Answered step by step

Verified Expert Solution

Question

1 Approved Answer

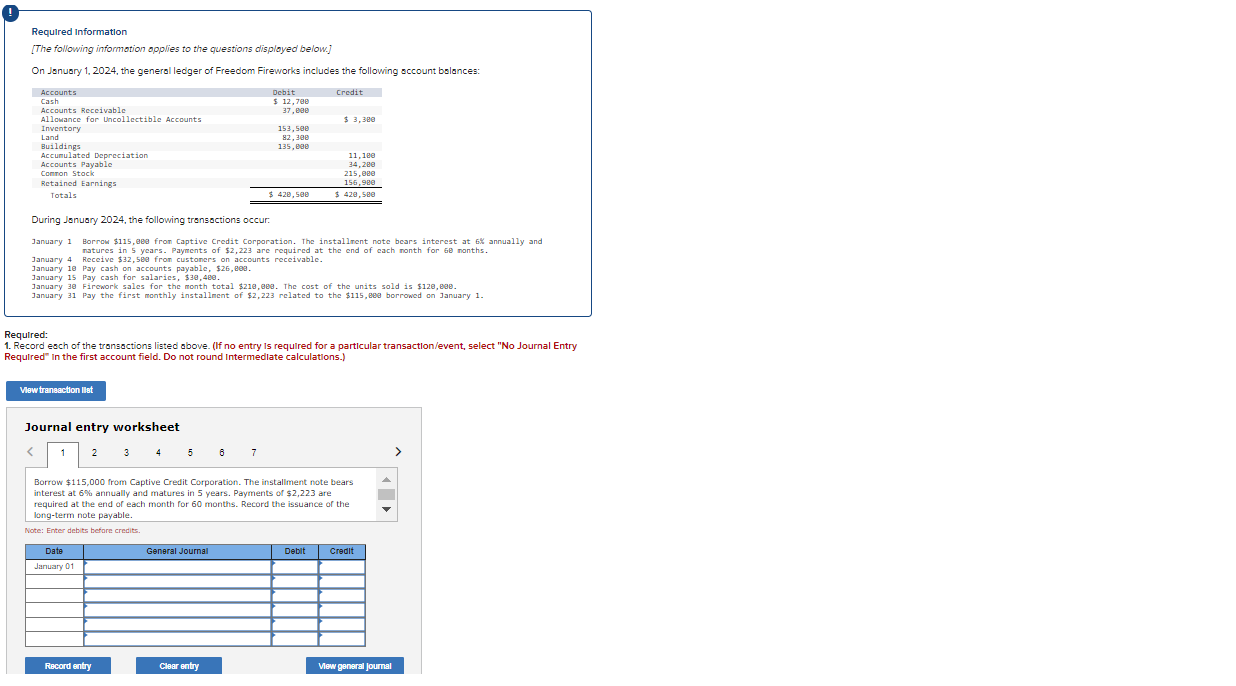

Requlred Information [The following informotion opplies to the questions disployed below.] On Jonuary 1, 2024, the general ledger of Freedom Fireworks includes the following account

