Requirements for Problem 3 !

Please answer questions related to the lessee and lessor

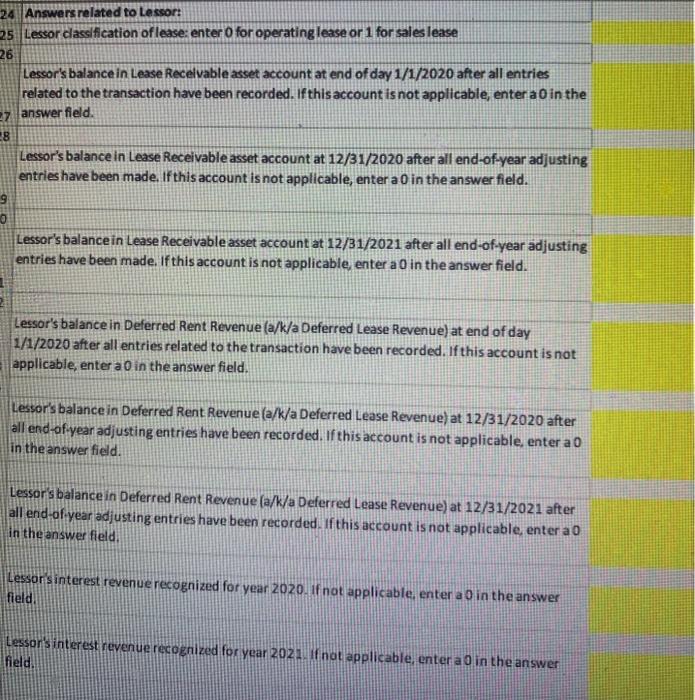

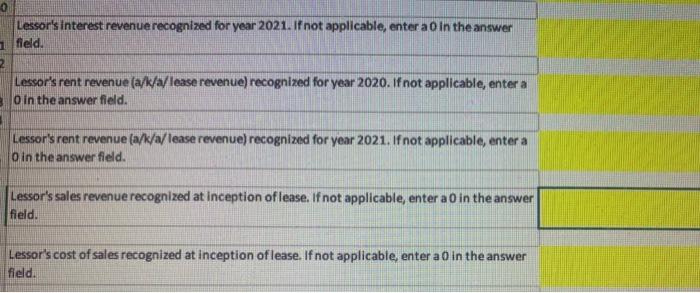

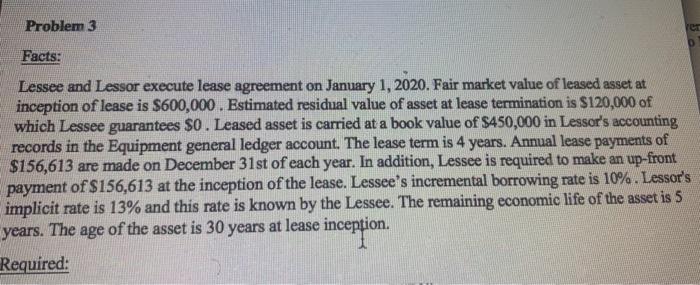

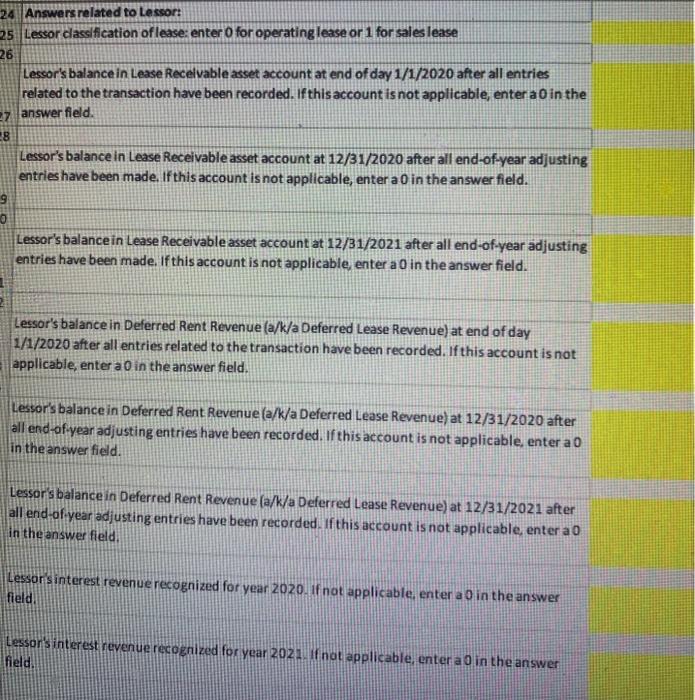

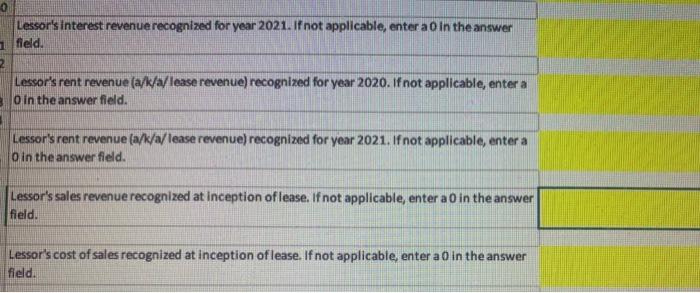

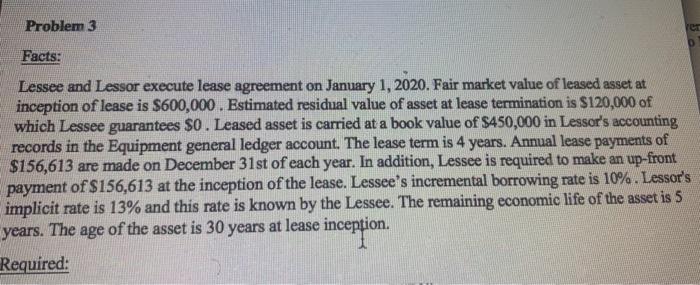

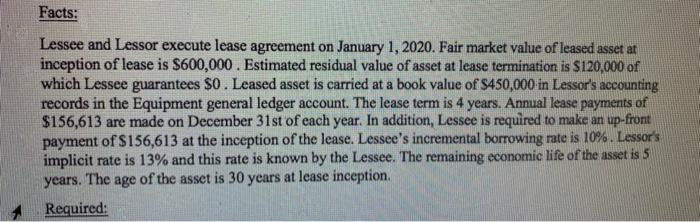

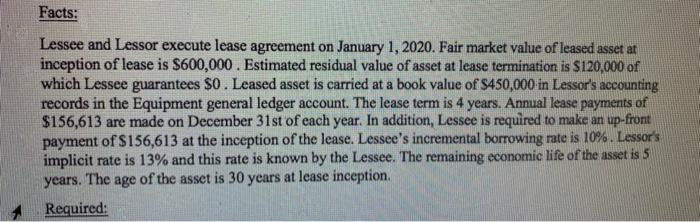

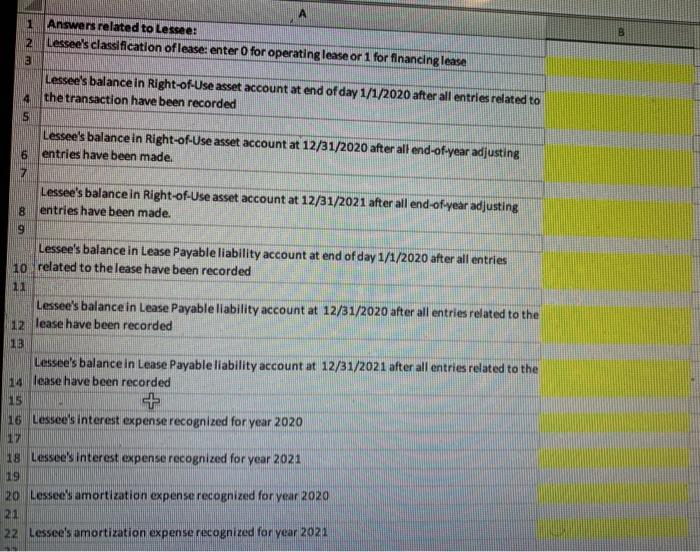

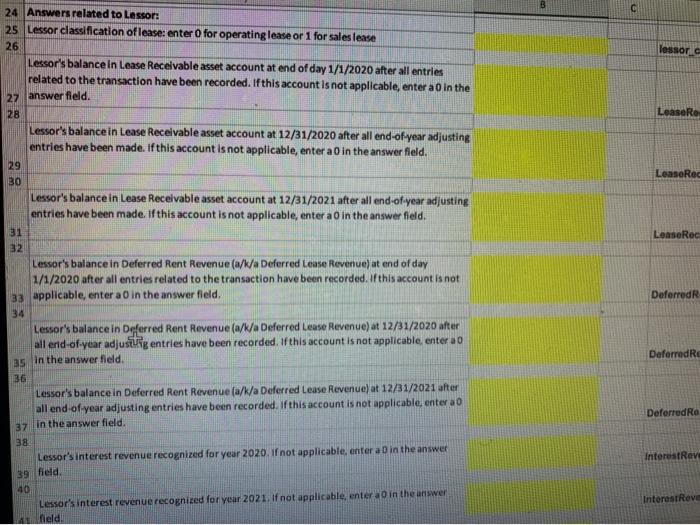

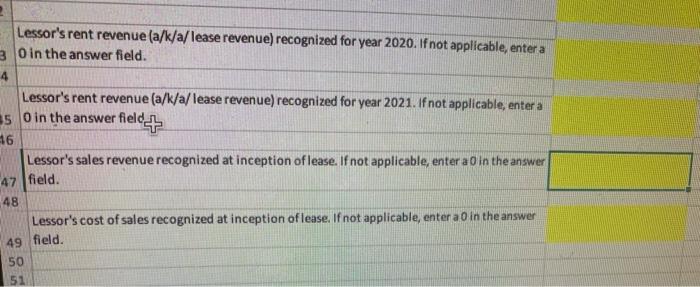

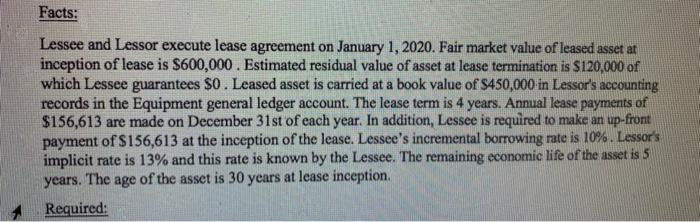

1 Answers related to Lessee: 2 Lessee's classification of lease: enter for operating lease or 1 for financing lease 3 Lessee's balance in Right-of-Use asset account at end of day 1/1/2020 after all entries related to the transaction have been recorded Lessee's balance in Right-of-Use asset account at 12/31/2020 after all end-of-year adjusting + entries have been made. Lessee's balance in Right-of-Use asset account at 12/31/2021 after all end-of-year adjusting entries have been made. Lessee's balance in Lease Payable liability account at end of day 1/1/2020 after all entries related to the lease have been recorded Lessee's balance in Lease Payable liability account at 12/31/2020 after all entries related to the lease have been recorded Lessee's balance in Lease Payable liability account at 12/31/2021 after all entries related to the lease have been recorded Lessee's interest expense recognized for year 2020 Lessee's interest expense recognized for year 2021 Lessee's amortization expense recognized for year 2020 Lessee's amortization expense recognized for year 2021 24 Answers related to Lessort 25 Lessor cassification of lease: enter o for operating lease or 1 for sales lease 26 Lessor's balance in Lease Receivable asset account at end of day 1/1/2020 after all entries related to the transaction have been recorded. If this account is not applicable, enter a 0 in the 27 answer field. 8 Lessor's balance in Lease Receivable asset account at 12/31/2020 after all end-of-year adjusting entries have been made. If this account is not applicable, enter a 0 in the answer field. 