Answered step by step

Verified Expert Solution

Question

1 Approved Answer

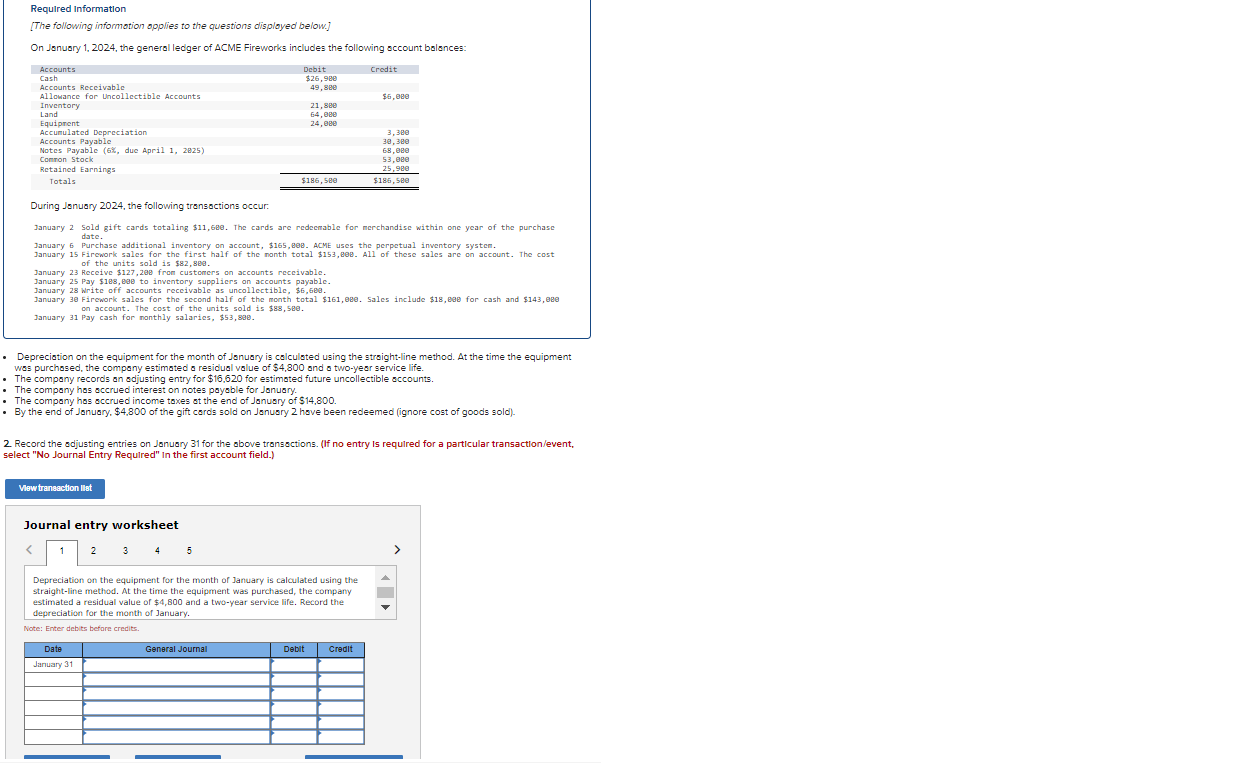

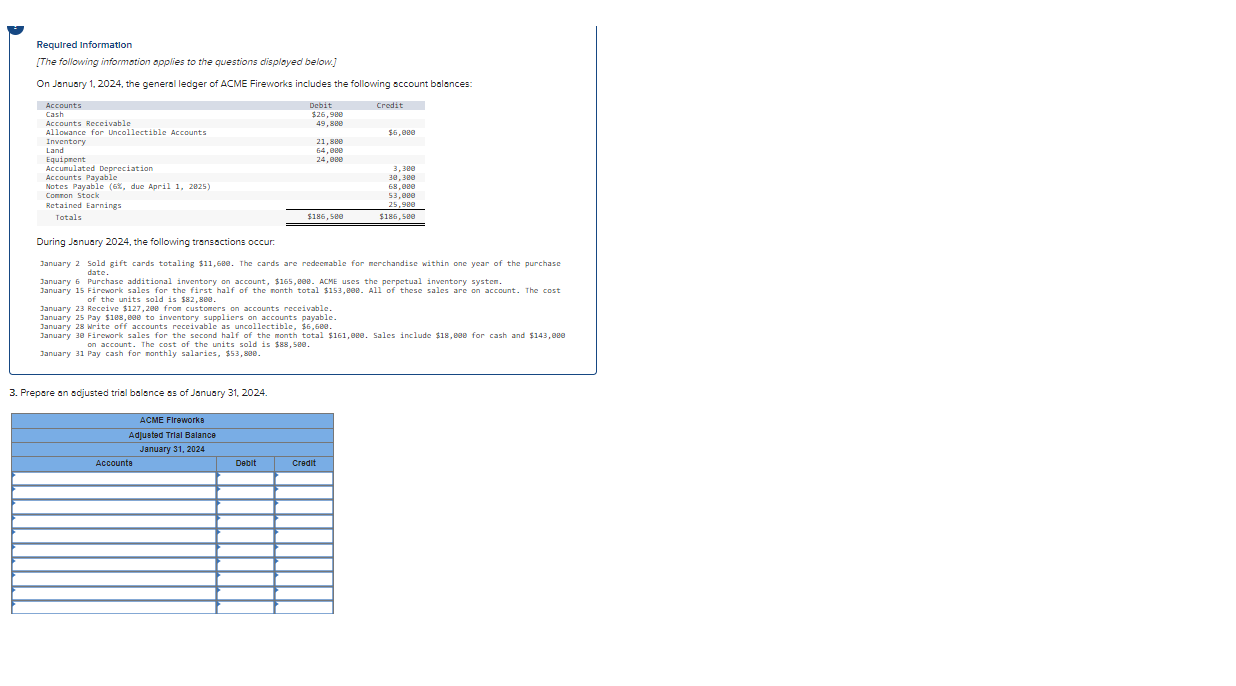

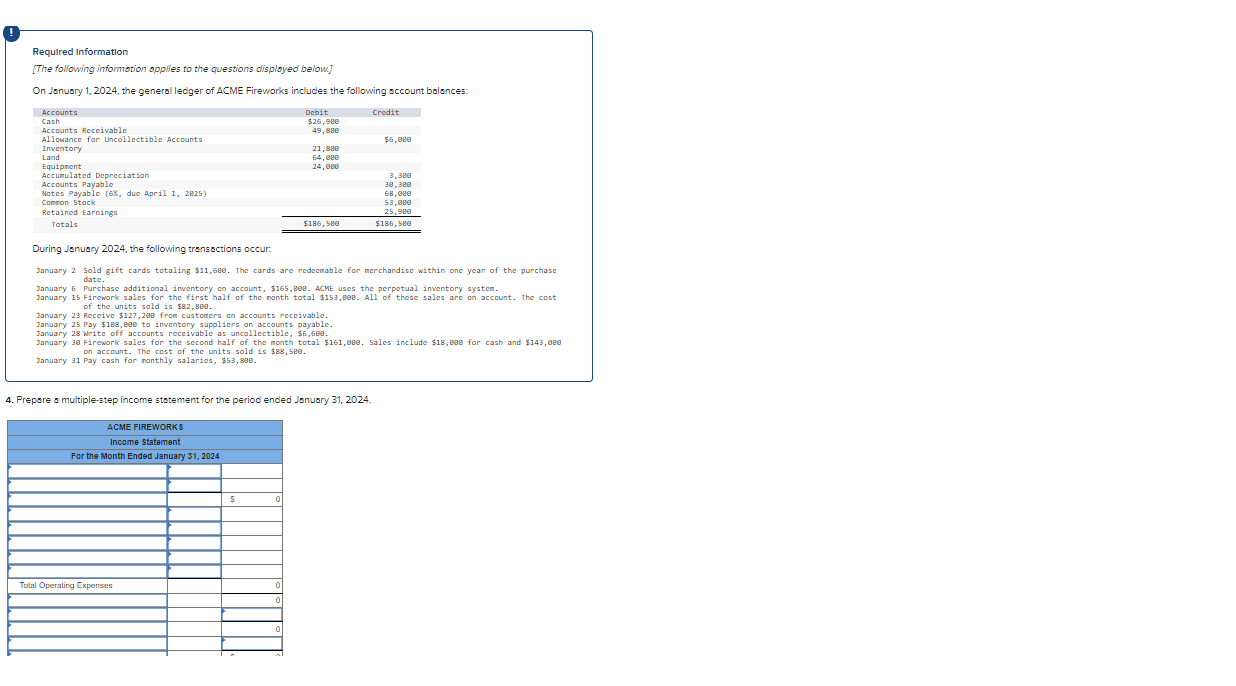

Requlred Information [The following informotion opplies to the questions disployed below.] On Jonuory 1, 2024, the general ledger of ACME Fireworks includes the following occount

Requlred Information [The following informotion opplies to the questions disployed below.] On Jonuory 1, 2024, the general ledger of ACME Fireworks includes the following occount bolances: During Jonuary 2024, the following transactions occur. date. January 6 Purchase additional inventory on account, \$165, ReB. ACME uses the perpetual inventory systen. of the units sold is $82,8ge. January 23 Receive $127,290 fron customers an accounts reccivable. January 25 Pay $183, eae to inventory supplicrs on accounts payable. January 28 Writc off accounts reccivable as uncollectible, $6,6E9. on sccount. The cost of the units sold is $88,5ee. January 31 Pay cash for nonthly salaries, \$53, 89e. - Deprecistion on the equipment for the month of Jsnuary is calculated using the stroight-line method. At the time the equipment wos purchosed, the compony estimoted o residual value of $4,800 and o two-year service life. - The company records an adjusting entry for $16,620 for estimated future uncollectible accounts. - The