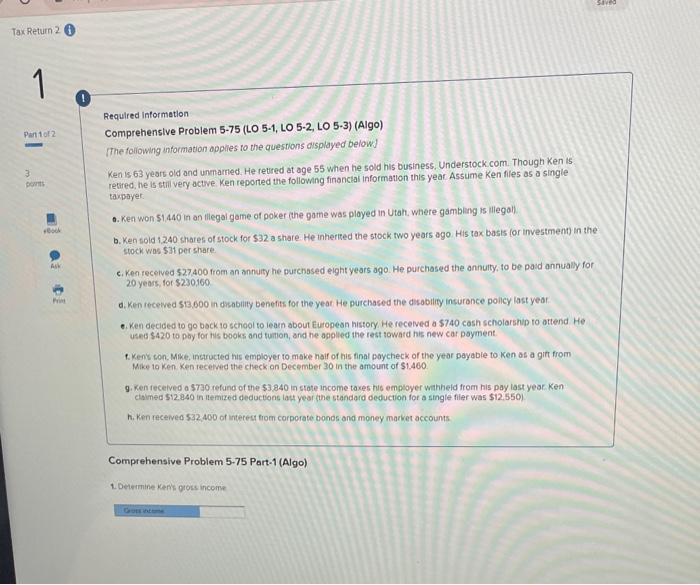

Requlred Information Comprehenslve Problem 5-75 (LO 5-1, LO 5-2, LO 5-3) (AlgO) IThe foliowing information applies to the questions displayed belowd Ken is. 63 years old and unmarted. He retred at age 55 when he sold his business. Understock.com. Though Ken is resired, he is thil very actve. Ken reported the following finoncial information this year Assume Ken files as a single taxpayer. 0. Kea won 51,440 in an lliegai game of poker (the game was ployed in Utah. where gambling is illegall b. Ken fold 1,240 sharef of stock for $32 a share. He inherised the stock two years ago His tax basis (or investment) in the stock wos 531 per share c. Ken recetved 527400 from an annuity he purchosed elght years ago. He purchased the annuity, to be paid annually for 20 yeass, tor $230,160 d. Ken recewed 513,600 in disobility benefits for the year He purchased the disobility insurance policy last year. *. Ken decided to go back to school to iearn about Europesn history. He recewed a 5740 cash scholarship to attend He used $420 to ply for his books and fumion, and he agglled the test towatd his new car poyment f. Kenk son. Mike, insuructed his employer to make naif of his final poycheck of the year payable to ken as a git from Mike to Ken Ken recetwed the check an December 30 in the amount of $1,460. 9. Ken feceived a $730 refund of the $3.840 in state income taxes hus employer wahheid from his pay last year. Ken ctaimed $12.840 in ltemized dedactons lat year (the standard deduction for a single fler was $12.550 ) h. Ken received 532.400 of intereut from corporate bonds and money market accounts Comprehensive Problem 5-75 Part-1 (Algo) 1. Determine kent gross incorine Requlred Information Comprehenslve Problem 5-75 (LO 5-1, LO 5-2, LO 5-3) (AlgO) IThe foliowing information applies to the questions displayed belowd Ken is. 63 years old and unmarted. He retred at age 55 when he sold his business. Understock.com. Though Ken is resired, he is thil very actve. Ken reported the following finoncial information this year Assume Ken files as a single taxpayer. 0. Kea won 51,440 in an lliegai game of poker (the game was ployed in Utah. where gambling is illegall b. Ken fold 1,240 sharef of stock for $32 a share. He inherised the stock two years ago His tax basis (or investment) in the stock wos 531 per share c. Ken recetved 527400 from an annuity he purchosed elght years ago. He purchased the annuity, to be paid annually for 20 yeass, tor $230,160 d. Ken recewed 513,600 in disobility benefits for the year He purchased the disobility insurance policy last year. *. Ken decided to go back to school to iearn about Europesn history. He recewed a 5740 cash scholarship to attend He used $420 to ply for his books and fumion, and he agglled the test towatd his new car poyment f. Kenk son. Mike, insuructed his employer to make naif of his final poycheck of the year payable to ken as a git from Mike to Ken Ken recetwed the check an December 30 in the amount of $1,460. 9. Ken feceived a $730 refund of the $3.840 in state income taxes hus employer wahheid from his pay last year. Ken ctaimed $12.840 in ltemized dedactons lat year (the standard deduction for a single fler was $12.550 ) h. Ken received 532.400 of intereut from corporate bonds and money market accounts Comprehensive Problem 5-75 Part-1 (Algo) 1. Determine kent gross incorine