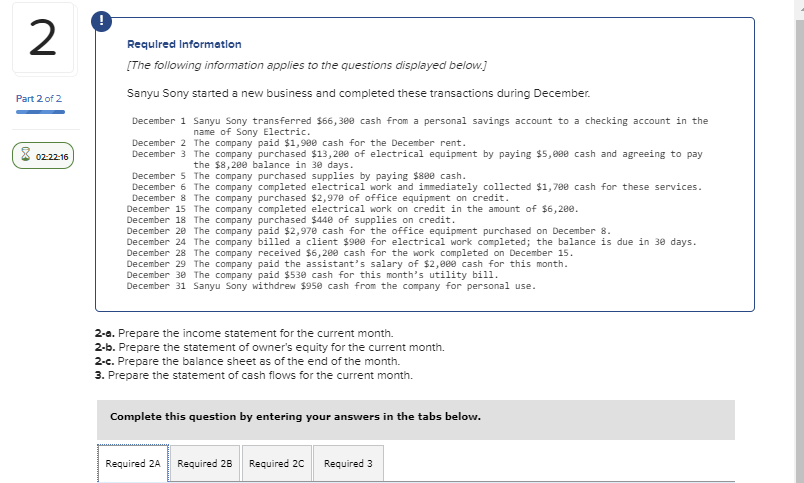

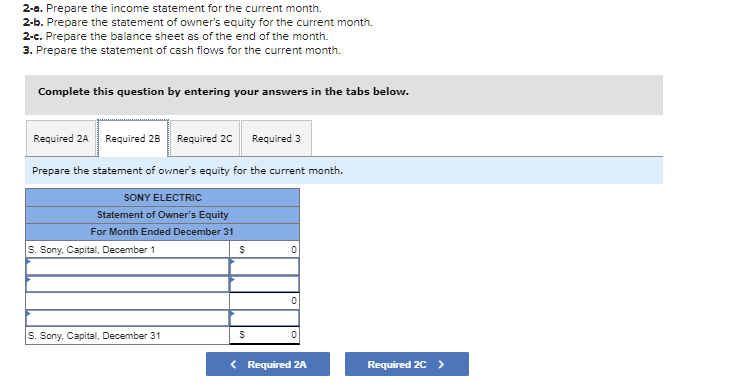

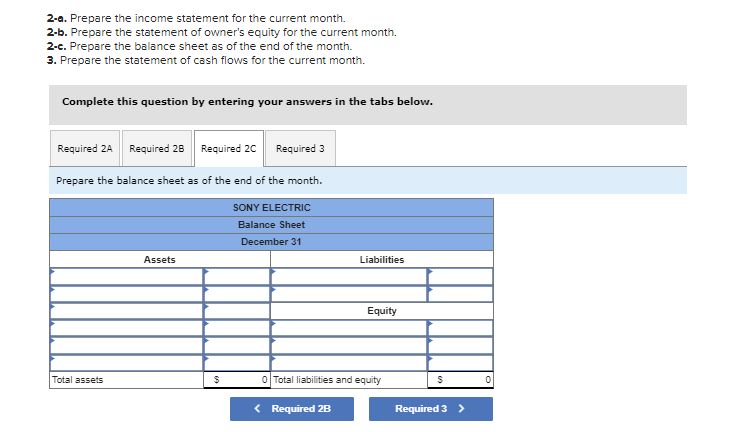

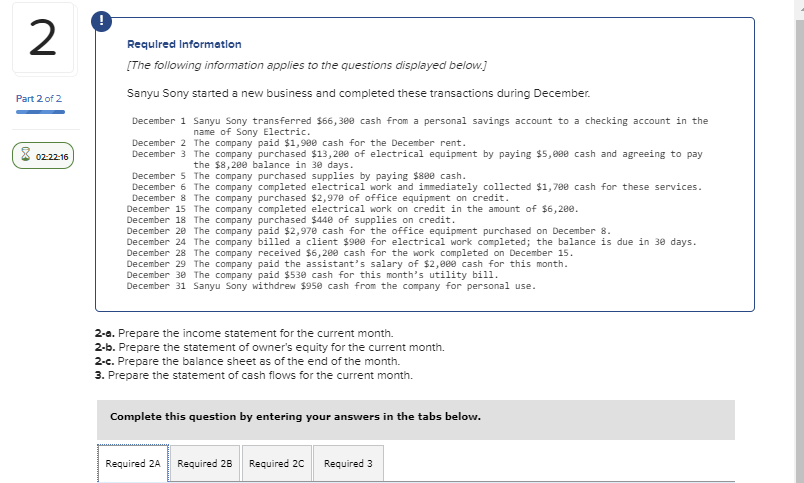

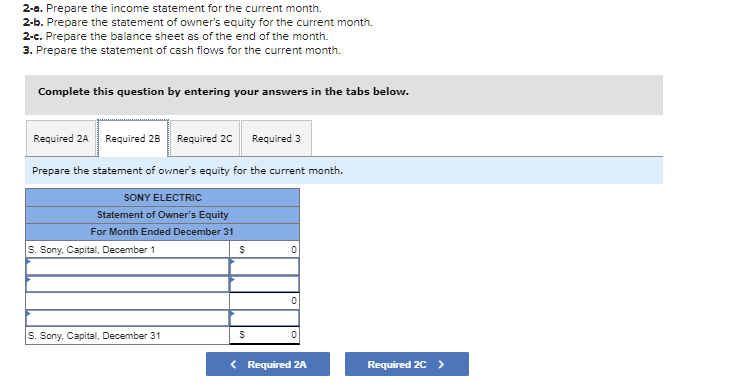

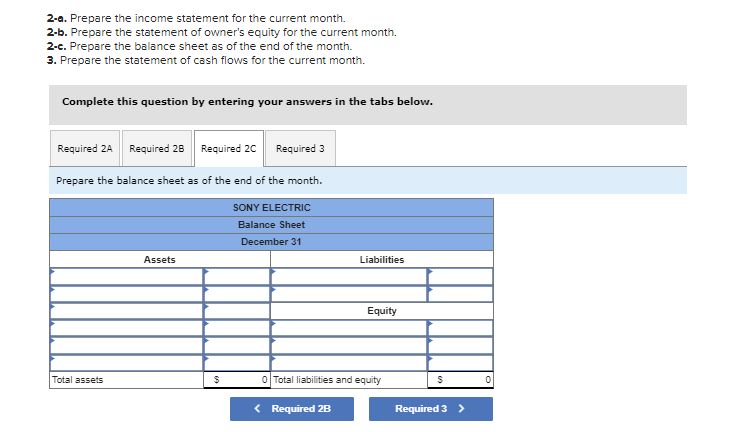

Requlred Informetion [The following information applies to the questions displayed below.] Sanyu Sony started a new business and completed these transactions during December. December 1 Sanyu Sony transferred $66,300 cash from a personal savings account to a checking account in the name of Sony Electric. December 2 The company paid $1,990 cash for the December rent. December 3 The company purchased $13,200 of electrical equipment by paying $5,60 cash and agreeing to pay the $8,200 balance in 30 days. December 5 The company purchased supplies by paying $80 cash. December 6 The company completed electrical work and immediately collected $1,79 cash for these services. December 8 The company purchased $2,97 of office equipment on credit. December 15 The company completed electrical work on credit in the amount of $6,280. December 18 The company purchased $440 of supplies on credit. December 20 The company paid $2,97 cash for the office equipment purchased on December 8. December 24 The company billed a client $90e for electrical work completed; the balance is due in 30 days. December 28 The company received $6,260 cash for the work completed on December 15. December 29 The company paid the assistant's salary of \$2, 60 cash for this month. December 30 The company paid $530 cash for this month's utility bill. December 31 Sanyu Sony withdrew $950 cash from the company for personal use. 2-e. Prepare the income statement for the current month. 2-b. Prepare the statement of owner's equity for the current month. 2-c. Prepare the balance sheet as of the end of the month. 3. Prepare the statement of cash flows for the current month. Complete this question by entering your answers in the tabs below. 2-a. Prepare the income statement for the current month. 2-b. Prepare the statement of owner's equity for the current month. 2-c. Prepare the balance sheet as of the end of the month. 3. Prepare the statement of cash flows for the current month. Complete this question by entering your answers in the tabs below. Prepare the statement of owner's equity for the current month. 2-a. Prepare the income statement for the current month. 2-b. Prepare the statement of owner's equity for the current month. 2-c. Prepare the balance sheet as of the end of the month. 3. Prepare the statement of cash flows for the current month. Complete this question by entering your answers in the tabs below. Prepare the balance sheet as of the end of the month. 2-a. Prepare the income statement for the current month. 2-b. Prepare the statement of owner's equity for the current month. 2-c. Prepare the balance sheet as of the end of the month. 