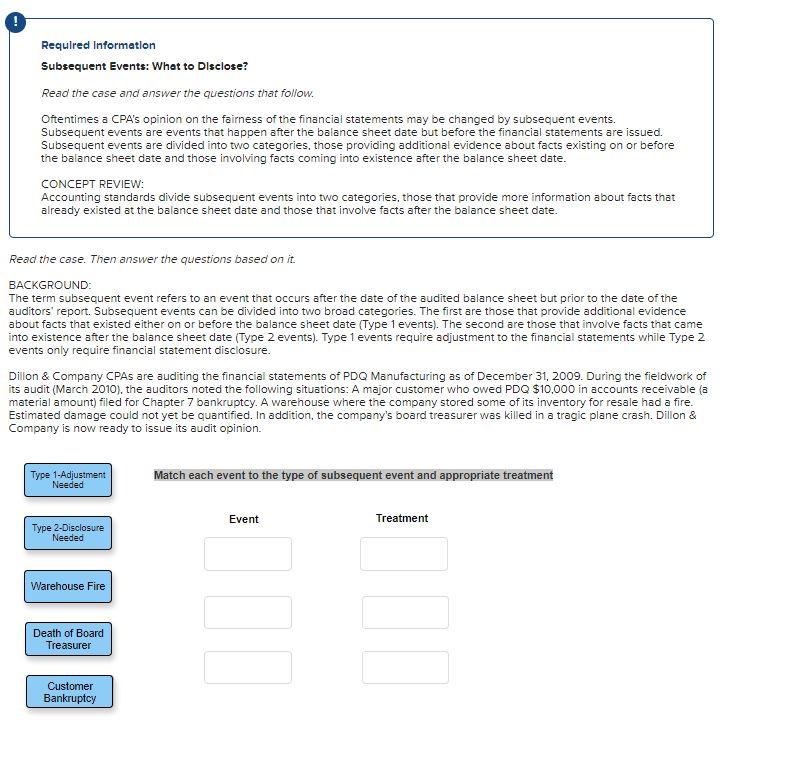

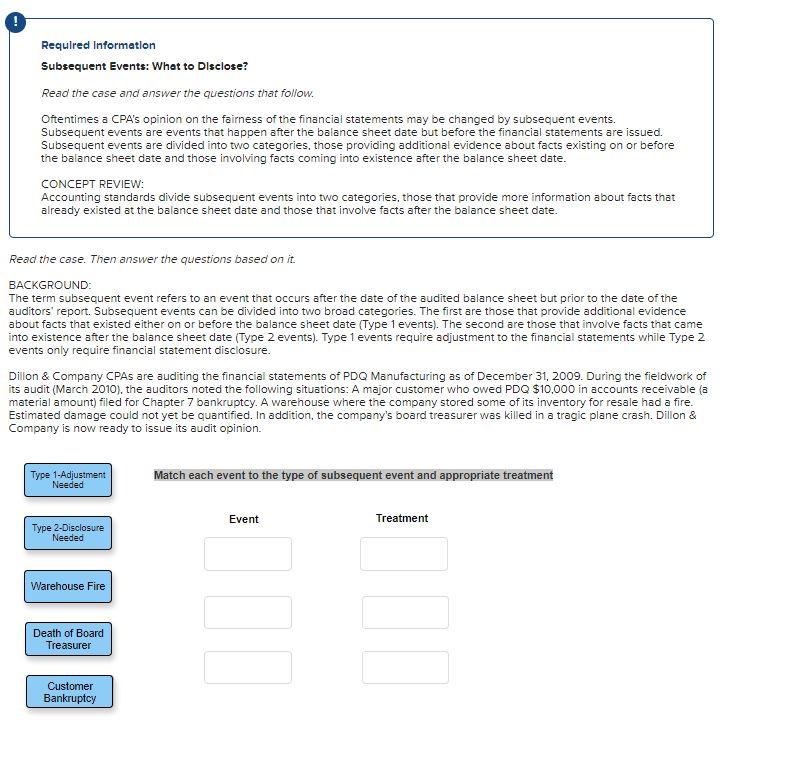

Requlred Information Subsequent Events: What to Disclose? Read the case and answer the questions that follow. Oftentimes a CPA's opinion on the fairness of the financial statements may be changed by subsequent events. Subsequent events are events that happen after the balance sheet date but before the financial statements are issued. Subsequent events are divided into two categories, those providing additional evidence about facts existing on or before the balance sheet date and those involving facts coming into existence after the balance sheet date. CONCEPT REVIEW: Accounting standards divide subsequent events into two categories, those that provide more information about facts that already existed at the balance sheet date and those that involve facts after the balance sheet date. Read the case. Then answer the questions based on it. BACKGROUND: The term subsequent event refers to an event that occurs after the date of the audited balance sheet but prior to the date of the auditors' report. Subsequent events can be divided into two broad categories. The first are those that provide additional evidence about facts that existed either on or before the balance sheet date (Type 1 events). The second are those that involve facts that came into existence after the balance sheet date (Type 2 events). Type 1 events require adjustment to the financial statements while Type 2 events only require financial statement disclosure. Dillon & Company CPAs are auditing the financial statements of PDQ Manufacturing as of December 31, 2009. During the fieldwork of its audit (March 2010), the auditors noted the following situations: A major customer who owed PDQ $10,000 in accounts receivable (a material amount) filed for Chapter 7 bankruptcy. A warehouse where the company stored some of its inventory for resale had a fire. Estimated damage could not yet be quantified. In addition, the company's board treasurer was killed in a tragic plane crash. Dillon & Company is now ready to issue its audit opinion. Type 1-Adjustment Needed Match each event to the type of subsequent event and appropriate treatment Event Treatment Type 2-Disclosure Needed Warehouse Fire Death of Board Treasurer Customer Bankruptcy