Question

Requirements: Determine the adjusted balances of the following: (Ignore tax implications) 1. Petty cash fund 2. Cash in bank 3. Trading Securities 4. Accounts receivable

Requirements: Determine the adjusted balances of the following: (Ignore tax implications) 1. Petty cash fund 2. Cash in bank 3. Trading Securities 4. Accounts receivable 5. Allowance for doubtful accounts 6. Notes and interest receivable 7. Inventories 8. Prepaid insurance 9. Prepaid rent 10. Prepaid advertising 11. Office supplies inventory 12. Total current assets 13. Property, plant, and equipment 14. Accumulated depreciation 15. Accounts payable 16. Interest payable 17. Total current liabilities 18. Sales 19. Cost of goods sold 20. Operating expenses

Prepare Adjusted Financial Statements: 1. Trial Balance 2. Income statement 3. Statement of changes in shareholders equity 4. Statement of financial position 5. Statement of cash flows

I need help

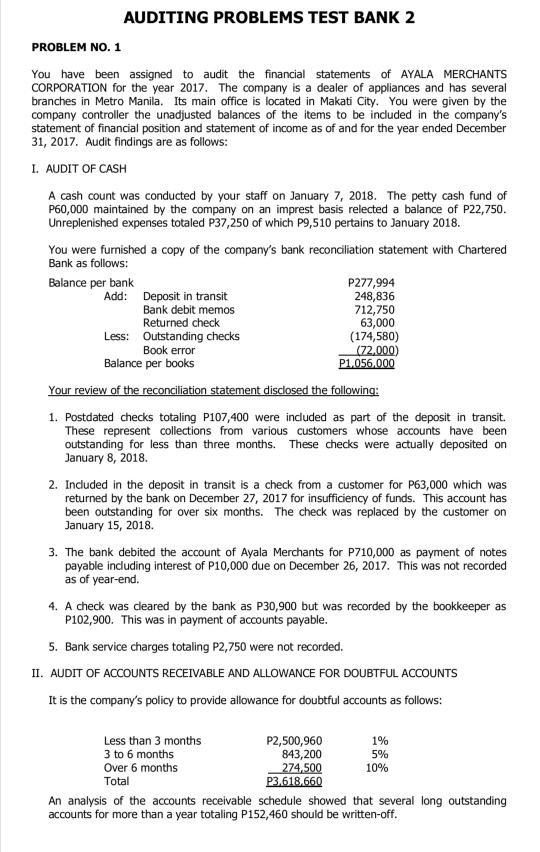

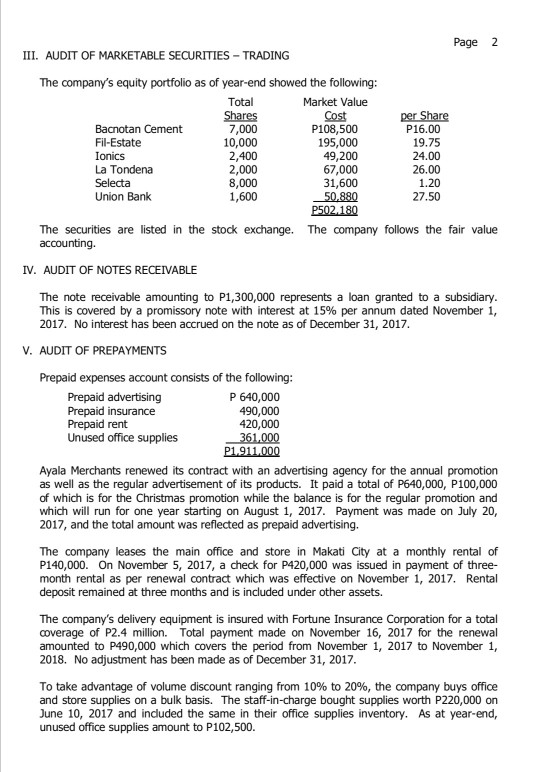

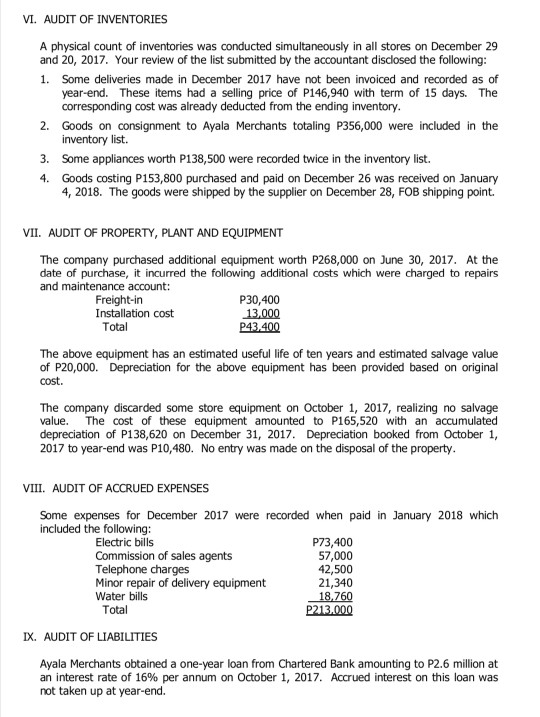

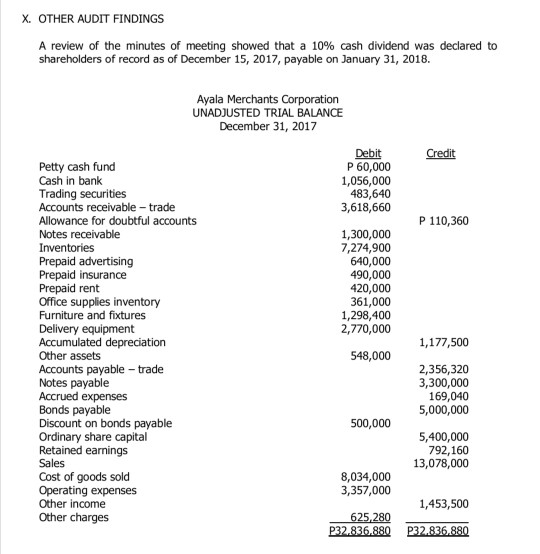

AUDITING PROBLEMS TEST BANK 2 PROBLEM NO. 1 You have been assigned to audit the financial statements of AYALA MERCHANTS CORPORATION for the year 2017. The company is a dealer of appliances and has several branches in Metro Manila. Its main office is located in Makati City. You were given by the company controller the unadjusted balances of the items to be included in the company's statement of financial position and statement of income as of and for the year ended December 31, 2017. Audit findings are as follows: I. AUDIT OF CASH A cash count was conducted by your staff on January 7, 2018. The petty cash fund of P60,000 maintained by the company on an imprest basis relected a balance of P22,750. Unreplenished expenses totaled P37,250 of which P9,510 pertains to January 2018. You were furnished a copy of the company's bank reconciliation statement with Chartered Bank as follows: Balance per bank P277,994 Add: Deposit in transit 248,836 Bank debit memos 712,750 Returned check 63,000 Less: Outstanding checks (174,580) Book error (72.000) Balance per books P1.056,000 Your review of the reconciliation statement disclosed the following: 1. Postdated checks totaling P107,400 were included as part of the deposit in transit. These represent collections from various customers whose accounts have been outstanding for less than three months. These checks were actually deposited on January 8, 2018 2. Included in the deposit in transit is a check from a customer for P63,000 which was returned by the bank on December 27, 2017 for insufficiency of funds. This account has been outstanding for over six months. The check was replaced by the customer on January 15, 2018. 3. The bank debited the account of Ayala Merchants for P710,000 as payment of notes payable including interest of P10,000 due on December 26, 2017. This was not recorded as of year-end. 4. A check was cleared by the bank as P30,900 but was recorded by the bookkeeper as P102,900. This was in payment of accounts payable. 