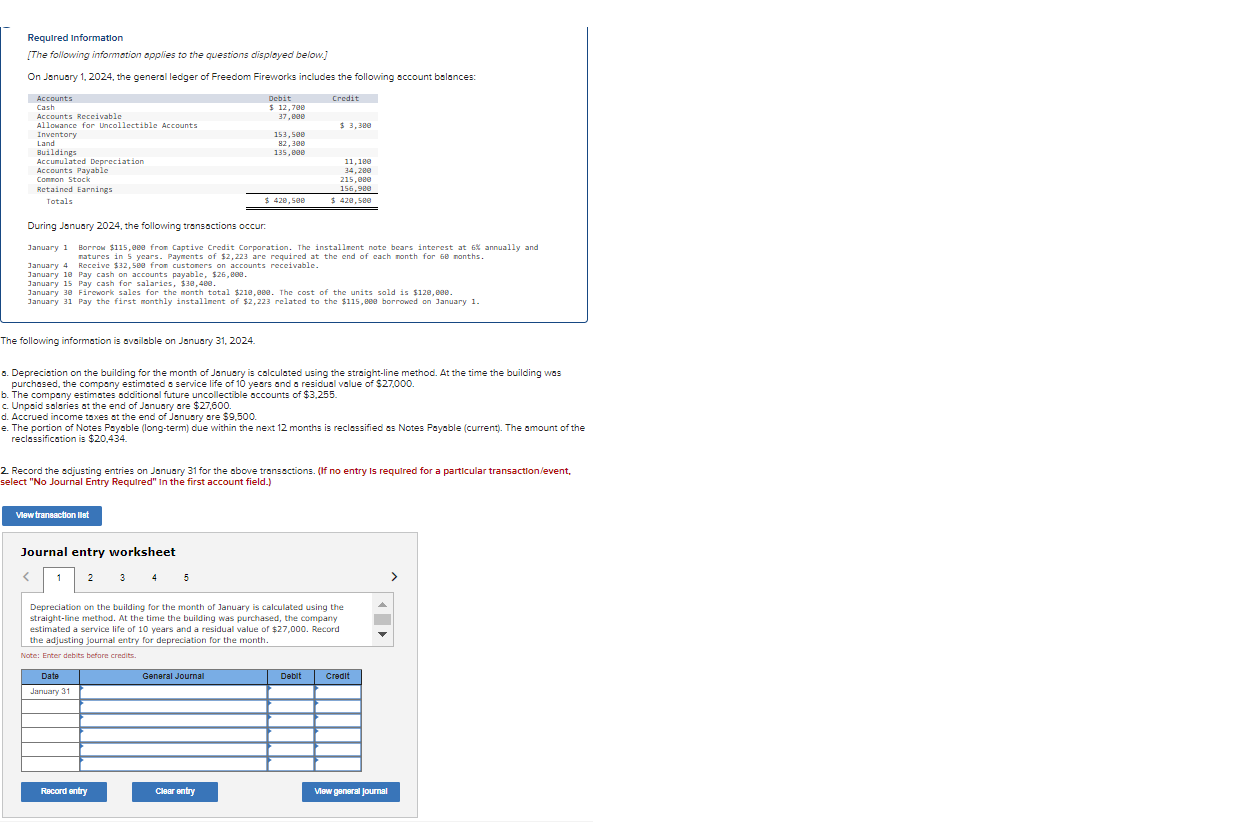

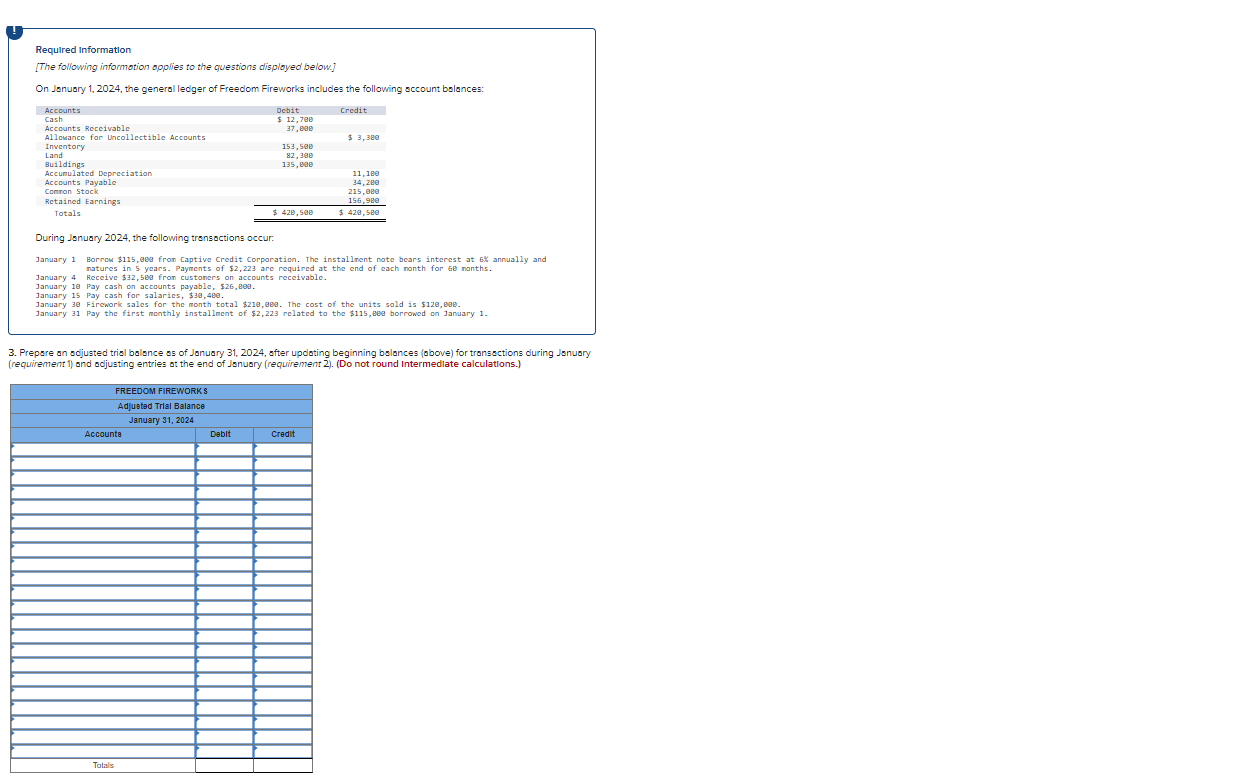

Requlred Information [The following informotion opplies to the questions disployed below.] On Jonuary 1, 2024, the general ledger of Freedom Fireworks includes the following account bolances: During Jenuary 2024, the following transactions occur. matures in 5 years. Payments of $2,223 are required at the end of each nonth for 6 nonths. January 4 Receive \$32, 5ea fron custoners on accounts receivable. January 19 Pay cash on accounts payable, $26, Rea. January 15 Pay cash for salarics, $30,480. January 30 Fircwork sales for the month total \$21e, eee. The cost of the units sold is $120, eae. January 31 Pay the first monthly installment of $2,223 related to the $115, eeg borrowed on January 1. Required: 1. Record esch of the tronsactions listed above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" In the first account field. Do not round Intermedlate calculations.) Journal entry worksheet 234567 Borrow $115,000 from Captive Credit Corporation. The installment note bears interest at 6% annually and matures in 5 years. Payments of $2,223 are required at the end of each month for 60 months. Record the issuance of the long-term note payable. Required Information [The following informotion opplies to the questions disployed below.] On Jonuary 1, 2024, the general ledger of Freedom Fireworks includes the following occount bolances: During Jenuary 2024, the following trensactions occur. January 1 Borrow \$115, eea fron Captive Credit Corporation. The installnent note bears interest at 6K annually and natures in 5 years. Payments of $2,223 are required at the end of each nonth for 6 nonths. January 4 Receive $32,5eg fron custoners on accounts receivable. January 10 Pay cash on accounts payable, $26, January 15 Pay cash for salarics, $30,4e. January 30 Fircwork sales for the month total \$210, eee. The cost of the units sold is $120, ege. January 31 Pay the first monthly installment