Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requirements: Download the relevant data into a spreadsheet and complete (show) the needed calculation accordingly. Provide written answers to both questions in the spreadsheet. Submit

Requirements:

- Download the relevant data into a spreadsheet and complete (show) the needed calculation accordingly.

- Provide written answers to both questions in the spreadsheet.

- Submit your project report in a spreadsheet where you need to

- Show raw data as downloaded and specify the date of downloading

- Select (highlight data in your spreadsheet) relevant data and show needed calculations.

- Provide written answers to questions.

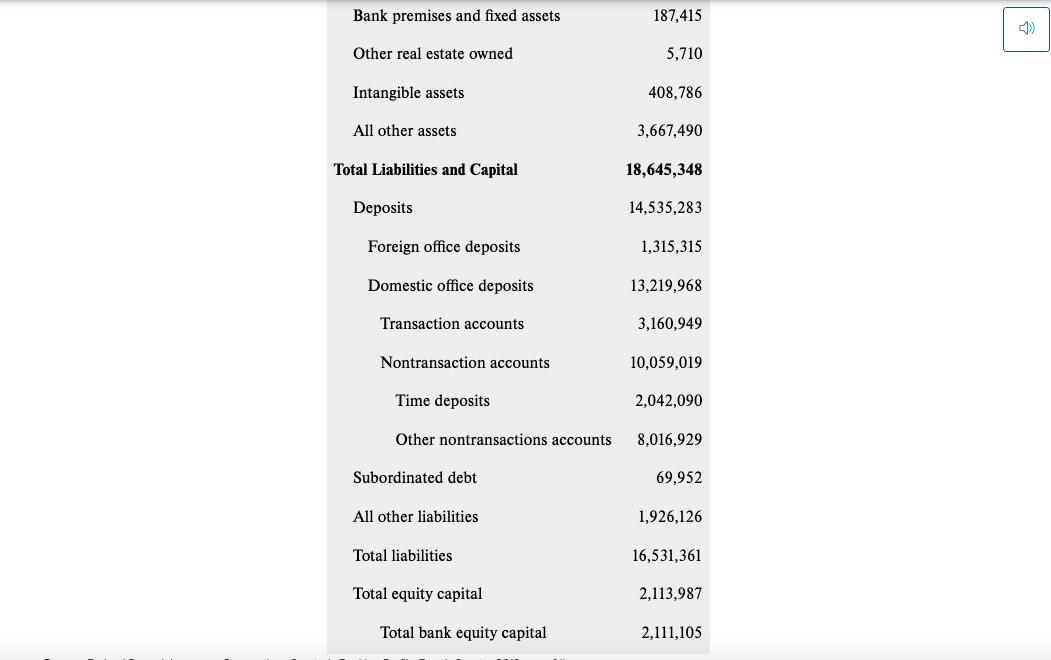

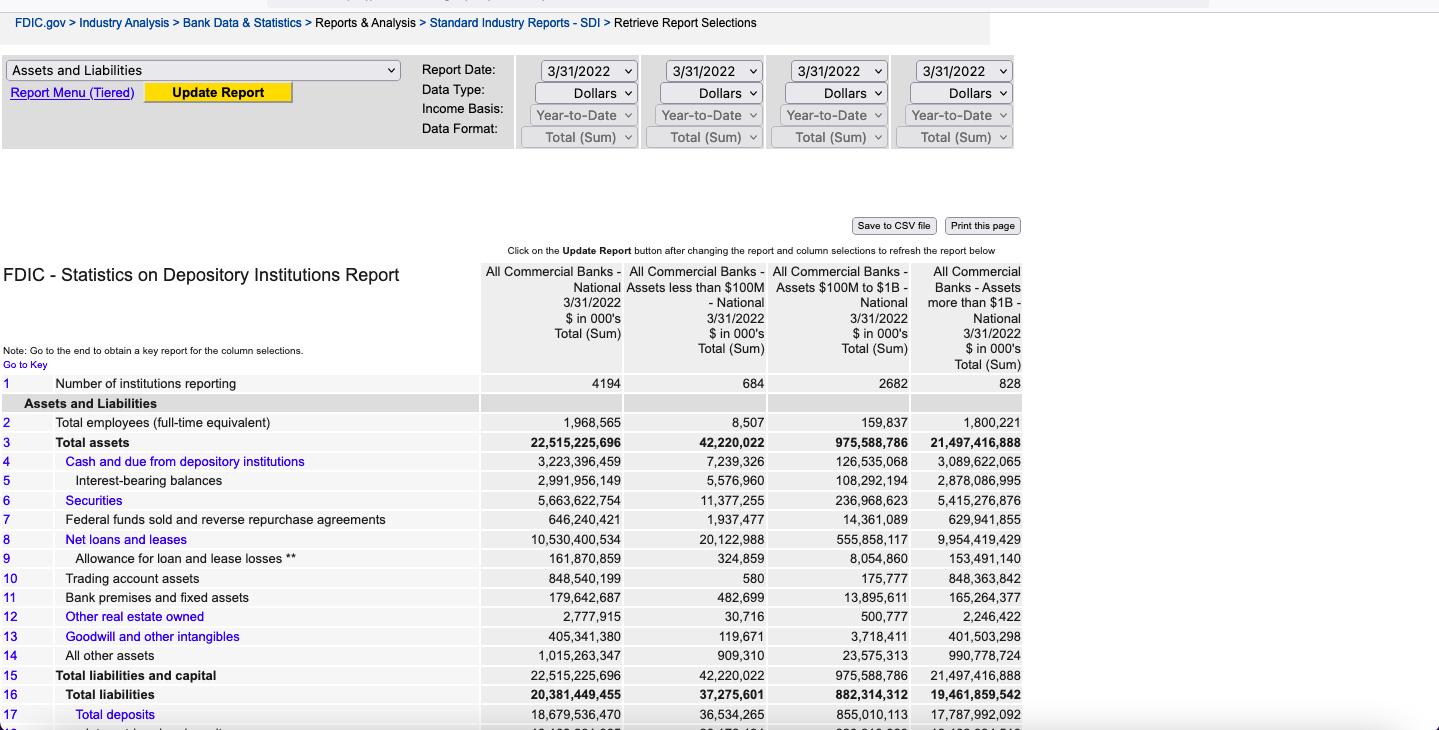

Table 11-1 Balance Sheet of U.S. Commercial Banks (millions of dollars) Total Assets Loans secured by real estate Commercial and industrial loans Loans to individuals Credit cards Other loans to individuals Other loans and leases. Gross total loans and leases Less: Unearned income Total loans and leases Less: Reserve for losses. Net loans and leases Securities Bank premises and fixed assets Other real estate owned 18,645,348 5,045,856 2,205,006 1,837,510 941,557 895,953 1,432,167 10,520,539 2,337 10,518,202 123,889 10,394,313 3,981,634 187,415 5,710

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are more detailed answers to the questions 1 What percentage of total assets are loans and leas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started