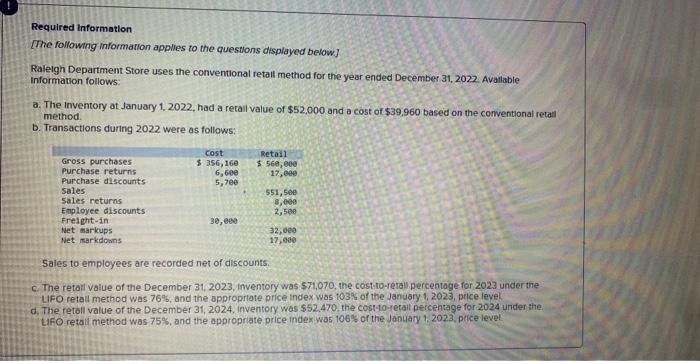

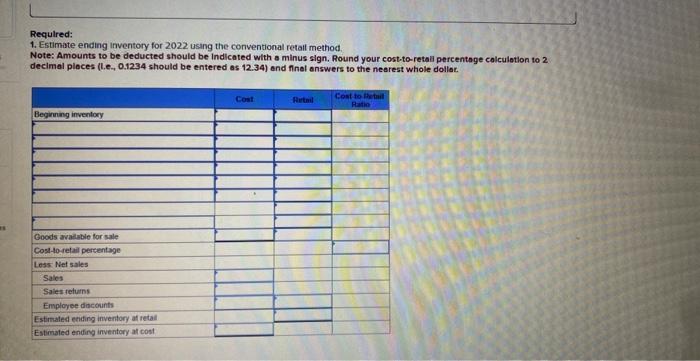

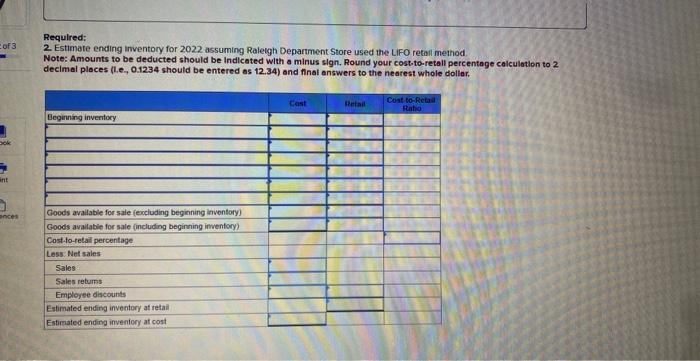

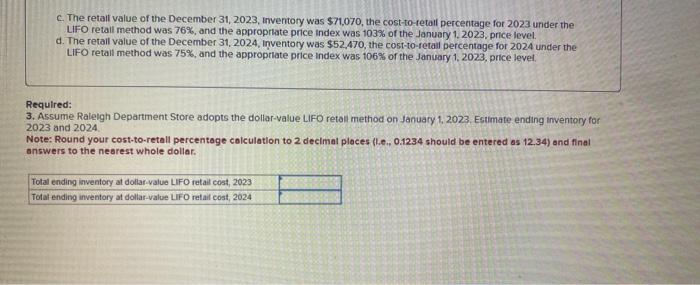

Requlred: 1. Estimate ending inventory for 2022 using the conventional retall method: Note: Amounts to be deducted should be indicated with a minus sign. Round your cost-to-retall percentage calculotion to 2 declmal places (l.e., 0.1234 should be entered as 12.34 ) and final answers to the nearest whole dollat. Required information The following information applies to the questions dispiayed below] Ralelgh Department Store uses the conventional retall method for the year ended December 31, 2022. Avallable information follows: a. The inventory at January 1,2022 , had a retall value of $52,000 and a cost of $39,960 based on the conventionai retall method. b. Transactions during 2022 were as follows: Sales to employees are recorded net of discounts. c. The retat value of the December 31,2023 , inventory was 571,070 , the cost-to-retal percentage for 2023 under the LFO retall method was 76%, and the approprlate price index was 103% of the January 4,2023 , price level. d. The fetall value of the December 31,2024 , inventory was $52.470, the cost-to-retall percentage for 2024 under the LifO-retali method was 75%, and the appropriate price index was, 106% of the January 1,202.3, price level Required: 2. Estimate ending inventory for 2022 assuming Ralelgh Department Store used the LiFO retall method Note: Amounts to be deducted should be Indicated with a minus sign, Round your cost-to-retall percentage calculation to 2 decimal places (1.e, 0.1234 should be entered as 12.34 ) and nnal answers to the nearest whole dollar. c. The retall value of the December 31,2023 , Inventory was $71,070, the cost-to-retall percentage for 2023 under the LIFO retall method was 76%, and the approprate price index was 103% of the January 1,2023, price level. d. The retall value of the December 31,2024 , inventory was $52,470, the cost-to-retall percentage for 2024 under the LIFO retall method was 75%, and the appropriate price index was 106% or the January 1,2023 , price level. Required: 3. Assume Raleigh Department Store adopts the dollar-value LIFO retoll method on January 1, 2023, Estimate ending inventory for 2023 and 2024 . Note: Round your cost-to-retall percentage calculation to 2 declmal ploces (l.e., 0.1234 should be entered as 12.34 ) and final answers to the nearest whole dollar