Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requlred Information Comprehensive Problem 22-86 (AlgO) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5, LO 22-6) While James Craig and his former classmate

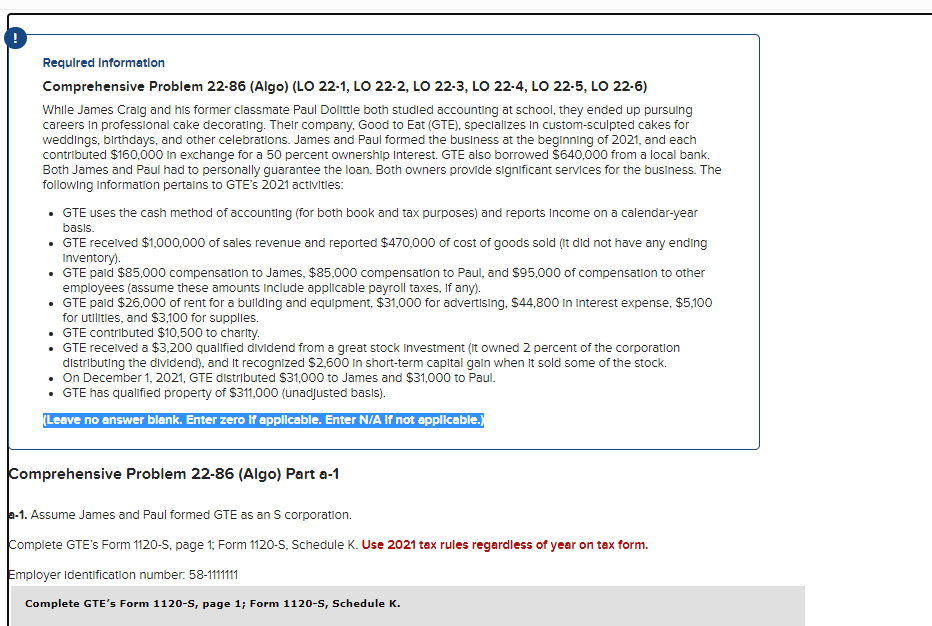

Requlred Information Comprehensive Problem 22-86 (AlgO) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5, LO 22-6) While James Craig and his former classmate Paul Dolittle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Thelr company, Good to Eat (GTE), speclallzes in custom-sculpted cakes for weddings, birthdays, and other celebrations. James and Paul formed the business at the beginning of 2021, and each contrlbuted $160,000 in exchange for a 50 percent ownership interest. GTE also borrowed $640,000 from a local bank. Both James and Paul had to personally guarantee the loan. Both owners provide significant services for the business. The following Information pertains to GTE's 2021 actlvitles: - GTE uses the cash method of accounting (for both book and tax purposes) and reports Income on a calendar-year basis. - GTE recelved $1,000,000 of sales revenue and reported $470,000 of cost of goods sold (It did not have any ending Inventory). - GTE paid $85,000 compensation to James, $85,000 compensation to Paul, and $95,000 of compensation to other employees (assume these amounts Include applicable payroll taxes, If any). - GTE paid $26,000 of rent for a bullding and equilpment, $31,000 for advertising, $44,800 in Interest expense, $5,100 for utilitles, and $3,100 for supplies. - GTE contributed $10,500 to charity. - GTE recelved a $3,200 quallfied dividend from a great stock Investment (it owned 2 percent of the corporation distributing the dividend), and It recognized $2,600 in short-term capltal gain when it sold some of the stock. - On December 1, 2021, GTE distributed $31,000 to James and $31,000 to Paul. - GTE has qualfied property of $311,000 (unadjusted basis). (Leave no answer blank. Enter zero if applicable. Enter N/A If not applicable.) Comprehensive Problem 22-86 (Algo) Part a-1 a-1. Assume James and Paul formed GTE as an S corporation. Complete GTE's Form 1120-S, page 1; Form 1120-S, Schedule K. Use 2021 tax rules regardless of year on tax form. Employer Identification number. 58-1111111 Complete GTE's Form 1120-S, page 1; Form 1120S, Schedule K. Requlred Information Comprehensive Problem 22-86 (AlgO) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5, LO 22-6) While James Craig and his former classmate Paul Dolittle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Thelr company, Good to Eat (GTE), speclallzes in custom-sculpted cakes for weddings, birthdays, and other celebrations. James and Paul formed the business at the beginning of 2021, and each contrlbuted $160,000 in exchange for a 50 percent ownership interest. GTE also borrowed $640,000 from a local bank. Both James and Paul had to personally guarantee the loan. Both owners provide significant services for the business. The following Information pertains to GTE's 2021 actlvitles: - GTE uses the cash method of accounting (for both book and tax purposes) and reports Income on a calendar-year basis. - GTE recelved $1,000,000 of sales revenue and reported $470,000 of cost of goods sold (It did not have any ending Inventory). - GTE paid $85,000 compensation to James, $85,000 compensation to Paul, and $95,000 of compensation to other employees (assume these amounts Include applicable payroll taxes, If any). - GTE paid $26,000 of rent for a bullding and equilpment, $31,000 for advertising, $44,800 in Interest expense, $5,100 for utilitles, and $3,100 for supplies. - GTE contributed $10,500 to charity. - GTE recelved a $3,200 quallfied dividend from a great stock Investment (it owned 2 percent of the corporation distributing the dividend), and It recognized $2,600 in short-term capltal gain when it sold some of the stock. - On December 1, 2021, GTE distributed $31,000 to James and $31,000 to Paul. - GTE has qualfied property of $311,000 (unadjusted basis). (Leave no answer blank. Enter zero if applicable. Enter N/A If not applicable.) Comprehensive Problem 22-86 (Algo) Part a-1 a-1. Assume James and Paul formed GTE as an S corporation. Complete GTE's Form 1120-S, page 1; Form 1120-S, Schedule K. Use 2021 tax rules regardless of year on tax form. Employer Identification number. 58-1111111 Complete GTE's Form 1120-S, page 1; Form 1120S, Schedule K