company has accrued interest on notes payable for Jonusry. - The company has accrued income toxes at the end of Janusry of $14,800. - By the end of Jonuary, $4,800 of the gift cards sold on Janusry 2 hove been redeemed (ignore cost of goods sold). 2. Record the odjusting entries on Jonusry 31 for the obove tronsoctions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" In the first account field.) Journal entry worksheet 3 4 5 Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a residual value of $4,800 and a two-year service life. Record the depreciation for the month of January. Required Information [The following informotion opplies to the questions disployed below] On Jonuary 1, 2024, the general ledger of ACME Fireworks includes the following sccount bolances: During Jonuary 2024, the following transactions occur: January 2 sold gift cards totaling \$11,68e. The cards are redecmable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, \$165, eee. ACME uses the perpetual inventory systen. January 15 Firework sales for the first half of the nanth total $153, eee. Al1 of these sales are on account. The cost of the units sold is $82,890. January 23 Receive $127, 200 fron customers on accounts reccivable. January 25 Pay \$1es, eoe to inventory suppliers on accounts payable. January 28 Write off accounts receivable as uncollectible, $6,6e. January 30 Fircwork sales for the second half of the month total \$161, eee. Sales include \$18, eee for cash and $143, eee on account. The cost of the units sold is $88,5ee. January 31 Pay cash for nonthly salaries, \$53, 800. 3. Prepare an adjusted trial bolance os of Jonuary 31,2024. Required Information [The following informotion opplies to the questions disployed below.] On Januory 1, 2024, the general ledger of ACME Fireworks includes the following occount bolances: During Jonuary 2024, the following transoctions occur: January 2 sold gift cards totaling \$11,6ee. The cards are redecmable for merchandisc within one year of the purchase date. January 6 Purchase additional inventory on account, \$165, eee. ACME uses the perpetual inventory systen. January 15 Firework sales for the first half of the nonth total \$153, eeB. A11 of these sales are on account. The cost of the units sold is $82,800. January 23 Receive $127, 200 from customers on accounts reccivable. January 25 Pay \$1es, eee to inventory suppliers on accounts payable. January 28 Write off accounts receivable as uncollectible, $6,6e. January 30 Firework sales for the sccond half of the month total \$161, eee. Sales include \$18, eee for cash and \$143, eee on sccount. The cost of the units sold is $88,580. January 31 Pay cash for nonthly salaries, \$53,8ae. 4. Prepore a multiple-step income statement for the period ended Jonusry 31, 2024

