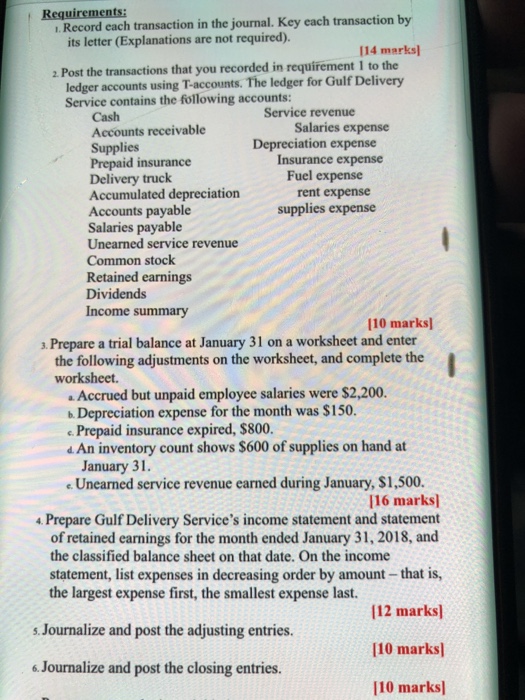

Requirements: .Record each transaction in the journal. Key each transaction by its letter (Explanations are not required). 114 marks 2 Post the transactions that you recorded in requirement 1 to the ledger accounts using T-accounts. The ledger for Gulf Delivery Service contains the following accounts: Service revenue Cash Accounts receivable Supplies Prepaid insurance Delivery truck Accumulated depreciation Accounts payable Salaries payable Unearned service revenue Common stock Retained earnings Dividends Income summary Salaries expense Depreciation expense Insurance expense Fuel expense rent expense supplies expense 110 marks) s Prepare a trial balance at January 31 on a worksheet and enter the following adjustments on the worksheet, and complete the worksheet. Accrued but unpaid employee salaries were $2,200 Depreciation expense for the month was $150. c. Prepaid insurance expired, $800. An inventory count shows $600 of supplies on hand at Unearned service revenue earned during January, $1,500. 4 Prepare Gulf Delivery Service's income statement and statement January 31 116 marks of retained earnings for the month ended January 31, 2018, and the classified balance sheet on that date. On the income statement, list expenses in decreasing order by amount- that is, 12 marks 110 marks 110 marks the largest expense first, the smallest expense last. s.Journalize and post the adjusting entries. 6.Journalize and post the closing entries Requirements: .Record each transaction in the journal. Key each transaction by its letter (Explanations are not required). 114 marks 2 Post the transactions that you recorded in requirement 1 to the ledger accounts using T-accounts. The ledger for Gulf Delivery Service contains the following accounts: Service revenue Cash Accounts receivable Supplies Prepaid insurance Delivery truck Accumulated depreciation Accounts payable Salaries payable Unearned service revenue Common stock Retained earnings Dividends Income summary Salaries expense Depreciation expense Insurance expense Fuel expense rent expense supplies expense 110 marks) s Prepare a trial balance at January 31 on a worksheet and enter the following adjustments on the worksheet, and complete the worksheet. Accrued but unpaid employee salaries were $2,200 Depreciation expense for the month was $150. c. Prepaid insurance expired, $800. An inventory count shows $600 of supplies on hand at Unearned service revenue earned during January, $1,500. 4 Prepare Gulf Delivery Service's income statement and statement January 31 116 marks of retained earnings for the month ended January 31, 2018, and the classified balance sheet on that date. On the income statement, list expenses in decreasing order by amount- that is, 12 marks 110 marks 110 marks the largest expense first, the smallest expense last. s.Journalize and post the adjusting entries. 6.Journalize and post the closing entries