Answered step by step

Verified Expert Solution

Question

1 Approved Answer

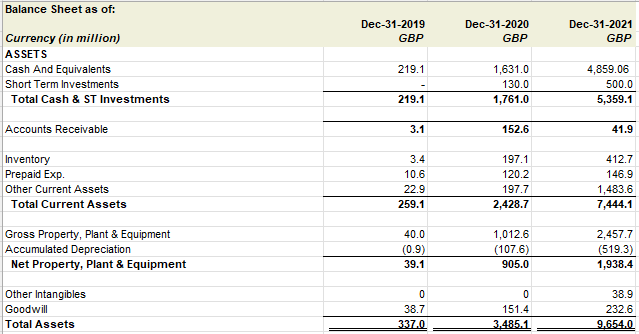

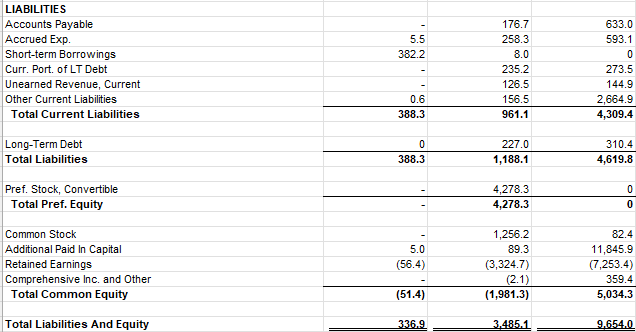

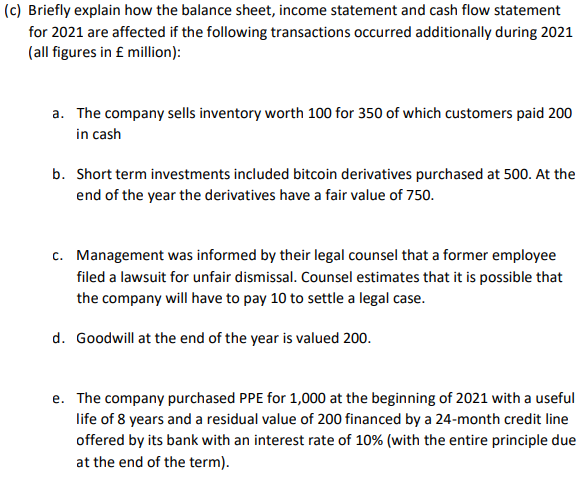

Requirements: LIABILITIES c) Briefly explain how the balance sheet, income statement and cash flow statement for 2021 are affected if the following transactions occurred additionally

Requirements:

LIABILITIES c) Briefly explain how the balance sheet, income statement and cash flow statement for 2021 are affected if the following transactions occurred additionally during 2021 (all figures in million): a. The company sells inventory worth 100 for 350 of which customers paid 200 in cash b. Short term investments included bitcoin derivatives purchased at 500. At the end of the year the derivatives have a fair value of 750 . c. Management was informed by their legal counsel that a former employee filed a lawsuit for unfair dismissal. Counsel estimates that it is possible that the company will have to pay 10 to settle a legal case. d. Goodwill at the end of the year is valued 200 . e. The company purchased PPE for 1,000 at the beginning of 2021 with a useful life of 8 years and a residual value of 200 financed by a 24 -month credit line offered by its bank with an interest rate of 10% (with the entire principle due at the end of the term). LIABILITIES c) Briefly explain how the balance sheet, income statement and cash flow statement for 2021 are affected if the following transactions occurred additionally during 2021 (all figures in million): a. The company sells inventory worth 100 for 350 of which customers paid 200 in cash b. Short term investments included bitcoin derivatives purchased at 500. At the end of the year the derivatives have a fair value of 750 . c. Management was informed by their legal counsel that a former employee filed a lawsuit for unfair dismissal. Counsel estimates that it is possible that the company will have to pay 10 to settle a legal case. d. Goodwill at the end of the year is valued 200 . e. The company purchased PPE for 1,000 at the beginning of 2021 with a useful life of 8 years and a residual value of 200 financed by a 24 -month credit line offered by its bank with an interest rate of 10% (with the entire principle due at the end of the term)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started