Requlred Information Comprehensive Problem 22-86 (AlgO) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5, LO 22-6) While James Craig and his former classmate Paul Dolittle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Thelr company, Good to Eat (GTE), speclallzes in custom-sculpted cakes for weddings, birthdays, and other celebrations. James and Paul formed the business at the beginning of 2021, and each contrlbuted $160,000 in exchange for a 50 percent ownership interest. GTE also borrowed $640,000 from a local bank. Both James and Paul had to personally guarantee the loan. Both owners provide significant services for the business. The following Information pertains to GTE's 2021 actlvitles: - GTE uses the cash method of accounting (for both book and tax purposes) and reports Income on a calendar-year basis. - GTE recelved $1,000,000 of sales revenue and reported $470,000 of cost of goods sold (It did not have any ending Inventory). - GTE paid $85,000 compensation to James, $85,000 compensation to Paul, and $95,000 of compensation to other employees (assume these amounts Include applicable payroll taxes, If any). - GTE paid $26,000 of rent for a bullding and equilpment, $31,000 for advertising, $44,800 in Interest expense, $5,100 for utilitles, and $3,100 for supplies. - GTE contributed $10,500 to charity. - GTE recelved a $3,200 quallfied dividend from a great stock Investment (it owned 2 percent of the corporation distributing the dividend), and It recognized $2,600 in short-term capltal gain when it sold some of the stock. - On December 1, 2021, GTE distributed $31,000 to James and $31,000 to Paul. - GTE has qualfied property of $311,000 (unadjusted basis). (Leave no answer blank. Enter zero if applicable. Enter N/A If not applicable.) Comprehensive Problem 22-86 (Algo) Part a-1 a-1. Assume James and Paul formed GTE as an S corporation. Complete GTE's Form 1120-S, page 1; Form 1120-S, Schedule K. Use 2021 tax rules regardless of year on tax form. Employer Identification number. 58-1111111 Complete GTE's Form 1120-S, page 1; Form 1120S, Schedule K. Requlred Information Comprehensive Problem 22-86 (AlgO) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5, LO 22-6) While James Craig and his former classmate Paul Dolittle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Thelr company, Good to Eat (GTE), speclallzes in custom-sculpted cakes for weddings, birthdays, and other celebrations. James and Paul formed the business at the beginning of 2021, and each contrlbuted $160,000 in exchange for a 50 percent ownership interest. GTE also borrowed $640,000 from a local bank. Both James and Paul had to personally guarantee the loan. Both owners provide significant services for the business. The following Information pertains to GTE's 2021 actlvitles: - GTE uses the cash method of accounting (for both book and tax purposes) and reports Income on a calendar-year basis. - GTE recelved $1,000,000 of sales revenue and reported $470,000 of cost of goods sold (It did not have any ending Inventory). - GTE paid $85,000 compensation to James, $85,000 compensation to Paul, and $95,000 of compensation to other employees (assume these amounts Include applicable payroll taxes, If any). - GTE paid $26,000 of rent for a bullding and equilpment, $31,000 for advertising, $44,800 in Interest expense, $5,100 for utilitles, and $3,100 for supplies. - GTE contributed $10,500 to charity. - GTE recelved a $3,200 quallfied dividend from a great stock Investment (it owned 2 percent of the corporation distributing the dividend), and It recognized $2,600 in short-term capltal gain when it sold some of the stock. - On December 1, 2021, GTE distributed $31,000 to James and $31,000 to Paul. - GTE has qualfied property of $311,000 (unadjusted basis). (Leave no answer blank. Enter zero if applicable. Enter N/A If not applicable.) Comprehensive Problem 22-86 (Algo) Part a-1 a-1. Assume James and Paul formed GTE as an S corporation. Complete GTE's Form 1120-S, page 1; Form 1120-S, Schedule K. Use 2021 tax rules regardless of year on tax form. Employer Identification number. 58-1111111 Complete GTE's Form 1120-S, page 1; Form 1120S, Schedule K Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started