of $2,223 related to the $115, eeg borrowed on January 1 . The following information is available on Jonuary 31,2024 . . Depreciation on the building for the month of January is colculated using the straight-line method. At the time the building was purchased, the company estimated service life of 10 years and a residual value of $27,000. b. The company estimates odditional future uncollectible accounts of $3,255. c. Unpaid salaries at the end of January are $27,600. d. Accrued income toxes at the end of January are $9,500. e. The portion of Notes Payoble (long-term) due within the next 12 months is reclassified as Notes Paysble (current). The amount of the reclassificstion is $20,434. 2. Record the odjusting entries on Jonuary 31 for the obove tronsactions. (If no entry Is required for a particular transactlon/event, select "No Journal Entry Required" In the first account field.) Journal entry worksheet Required Information [The following informotion opplies to the questions disployed below.] On Jonuary 1, 2024, the general ledger of Freedom Fireworks includes the following sccount bolances: During Jenusry 2024, the following trensactions occur: January 1 Borrow \$115, eee fron Captive Credit Corporation. The installnent nate bears interest at 6\% annually and natures in 5 years. Payments of $2,223 are required at the end of each nonth for 6 e nanths. January 4 Receive $32,5e fron custoners on accounts receivable. January 1e Pay cash on accounts payable, \$26, eea. January 15 Pay cash for salarics, \$3e,4ee. January 30 Firework sales for the month total \$21e, eee. The cost of the units sold is \$12e, eae. January 31 Pay the first monthly installment of $2,223 related to the $115, eee borrowed on January 1 . 3. Prepore an ocjusted trial balonce as of Jonuary 31,2024 , sfter updating beginning balonces (above) for tronsactions during Jonuary (requirement 1) and odjusting entries at the end of Jonusry (requirement 2). (Do not round Intermedlate calculations.)