5. Bank service charges totaling P2,750 were not recorded. II. AUDIT OF ACCOUNTS RECEIVABLE AND ALLOWANCE FOR DOUBTFUL ACCOUNTS It is the company's policy to provide allowance for doubtful accounts as follows: Less than 3 months P2,500,960 1% 3 to 6 months 843,200 5% Over 6 months 274,500 10% Total P3.618.660 An analysis of the accounts receivable schedule showed that several long outstanding accounts for more than a year totaling P152,460 should be written-off. 2 Page III. AUDIT OF MARKETABLE SECURITIES - TRADING The company's equity portfolio as of year-end showed the following: Total Market Value Shares Cost per Share Bacnotan Cement 7,000 P108,500 P16.00 Fil-Estate 10,000 195,000 19.75 Ionics 2,400 49,200 24.00 La Tondena 2,000 67,000 26.00 Selecta 8,000 31,600 1.20 Union Bank 1,600 50.880 27.50 P502.180 The securities are listed in the stock exchange. The company follows the fair value accounting IV. AUDIT OF NOTES RECEIVABLE The note receivable amounting to P1,300,000 represents a loan granted to a subsidiary. This is covered by a promissory note with interest at 15% per annum dated November 1, 2017. No interest has been accrued on the note as of December 31, 2017. V. AUDIT OF PREPAYMENTS Prepaid expenses account consists of the following: Prepaid advertising P 640,000 Prepaid insurance 490,000 Prepaid rent 420,000 Unused office supplies 361,000 P1.911.000 Ayala Merchants renewed its contract with an advertising agency for the annual promotion as well as the regular advertisement of its products. It paid a total of P640,000, P100,000 of which is for the Christmas promotion while the balance is for the regular promotion and which will run for one year starting on August 1, 2017. Payment was made on July 20, 2017, and the total amount was reflected as prepaid advertising. The company leases the main office and store in Makati City at a monthly rental of P140,000. On November 5, 2017, a check for P420,000 was issued in payment of three- month rental as per renewal contract which was effective on November 1, 2017. Rental deposit remained at three months and is included under other assets. The company's delivery equipment is insured with Fortune Insurance Corporation for a total coverage of P2.4 million. Total payment made on November 16, 2017 for the renewal amounted to P490,000 which covers the period from November 1, 2017 to November 1, 2018. No adjustment has been made as of December 31, 2017. To take advantage of volume discount ranging from 10% to 20%, the company buys office and store supplies on a bulk basis. The staff-in-charge bought supplies worth P220,000 on June 10, 2017 and included the same in their office supplies inventory. As at year-end, unused office supplies amount to P102,500. VI. AUDIT OF INVENTORIES A physical count of inventories was conducted simultaneously in all stores on December 29 and 20, 2017. Your review of the list submitted by the accountant disclosed the following: 1. Some deliveries made in December 2017 have not been invoiced and recorded as of year-end. These items had a selling price of P146,940 with term of 15 days. The corresponding cost was already deducted from the ending inventory. 