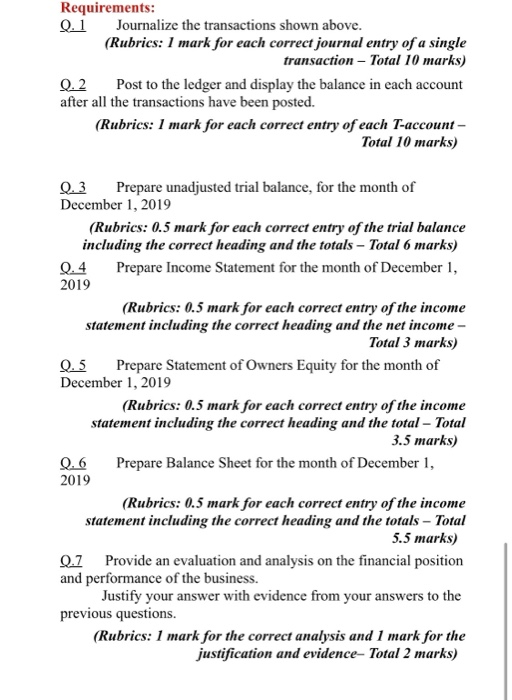

Requirements: Q.1 Journalize the transactions shown above. (Rubrics: 1 mark for each correct journal entry of a single transaction - Total 10 marks) 2.2 Post to the ledger and display the balance in each account after all the transactions have been posted. (Rubrics: I mark for each correct entry of each T-account - Total 10 marks) 1.3 Prepare unadjusted trial balance, for the month of December 1, 2019 (Rubrics: 0.5 mark for each correct entry of the trial balance including the correct heading and the totals - Total 6 marks) 0.4 Prepare Income Statement for the month of December 1, 2019 (Rubrics: 0.5 mark for each correct entry of the income statement including the correct heading and the net income - Total 3 marks) Q.5 Prepare Statement of Owners Equity for the month of December 1, 2019 (Rubrics: 0.5 mark for each correct entry of the income statement including the correct heading and the total - Total 3.5 marks) 2.6 Prepare Balance Sheet for the month of December 1, 2019 (Rubrics: 0.5 mark for each correct entry of the income statement including the correct heading and the totals - Total 5.5 marks) 0.7 Provide an evaluation and analysis on the financial position and performance of the business. Justify your answer with evidence from your answers to the previous questions. (Rubrics: 1 mark for the correct analysis and 1 mark for the justification and evidence- Total 2 marks) Requirements: Q.1 Journalize the transactions shown above. (Rubrics: 1 mark for each correct journal entry of a single transaction - Total 10 marks) 2.2 Post to the ledger and display the balance in each account after all the transactions have been posted. (Rubrics: I mark for each correct entry of each T-account - Total 10 marks) 1.3 Prepare unadjusted trial balance, for the month of December 1, 2019 (Rubrics: 0.5 mark for each correct entry of the trial balance including the correct heading and the totals - Total 6 marks) 0.4 Prepare Income Statement for the month of December 1, 2019 (Rubrics: 0.5 mark for each correct entry of the income statement including the correct heading and the net income - Total 3 marks) Q.5 Prepare Statement of Owners Equity for the month of December 1, 2019 (Rubrics: 0.5 mark for each correct entry of the income statement including the correct heading and the total - Total 3.5 marks) 2.6 Prepare Balance Sheet for the month of December 1, 2019 (Rubrics: 0.5 mark for each correct entry of the income statement including the correct heading and the totals - Total 5.5 marks) 0.7 Provide an evaluation and analysis on the financial position and performance of the business. Justify your answer with evidence from your answers to the previous questions. (Rubrics: 1 mark for the correct analysis and 1 mark for the justification and evidence- Total 2 marks)