Requlred Information [The following informotion opplies to the questions disployed below.] On Jonuary 1, 2024, the general ledger of Freedom Fireworks includes the following account bolances: During Jenuary 2024, the following transactions occur. matures in 5 years. Payments of $2,223 are required at the end of each nonth for 6 nonths. January 4 Receive \$32, 5ea fron custoners on accounts receivable. January 19 Pay cash on accounts payable, $26, Rea. January 15 Pay cash for salarics, $30,480. January 30 Fircwork sales for the month total \$21e, eee. The cost of the units sold is $120, eae. January 31 Pay the first monthly installment of $2,223 related to the $115, eeg borrowed on January 1. Required: 1. Record esch of the tronsactions listed above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" In the first account field. Do not round Intermedlate calculations.) Journal entry worksheet 234567 Borrow $115,000 from Captive Credit Corporation. The installment note bears interest at 6% annually and matures in 5 years. Payments of $2,223 are required at the end of each month for 60 months. Record the issuance of the long-term note payable. Required Information [The following informotion opplies to the questions disployed below.] On Jonuary 1, 2024, the general ledger of Freedom Fireworks includes the following occount bolances: During Jenuary 2024, the following trensactions occur. January 1 Borrow \$115, eea fron Captive Credit Corporation. The installnent note bears interest at 6K annually and natures in 5 years. Payments of $2,223 are required at the end of each nonth for 6 nonths. January 4 Receive $32,5eg fron custoners on accounts receivable. January 10 Pay cash on accounts payable, $26, January 15 Pay cash for salarics, $30,4e. January 30 Fircwork sales for the month total \$210, eee. The cost of the units sold is $120, ege. January 31 Pay the first monthly installment of $2,223 related to the $115, eeg borrowed on January 1 . The following information is available on Jonuary 31,2024 . . Depreciation on the building for the month of January is colculated using the straight-line method. At the time the building was purchased, the company estimated service life of 10 years and a residual value of $27,000. b. The company estimates odditional future uncollectible accounts of $3,255. c. Unpaid salaries at the end of January are $27,600. d. Accrued income toxes at the end of January are $9,500. e. The portion of Notes Payoble (long-term) due within the next 12 months is reclassified as Notes Paysble (current). The amount of the reclassificstion is $20,434. 2. Record the odjusting entries on Jonuary 31 for the obove tronsactions. (If no entry Is required for a particular transactlon/event, select "No Journal Entry Required" In the first account field.) Journal entry worksheet Required Information [The following informotion opplies to the questions disployed below.] On Jonuary 1, 2024, the general ledger of Freedom Fireworks includes the following sccount bolances: During Jenusry 2024, the following trensactions occur: January 1 Borrow \$115, eee fron Captive Credit Corporation. The installnent nate bears interest at 6\% annually and natures in 5 years. Payments of $2,223 are required at the end of each nonth for 6 e nanths. January 4 Receive $32,5e fron custoners on accounts receivable. January 1e Pay cash on accounts payable, \$26, eea. January 15 Pay cash for salarics, \$3e,4ee. January 30 Firework sales for the month total \$21e, eee. The cost of the units sold is \$12e, eae. January 31 Pay the first monthly installment of $2,223 related to the $115, eee borrowed on January 1 . 3. Prepore an ocjusted trial balonce as of Jonuary 31,2024 , sfter updating beginning balonces (above) for tronsactions during Jonuary (requirement 1) and odjusting entries at the end of Jonusry (requirement 2). (Do not round Intermedlate calculations.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started