2. Goods on consignment to Ayala Merchants totaling P356,000 were included in the inventory list. 3. Some appliances worth P138,500 were recorded twice in the inventory list. 4. Goods costing P153,800 purchased and paid on December 26 was received on January 4, 2018. The goods were shipped by the supplier on December 28, FOB shipping point. VII. AUDIT OF PROPERTY, PLANT AND EQUIPMENT The company purchased additional equipment worth P268,000 on June 30, 2017. At the date of purchase, it incurred the following additional costs which were charged to repairs and maintenance account: Freight-in P30,400 Installation cost 13,000 Total P43.400 The above equipment has an estimated useful life of ten years and estimated salvage value of P20,000. Depreciation for the above equipment has been provided based on original cost. The company discarded some store equipment on October 1, 2017, realizing no salvage value. The cost of these equipment amounted to P165,520 with an accumulated depreciation of P138,620 on December 31, 2017. Depreciation booked from October 1, 2017 to year-end was P10,480. No entry was made on the disposal of the property. VIII. AUDIT OF ACCRUED EXPENSES Some expenses for December 2017 were recorded when paid in January 2018 which included the following: Electric bills P73,400 Commission of sales agents 57,000 Telephone charges 42,500 Minor repair of delivery equipment 21,340 Water bills 18,760 Total P213.000 IX. AUDIT OF LIABILITIES Ayala Merchants obtained a one-year loan from Chartered Bank amounting to P2.6 million at an interest rate of 16% per annum on October 1, 2017. Accrued interest on this loan was not taken up at year-end. X. OTHER AUDIT FINDINGS A review of the minutes of meeting showed that a 10% cash dividend was declared to shareholders of record as of December 15, 2017, payable on January 31, 2018. Ayala Merchants Corporation UNADJUSTED TRIAL BALANCE December 31, 2017 Credit P 110,360 Debit P 60,000 1,056,000 483,640 3,618,660 1,300,000 7,274,900 640,000 490,000 420,000 361,000 1,298,400 2,770,000 Petty cash fund Cash in bank Trading securities Accounts receivable - trade Allowance for doubtful accounts Notes receivable Inventories Prepaid advertising Prepaid insurance Prepaid rent Office supplies inventory Furniture and fixtures Delivery equipment Accumulated depreciation Other assets Accounts payable - trade Notes payable Accrued expenses Bonds payable Discount on bonds payable Ordinary share capital Retained earnings Sales Cost of goods sold Operating expenses Other income Other charges 548,000 1,177,500 2,356,320 3,300,000 169,040 5,000,000 500,000 5,400,000 792,160 13,078,000 8,034,000 3,357,000 1,453,500 625,280 P32.836.880 P32.836.880 AUDITING PROBLEMS TEST BANK 2 PROBLEM NO. 1 You have been assigned to audit the financial statements of AYALA MERCHANTS CORPORATION for the year 2017. The company is a dealer of appliances and has several branches in Metro Manila. Its main office is located in Makati City. You were given by the company controller the unadjusted balances of the items to be included in the company's statement of financial position and statement of income as of and for the year ended December 31, 2017. Audit findings are as follows: I. AUDIT OF CASH A cash count was conducted by your staff on January 7, 2018. The petty cash fund of P60,000 maintained by the company on an imprest basis relected a balance of P22,750. Unreplenished expenses totaled P37,250 of which P9,510 pertains to January 2018. You were furnished a copy of the company's bank reconciliation statement with Chartered Bank as follows: Balance per bank P277,994 Add: Deposit in transit 248,836 Bank debit memos 712,750 Returned check 63,000 Less: Outstanding checks (174,580) Book error (72.000) Balance per books P1.056,000 Your review of the reconciliation statement disclosed the following: 1. Postdated checks totaling P107,400 were included as part of the deposit in transit. These represent collections from various customers whose accounts have been outstanding for less than three months. These checks were actually deposited on January 8, 2018 2. Included in the deposit in transit is a check from a customer for P63,000 which was returned by the bank on December 27, 2017 for insufficiency of funds. This account has been outstanding for over six months. The check was replaced by the customer on January 15, 2018. 