars). Total Assets Paint Stores Sales Operating Income $ 3,950,000 $ 553,000 $ 1,200,000 $ 180,000 $ 1,975,000 Consumer. $ 1,600,000 Print Done Check A work. Un 2 pts or-created question s is a national paint manufacturer and retailer. me icon to view additional information.) t management has specified a 22% target rate of return. equirements. ent 1. Calculate each division's ROI. the formula, then calculate the ROI for each division. (Enter the RC Operating income Total assets res 553000 1975000 er 180000 1 1600000 ment 2. Calculate each division's sales margin. Interpret your results. e formula, then calculate the sales margin for each division. (Enter the Operating income Sales kores 553000 3950000 mer 180000 1200000 Instructor-created question Miami Paints is a national paint manufacturer and retailer. Click the icon to view additional information) Assume that management has specified a 22% target rate of retum Read the requirements Enter the formula, then calculate the sales margin for each division (Enter the sales margin as a percent rounded to the ne Operating income Sales Sales margin Paint Stores 553000 3950000 Consumer 180000 1200000 15% 7 14% Interpret your results The Consumer Division is more profitable on each dollar of sales. Requirement 3. Calculato each division's capital turnover. Interpret your results. First enter the formula, then calculate the capital turnover for each division (Round to two decimal places.) Sales Total assets Capital tumover Paint Shores 3950000 1975000 2 times Consumer 1200000 1600000 = 75 times = = The Paint Store Division in more efficient in onerating sales with its AS Choose from any list or enter any number in the input fields and then click Check Answer. All parts showing Clear A Previous G Search or type URL @ 4 of 15 complet Score: 0 of 2 pts Instructor-created question Mari Partais a nationalent manufacturer and retailer colecontowane normation Asunt management has specified 22% rate of retum Read the Requirement. Use the expanded Roommate com your results from Heurenent interpret your results First enter the expanded Roommate all the Roach division (ie the ROI percent rounded to the undredth of a paga, XX Capitalumo ROS 14 Corner 75 11:25 The Consumer Direttably on each dollar of migrare e Pune Store Divine prototyw, the part owe Dwon' forney ignty Nepal Punte Di Roberthane Consumer ROL Requirement achet your results and the recommendations for any union wth rogative First enter the menu for visione mentionem formato RI Chocometer enterary bethaufenden die Choo Answer All parts showing Previous C Search or type URL # 3 % 5 C 9 2 4 6 7 Q W E R I. | UNG | OP S DF G H JK N x | C | NM 1" 92 Paints is a national paint manufacturer and retailer Click the icon to view detonal Information) who the management has specified a 22 target rate of return dements uirements, ac achawion, repet your mums and cnet recommendations for any awon with negative tenter the formula. Then calculate the Rifor each division. Ce the amount in thousands Usparenthesesoraming for negative residuo come! RI Stor Out x Improving maydonchieve pouve residual income repet your rests and offer recommendations for any division with negative RI. meeting management' target rate of rebum. The should work on improving Requirements. Removed by instructor Requirement 7. Descreme de factors that management considers when ting timmtare te ofre Choose from my order any number in the routes and then click Check Answer All parts showing Cear All Previous Search or type URL A 3 4 5 6 7 00 9 0 Il delete om the management considers when ting its minimum Large rate of return Requirements. Explain why some fm refer to sell rather than ROI for performance measurement Fodor ber of Requirement.clan why budget a chual pertomance reports are not for stating the performance of investment centers. stretchers were for Budget versus actual performance reports are insuficient de nome Choose from any list orter any number in the input fields and then click Checker All parts showing Clear All Check Art Previous