0 Lessor's balance in Lease Receivable asset account at 12/31/2021 after all end-of-year adjusting entries have been made. If this account is not applicable, enter a 0 in the answer field. Lessor's balance in Deferred Rent Revenue (a/k/a Deferred Lease Revenue) at end of day 1/1/2020 after all entries related to the transaction have been recorded. If this account is not applicable, enter a 0 in the answer field. Lessor's balance in Deferred Rent Revenue (a/k/a Deferred Lease Revenue) at 12/31/2020 after all end-of-year adjusting entries have been recorded. If this account is not applicable, enter a O in the answer field. Lessor's balance in Deferred Rent Revenue (a/k/a Deferred Lease Revenue) at 12/31/2021 after all end-of-year adjusting entries have been recorded. If this account is not applicable, enter a 0 in the answer field, Lessor's interest revenue recognized for year 2020. if not applicable, enter a O in the answer field. Lessor's interest revenue recognized for year 2021. If not applicable, enter a 0 in the answer field. Lessor's interest revenue recognized for year 2021. If not applicable, enter a in the answer 1 field. 2 Lessor's rent revenue (a/k/a/lease revenue) recognized for year 2020. If not applicable, enter a Oin the answer field, Lessor's rent revenue (a/k/a/lease revenue) recognized for year 2021. If not applicable, enter a o in the answer field. Lessor's sales revenue recognized at inception of lease. If not applicable, enter a 0 in the answer field. Lessor's cost of sales recognized at inception of lease. If not applicable, enter a 0 in the answer field. Problem 3 Facts: Lessee and Lessor execute lease agreement on January 1, 2020. Fair market value of leased asset at inception of lease is $600,000. Estimated residual value of asset at lease termination is $120,000 of which Lessee guarantees $0. Leased asset is carried at a book value of $450,000 in Lessor's accounting records in the Equipment general ledger account. The lease term is 4 years. Annual lease payments of $156,613 are made on December 31st of each year. In addition, Lessee is required to make an up-front payment of $156,613 at the inception of the lease. Lessee's incremental borrowing rate is 10%. Lessor's implicit rate is 13% and this rate is known by the Lessee. The remaining economic life of the asset is 5 years. The age of the asset is 30 years at lease inception. Required: Facts: Lessee and Lessor execute lease agreement on January 1, 2020. Fair market value of leased asset at inception of lease is $600,000. Estimated residual value of asset at lease termination is $120,000 of which Lessee guarantees $0.Leased asset is carried at a book value of $450,000 in Lessor's accounting records in the Equipment general ledger account. The lease term is 4 years. Annual lease payments of $156,613 are made on December 31st of each year. In addition, Lessee is required to make an up-front payment of $156,613 at the inception of the lease. Lessee's incremental borrowing rate is 10%. Lessors implicit rate is 13% and this rate is known by the Lessee. The remaining economic life of the asset is 5 years. The age of the asset is 30 years at lease inception. Required: A 1 Answers related to Lessee: Lessee's classification of lease enter 0 for operating lease or 1 for financing lease B Lessee's balance in Right-of-Use asset account at end of day 1/1/2020 after all entries related to the transaction have been recorded Lessee's balance in Right-of-Use asset account at 12/31/2020 after all end-of-year adjusting entries have been made. Lessee's balance in Right-of-Use asset account at 12/31/2021 after all end of year adjusting entries have been made. Lessee's balance in Lease Payable liability account at end of day 1/1/2020 after all entries 10 related to the lease have been recorded 12 Lessee's balance in Lease Payable liability account at 12/31/2020 after all entries related to the 12 lease have been recorded 13 Lessee's balance in Lease Payable liability account at 12/31/2021 after all entries related to the 10 lease have been recorded 15 16 Lessee's interest expense recognized for year 2020 17 18 Lessee's interest expense recognized for year 2021 19 20 Lessee's amortization expense recognized for year 2020 21 22 Lessee's amortization expense recognized