3. The bank debited the account of Ayala Merchants for P710,000 as payment of notes payable including interest of P10,000 due on December 26, 2017. This was not recorded as of year-end. 4. A check was cleared by the bank as P30,900 but was recorded by the bookkeeper as P102,900. This was in payment of accounts payable. 5. Bank service charges totaling P2,750 were not recorded. II. AUDIT OF ACCOUNTS RECEIVABLE AND ALLOWANCE FOR DOUBTFUL ACCOUNTS It is the company's policy to provide allowance for doubtful accounts as follows: Less than 3 months P2,500,960 1% 3 to 6 months 843,200 5% Over 6 months 274,500 10% Total P3.618.660 An analysis of the accounts receivable schedule showed that several long outstanding accounts for more than a year totaling P152,460 should be written-off. 2 Page III. AUDIT OF MARKETABLE SECURITIES - TRADING The company's equity portfolio as of year-end showed the following: Total Market Value Shares Cost per Share Bacnotan Cement 7,000 P108,500 P16.00 Fil-Estate 10,000 195,000 19.75 Ionics 2,400 49,200 24.00 La Tondena 2,000 67,000 26.00 Selecta 8,000 31,600 1.20 Union Bank 1,600 50.880 27.50 P502.180 The securities are listed in the stock exchange. The company follows the fair value accounting IV. AUDIT OF NOTES RECEIVABLE The note receivable amounting to P1,300,000 represents a loan granted to a subsidiary. This is covered by a promissory note with interest at 15% per annum dated November 1, 2017. No interest has been accrued on the note as of December 31, 2017. V. AUDIT OF PREPAYMENTS Prepaid expenses account consists of the following: Prepaid advertising P 640,000 Prepaid insurance 490,000 Prepaid rent 420,000 Unused office supplies 361,000 P1.911.000 Ayala Merchants renewed its contract with an advertising agency for the annual promotion as well as the regular advertisement of its products. It paid a total of P640,000, P100,000 of which is for the Christmas promotion while the balance is for the regular promotion and which will run for one year starting on August 1, 2017. Payment was made on July 20, 2017, and the total amount was reflected as prepaid advertising. The company leases the main office and store in Makati City at a monthly rental of P140,000. On November 5, 2017, a check for P420,000 was issued in payment of three- month rental as per renewal contract which was effective on November 1, 2017. Rental deposit remained at three months and is included under other assets. The company's delivery equipment is insured with Fortune Insurance Corporation for a total coverage of P2.4 million. Total payment made on November 16, 2017 for the renewal amounted to P490,000 which covers the period from November 1, 2017 to November 1, 2018. No adjustment has been made as of December 31, 2017. To take advantage of volume discount ranging from 10% to 20%, the company buys office and store supplies on a bulk basis. The