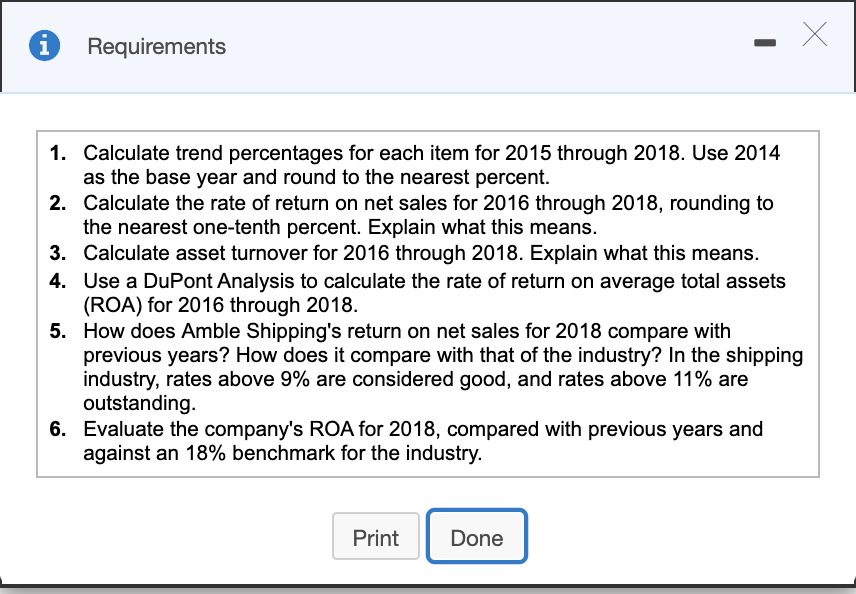

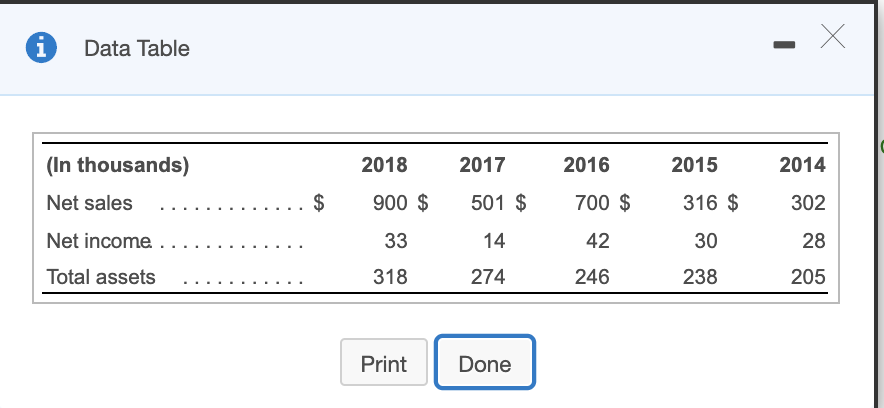

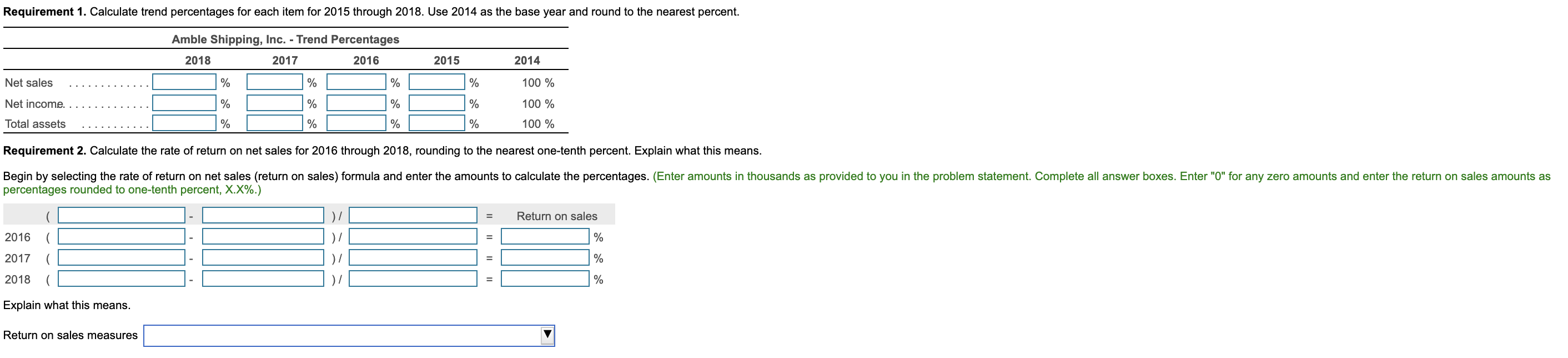

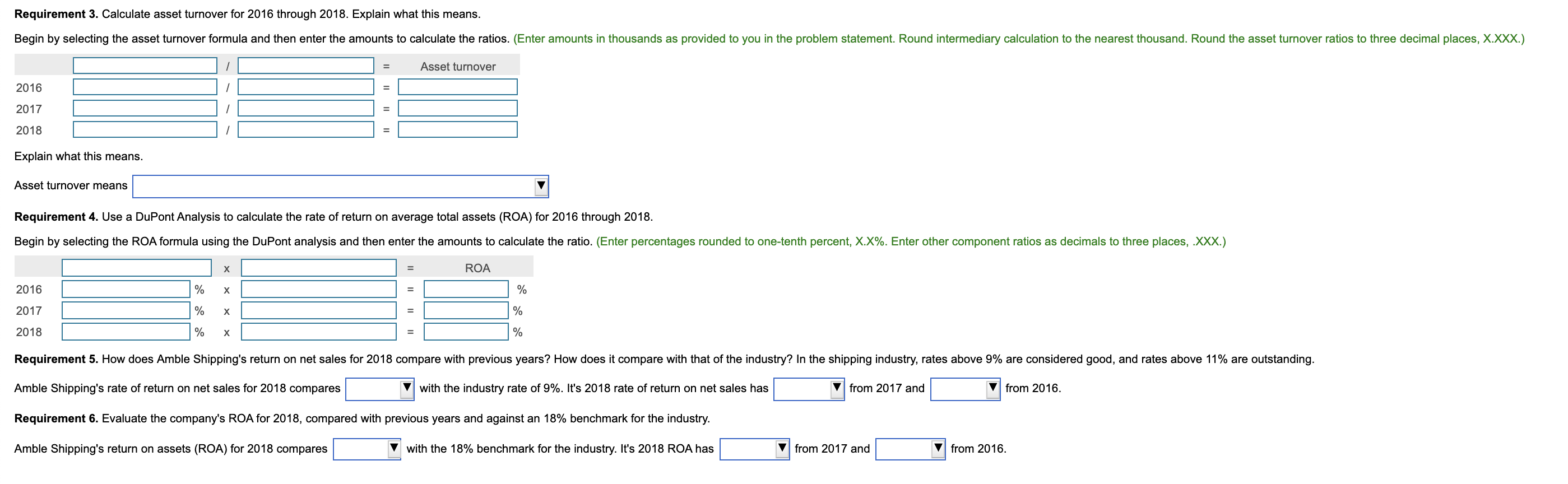

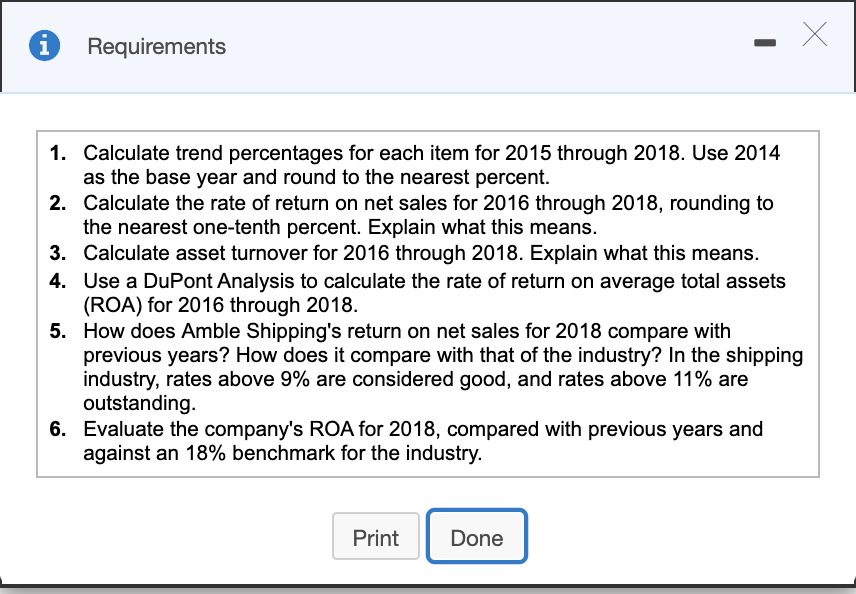

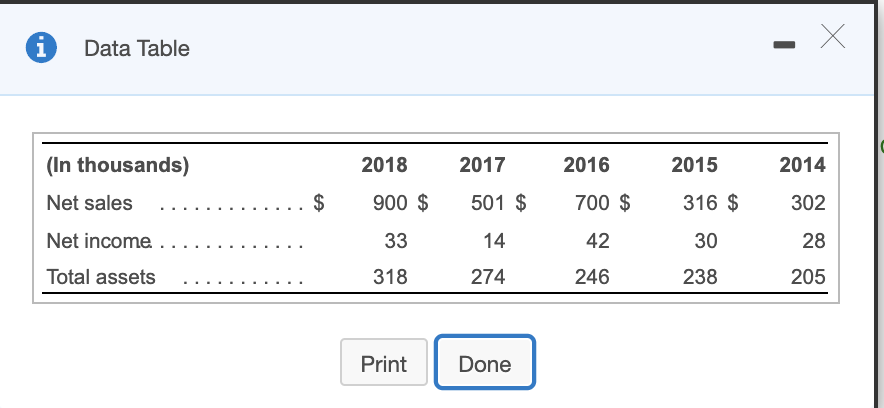

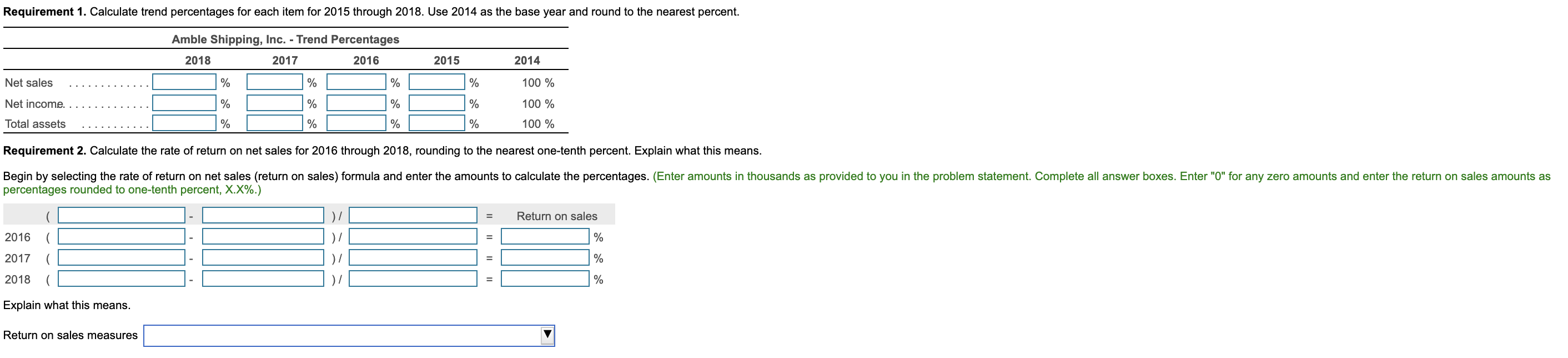

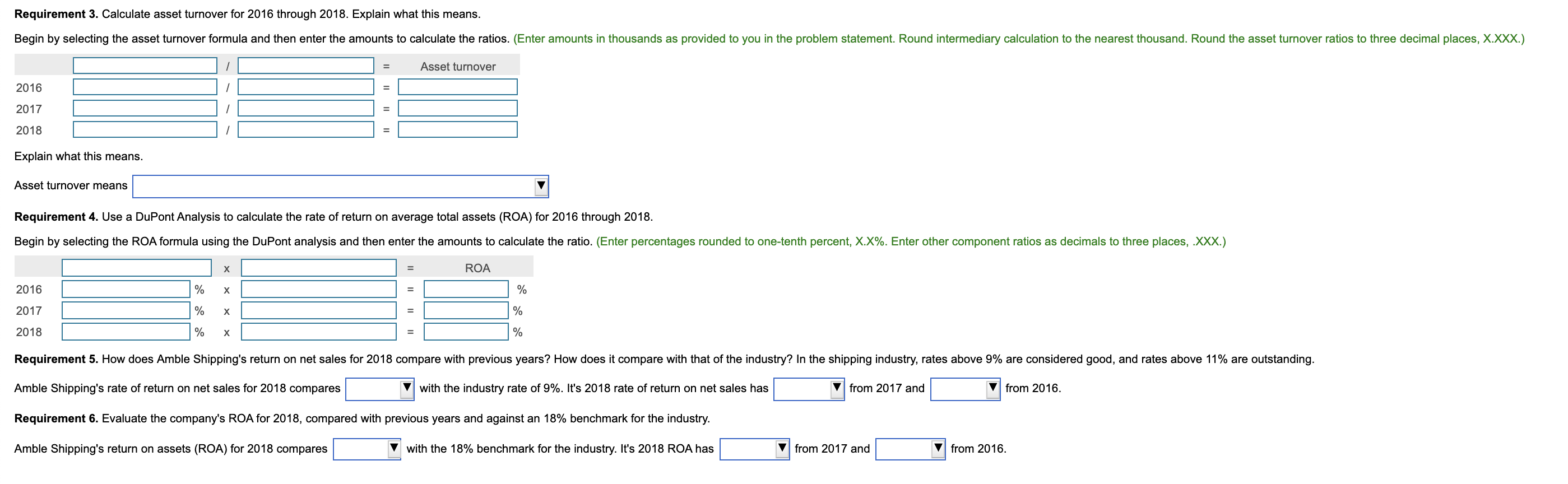

Requirements - X 1. Calculate trend percentages for each item for 2015 through 2018. Use 2014 as the base year and round to the nearest percent. 2. Calculate the rate of return on net sales for 2016 through 2018, rounding to the nearest one-tenth percent. Explain what this means. 3. Calculate asset turnover for 2016 through 2018. Explain what this means. 4. Use a DuPont Analysis to calculate the rate of return on average total assets (ROA) for 2016 through 2018. 5. How does Amble Shipping's return on net sales for 2018 compare with previous years? How does it compare with that of the industry? In the shipping industry, rates above 9% are considered good, and rates above 11% are outstanding. 