Answered step by step

Verified Expert Solution

Question

1 Approved Answer

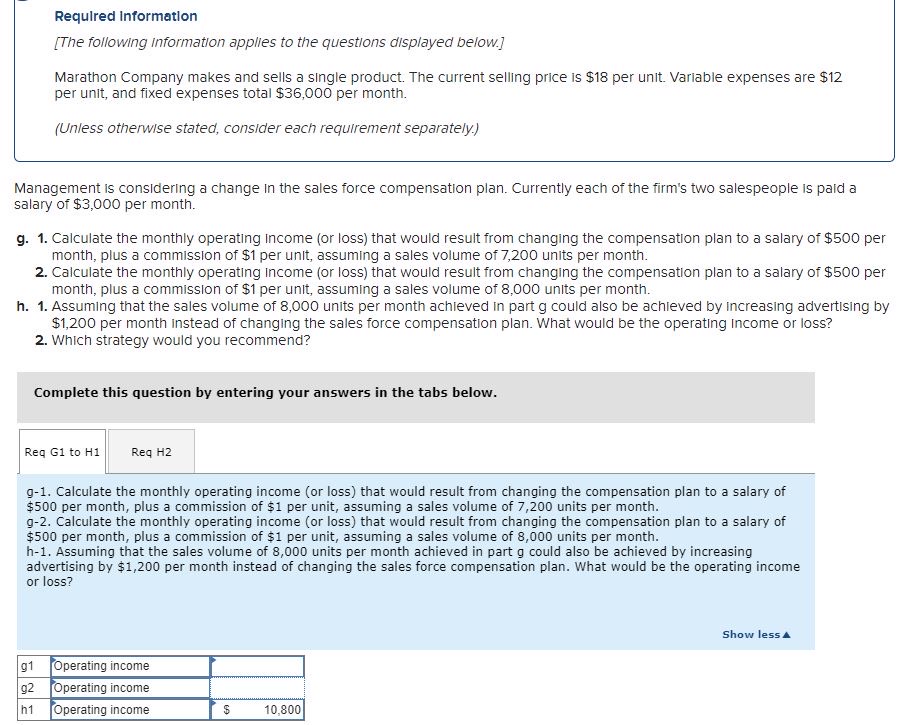

Requlred Information [ The following information applies to the questions displayed below. ] Marathon Company makes and sells a single product. The current selling price

Requlred Information

The following information applies to the questions displayed below.

Marathon Company makes and sells a single product. The current selling price is $ per unit. Variable expenses are $ per unit, and fixed expenses total $ per month.

Unless otherwise stated, consider each requirement separately.

Management is considering a change in the sales force compensation plan. Currently each of the firm's two salespeople is paid a salary of $ per month.

g Calculate the monthly operating income or loss that would result from changing the compensation plan to a salary of $ per month, plus a commission of $ per unit, assuming a sales volume of units per month.

Calculate the monthly operating income or loss that would result from changing the compensation plan to a salary of $ per month, plus a commission of $ per unit, assuming a sales volume of units per month.

h Assuming that the sales volume of units per month achieved in part could also be achieved by increasing advertising by $ per month instead of changing the sales force compensation plan. What would be the operating Income or loss?

Which strategy would you recommend?

Complete this question by entering your answers in the tabs below.

Req to

g Calculate the monthly operating income or loss that would result from changing the compensation plan to a salary of $ per month, plus a commission of $ per unit, assuming a sales volume of units per month.

g Calculate the monthly operating income or loss that would result from changing the compensation plan to a salary of $ per month, plus a commission of $ per unit, assuming a sales volume of units per month.

Assuming that the sales volume of units per month achieved in part could also be achieved by increasing advertising by $ per month instead of changing the sales force compensation plan. What would be the operating income or loss?

Show less

tablegOperating income,Operating income,hOperating income,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started