Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the cash flows shown, use an annual worth comparison and an interest rate of 10% per year. a) Determine the alternative that is economically

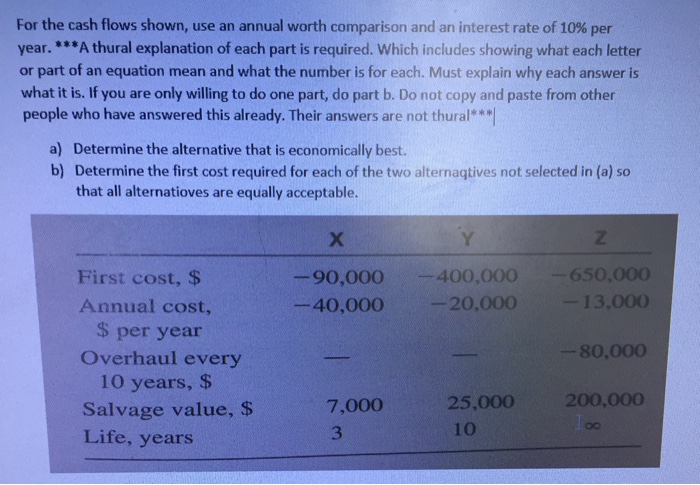

For the cash flows shown, use an annual worth comparison and an interest rate of 10% per year. a) Determine the alternative that is economically best.

b) Determine the first cost required for each of the two alternatives not selected in (a) so that all alternatives are equally acceptable.

I ESPECIALLY NEED HELP ON HOW TO DO (b) WITHOUT A COMPUTER

For the cash flows shown, use an annual worth comparison and an interest rate of 10% per year. ***A explanation of each part is required. Which includes showing what each letter Athural or part of an equation mean and what the number is for each. Must explain why each answer is what it is. If you are only willing to do one part, do part b. Do not copy and paste from other people who have answered this already. Their answers are not thural Determine the alternative that is economically best. a) b) Determine the first cost required for each of the two alternaqtives not selected in (a) so that all alternatioves are equally acceptable. 90,000 400,000 650,000 First cost, 13,000 40,000 20,000 Annual cost, per year 80,000 Overhaul every 10 years, 25,000 200,000 Salvage value, s 7,000 Life, yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started