6. Evaluate the company's ROA for 2018, compared with previous years and against an 18% benchmark for the industry. Print Done i Data Table (In thousands) Net sales ............. $ 2018 900 $ 1 318 2017 501 $ 14 274 2016 700 $ 42 246 2015 316 $ 30 238 2014 302 28 205 Net income ............. 33 Total assets ........... Print Print [ Done Done Requirement 1. Calculate trend percentages for each item for 2015 through 2018. Use 2014 as the base year and round to the nearest percent. 2015 2014 Net sales ........ Net income.............. Total assets ........... Amble Shipping, Inc. - Trend Percentages 2018 2017 2016 % L % % % % % % % % % 100 % 100 % 100 % Requirement 2. Calculate the rate of return on net sales for 2016 through 2018, rounding to the nearest one-tenth percent. Explain what this means. Begin by selecting the rate of return on net sales (return on sales) formula and enter the amounts to calculate the percentages. (Enter amounts in thousands as provided to you in the problem statement. Complete all answer boxes. Enter "O" for any zero amounts and enter the return on sales amounts as percentages rounded to one-tenth percent, X.X%.) = Return on sales 2016 2017 2018 (O (D ( Explain what this means. Return on sales measures Requirement 3. Calculate asset turnover for 2016 through 2018. Explain what this means. Begin by selecting the asset turnover formula and then enter the amounts to calculate the ratios. (Enter amounts in thousands as provided to you in the problem statement. Round intermediary calculation to the nearest thousand. Round the asset turnover ratios to three decimal places, X.XXX.) Asset turnover III 2016 2017 1 2018 II Explain what this means. Asset turnover means Requirement 4. Use a DuPont Analysis to calculate the rate of return on average total assets (ROA) for 2016 through 2018. Begin by selecting the ROA formula using the DuPont analysis and then enter the amounts to calculate the ratio. (Enter percentages rounded to one-tenth percent, X.X%. Enter other component ratios as decimals to three places, .XXX.) II ROA 2016 II 2017 % x % x % x II 2018 II Requirement 5. How does Amble Shipping's return on net sales for 2018 compare with previous years? How does it compare with that of the industry? In the shipping industry, rates above 9% are considered good, and rates above 11% are outstanding. Amble Shipping's rate of return on net sales for 2018 compares with the industry rate of 9%. It's 2018 rate of return on net sales has from 2017 and from 2016. Requirement 6. Evaluate the company's ROA for 2018, compared with previous years and against an 18% benchmark for the industry. Amble Shipping's return on assets (ROA) for 2018 compares with the 18% benchmark for the industry. It's 2018 ROA has from 2017 and from 2016