3. Prepare the statement of cash flows for the current month. Complete this question by entering your answers in the tabs below. Prepare the statement of cash flows for the current month. Note: Cash outflows should be indicated with a minus sign. Requlred Informetion [The following information applies to the questions displayed below.] Sanyu Sony started a new business and completed these transactions during December. December 1 Sanyu Sony transferred $66,300 cash from a personal savings account to a checking account in the name of Sony Electric. December 2 The company paid $1,990 cash for the December rent. December 3 The company purchased $13,200 of electrical equipment by paying $5,60 cash and agreeing to pay the $8,200 balance in 30 days. December 5 The company purchased supplies by paying $80 cash. December 6 The company completed electrical work and immediately collected $1,79 cash for these services. December 8 The company purchased $2,97 of office equipment on credit. December 15 The company completed electrical work on credit in the amount of $6,280. December 18 The company purchased $440 of supplies on credit. December 20 The company paid $2,97 cash for the office equipment purchased on December 8. December 24 The company billed a client $90e for electrical work completed; the balance is due in 30 days. December 28 The company received $6,260 cash for the work completed on December 15. December 29 The company paid the assistant's salary of \$2, 60 cash for this month. December 30 The company paid $530 cash for this month's utility bill. December 31 Sanyu Sony withdrew $950 cash from the company for personal use. 2-e. Prepare the income statement for the current month. 2-b. Prepare the statement of owner's equity for the current month. 2-c. Prepare the balance sheet as of the end of the month. 3. Prepare the statement of cash flows for the current month. Complete this question by entering your answers in the tabs below. 2-a. Prepare the income statement for the current month. 2-b. Prepare the statement of owner's equity for the current month. 2-c. Prepare the balance sheet as of the end of the month. 3. Prepare the statement of cash flows for the current month. Complete this question by entering your answers in the tabs below. Prepare the statement of owner's equity for the current month. 2-a. Prepare the income statement for the current month. 2-b. Prepare the statement of owner's equity for the current month. 2-c. Prepare the balance sheet as of the end of the month. 3. Prepare the statement of cash flows for the current month. Complete this question by entering your answers in the tabs below. Prepare the balance sheet as of the end of the month. 2-a. Prepare the income statement for the current month. 2-b. Prepare the statement of owner's equity for the current month. 2-c. Prepare the balance sheet as of the end of the month. 3. Prepare the statement of cash flows for the current month. Complete this question by entering your answers in the tabs below. Prepare the statement of cash flows for the current month. Note: Cash outflows should be indicated with a minus sign