Requlred Information [The following informotion opplies to the questions disployed below.] On Jonuory 1, 2024, the general ledger of ACME Fireworks includes the following occount bolances: During Jonuary 2024, the following transactions occur. date. January 6 Purchase additional inventory on account, \$165, ReB. ACME uses the perpetual inventory systen. of the units sold is $82,8ge. January 23 Receive $127,290 fron customers an accounts reccivable. January 25 Pay $183, eae to inventory supplicrs on accounts payable. January 28 Writc off accounts reccivable as uncollectible, $6,6E9. on sccount. The cost of the units sold is $88,5ee. January 31 Pay cash for nonthly salaries, \$53, 89e. - Deprecistion on the equipment for the month of Jsnuary is calculated using the stroight-line method. At the time the equipment wos purchosed, the compony estimoted o residual value of $4,800 and o two-year service life. - The company records an adjusting entry for $16,620 for estimated future uncollectible accounts. - The company has accrued interest on notes payable for Jonusry. - The company has accrued income toxes at the end of Janusry of $14,800. - By the end of Jonuary, $4,800 of the gift cards sold on Janusry 2 hove been redeemed (ignore cost of goods sold). 2. Record the odjusting entries on Jonusry 31 for the obove tronsoctions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" In the first account field.) Journal entry worksheet 3 4 5 Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a residual value of $4,800 and a two-year service life. Record the depreciation for the month of January. Required Information [The following informotion opplies to the questions disployed below] On Jonuary 1, 2024, the general ledger of ACME Fireworks includes the following sccount bolances: During Jonuary 2024, the following transactions occur: January 2 sold gift cards totaling \$11,68e. The cards are redecmable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, \$165, eee. ACME uses the perpetual inventory systen. January 15 Firework sales for the first half of the nanth total $153, eee. Al1 of these sales are on account. The cost of the units sold is $82,890. January 23 Receive $127, 200 fron customers on accounts reccivable. January 25 Pay \$1es, eoe to inventory suppliers on accounts payable. January 28 Write off accounts receivable as uncollectible, $6,6e. January 30 Fircwork sales for the second half of the month total \$161, eee. Sales include \$18, eee for cash and $143, eee on account. The cost of the units sold is $88,5ee. January 31 Pay cash for nonthly salaries, \$53, 800. 3. Prepare an adjusted trial bolance os of Jonuary 31,2024. Required Information [The following informotion opplies to the questions disployed below.] On Januory 1, 2024, the general ledger of ACME Fireworks includes the following occount bolances: During Jonuary 2024, the following transoctions occur: January 2 sold gift cards totaling \$11,6ee. The cards are redecmable for merchandisc within one year of the purchase date. January 6 Purchase additional inventory on account, \$165, eee. ACME uses the perpetual inventory systen. January 15 Firework sales for the first half of the nonth total \$153, eeB. A11 of these sales are on account. The cost of the units sold is $82,800. January 23 Receive $127, 200 from customers on accounts reccivable. January 25 Pay \$1es, eee to inventory suppliers on accounts payable. January 28 Write off accounts receivable as uncollectible, $6,6e. January 30 Firework sales for the sccond half of the month total \$161, eee. Sales include \$18, eee for cash and \$143, eee on sccount. The cost of the units sold is $88,580. January 31 Pay cash for nonthly salaries, \$53,8ae. 4. Prepore a multiple-step income statement for the period ended Jonusry 31, 2024 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started