for year 2021 lessor Lease Re Lease Red 24 Answers related to Lessor: 25 Lessor classification of lease: enter for operating lease or 1 for sales lease 26 Lessor's balance in Lease Receivable asset account at end of day 1/1/2020 after all entries related to the transaction have been recorded. If this account is not applicable, enter a 0 in the 27 answer field. 28 Lessor's balance in Lease Receivable asset account at 12/31/2020 after all end of year adjusting entries have been made. If this account is not applicable, enter a 0 in the answer field. 29 30 Lessor's balance in Lease Receivable asset account at 12/31/2021 after all end-of-year adjusting entries have been made. If this account is not applicable, enter a in the answer field. 31 32 Lessor's balance in Deferred Rent Revenue (a/k/a Deferred Lease Revenue) at end of day 1/1/2020 after all entries related to the transaction have been recorded. If this account is not 33 applicable, enter a 0 in the answer field. 34 Lessor's balance in Deferred Rent Revenue (a/b/a Deferred Lease Revenue) at 12/31/2020 after all end-of-year adjustig entries have been recorded. If this account is not applicable, enter a 0 35 in the answer field. 36 Lessor's balance in Deferred Rent Revenue (a/k/a Deferred Lease Revenue) at 12/31/2021 after all end of year adjusting entries have been recorded. If this account is not applicable, enter ao 37 in the answer field. 38 Lessor's interest revenue recognized for year 2020. if not applicable, enter a Din the answer LeaseRec Deferred Deferred DeferredRo InterestReve 39 field 40 Interest Reve Lessor's interest revenue recognized for year 2021. If not applicable, enter in the answer Rield Lessor's rent revenue (a/k/a/lease revenue) recognized for year 2020. If not applicable, enter a 3 O in the answer field. 4 Lessor's rent revenue (a/k/a/lease revenue) recognized for year 2021. If not applicable, enter a 35 O in the answer field 16 Lessor's sales revenue recognized at inception of lease. If not applicable, enter a Oin the answer 47 field. 48 Lessor's cost of sales recognized at inception of lease. If not applicable, enter a 0 in the answer 49 field. 50 51