staff-in-charge bought supplies worth P220,000 on June 10, 2017 and included the same in their office supplies inventory. As at year-end, unused office supplies amount to P102,500. VI. AUDIT OF INVENTORIES A physical count of inventories was conducted simultaneously in all stores on December 29 and 20, 2017. Your review of the list submitted by the accountant disclosed the following: 1. Some deliveries made in December 2017 have not been invoiced and recorded as of year-end. These items had a selling price of P146,940 with term of 15 days. The corresponding cost was already deducted from the ending inventory. 2. Goods on consignment to Ayala Merchants totaling P356,000 were included in the inventory list. 3. Some appliances worth P138,500 were recorded twice in the inventory list. 4. Goods costing P153,800 purchased and paid on December 26 was received on January 4, 2018. The goods were shipped by the supplier on December 28, FOB shipping point. VII. AUDIT OF PROPERTY, PLANT AND EQUIPMENT The company purchased additional equipment worth P268,000 on June 30, 2017. At the date of purchase, it incurred the following additional costs which were charged to repairs and maintenance account: Freight-in P30,400 Installation cost 13,000 Total P43.400 The above equipment has an estimated useful life of ten years and estimated salvage value of P20,000. Depreciation for the above equipment has been provided based on original cost. The company discarded some store equipment on October 1, 2017, realizing no salvage value. The cost of these equipment amounted to P165,520 with an accumulated depreciation of P138,620 on December 31, 2017. Depreciation booked from October 1, 2017 to year-end was P10,480. No entry was made on the disposal of the property. VIII. AUDIT OF ACCRUED EXPENSES Some expenses for December 2017 were recorded when paid in January 2018 which included the following: Electric bills P73,400 Commission of sales agents 57,000 Telephone charges 42,500 Minor repair of delivery equipment 21,340 Water bills 18,760 Total P213.000 IX. AUDIT OF LIABILITIES Ayala Merchants obtained a one-year loan from Chartered Bank amounting to P2.6 million at an interest rate of 16% per annum on October 1, 2017. Accrued interest on this loan was not taken up at year-end. X. OTHER AUDIT FINDINGS A review of the minutes of meeting showed that a 10% cash dividend was declared to shareholders of record as of December 15, 2017, payable on January 31, 2018. Ayala Merchants Corporation UNADJUSTED TRIAL BALANCE December 31, 2017 Credit P 110,360 Debit P 60,000 1,056,000 483,640 3,618,660 1,300,000 7,274,900 640,000 490,000 420,000 361,000 1,298,400 2,770,000 Petty cash fund Cash in bank Trading securities Accounts receivable - trade Allowance for doubtful accounts Notes receivable Inventories Prepaid advertising Prepaid insurance Prepaid rent Office supplies inventory Furniture and fixtures Delivery equipment Accumulated depreciation Other assets Accounts payable - trade Notes payable Accrued expenses Bonds payable Discount on bonds payable Ordinary share capital Retained earnings Sales Cost of goods sold Operating expenses Other income Other charges 548,000 1,177,500 2,356,320 3,300,000 169,040 5,000,000 500,000 5,400,000 792,160 13,078,000 8,034,000 3,357,000 1,453,500 625,280 P32.836.880 P32.836.880Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started