Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requlred Informetion [The following information applies to the questions displayed below.] I only get one shot at this? you wonder aloud. Martina, human resources manager

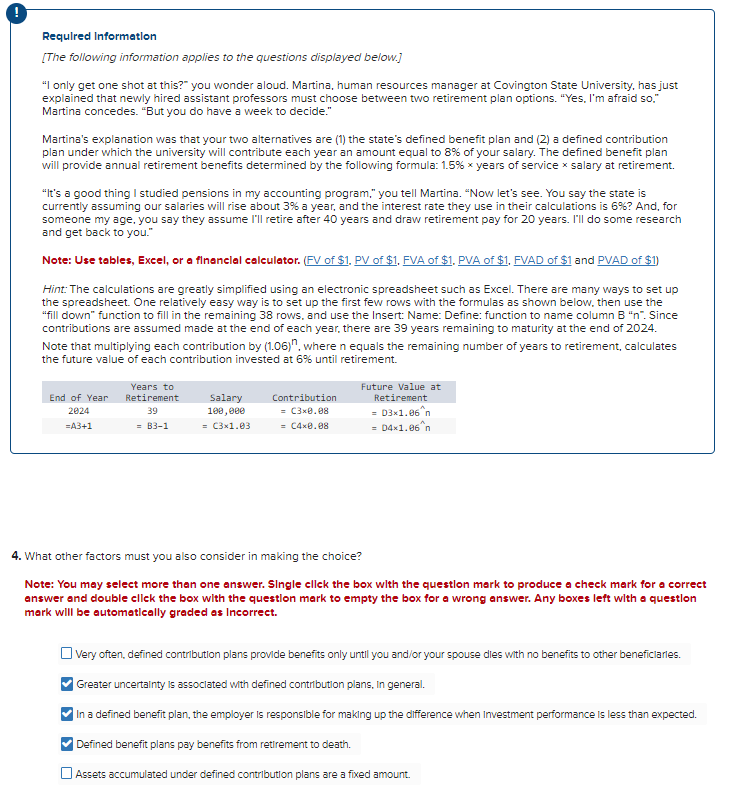

Requlred Informetion [The following information applies to the questions displayed below.] "I only get one shot at this?" you wonder aloud. Martina, human resources manager at Covington State University, has just explained that newly hired assistant professors must choose between two retirement plan options. "Yes, I'm afraid so," Martina concedes. "But you do have a week to decide." Martina's explanation was that your two alternatives are (1) the state's defined benefit plan and (2) a defined contribution plan under which the university will contribute each year an amount equal to 8% of your salary. The defined benefit plan will provide annual retirement benefits determined by the following formula: 1.5% years of service salary at retirement. "It's a good thing I studied pensions in my accounting program," you tell Martina. "Now let's see. You say the state is currently assuming our salaries will rise about 3% a year, and the interest rate they use in their calculations is 6% ? And, for someone my age, you say they assume l'll retire after 40 years and draw retirement pay for 20 years. l'll do some research and get back to you." Note: Use tables, Excel, or a flnenclel celculetor. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1 ) Hint: The calculations are greatly simplified using an electronic spreadsheet such as Excel. There are many ways to set up the spreadsheet. One relatively easy way is to set up the first few rows with the formulas as shown below, then use the "fill down" function to fill in the remaining 38 rows, and use the Insert: Name: Define: function to name column B "n". Since contributions are assumed made at the end of each year, there are 39 years remaining to maturity at the end of 2024 . Note that multiplying each contribution by (1.06)n, where n equals the remaining number of years to retirement, calculates the future value of each contribution invested at 6% until retirement. 4. What other factors must you also consider in making the choice? Note: You may select more than one answer. Slngle cllek the box wlth the questlon merk to produce a check mark for a correct answer and double cllck the box wlth the questlon mark to empty the box for a wrong answer. Any boxes left wlth a questlon mark will be automatleally graded as lncorrect. Very often, defined contrlbution plans provide benefits only untll you and/or your spouse dies with no benefits to other beneficlarles. Greater uncertainty is assoclated wth defined contrbutlon plans, In general. In a defined benefit plan, the employer is responsible for making up the dlfference when investment performance is less than expected. Defined benefit plans pay benefits from retirement to death. Assets accumulated under defined contrlbution plans are a fixed amount

Requlred Informetion [The following information applies to the questions displayed below.] "I only get one shot at this?" you wonder aloud. Martina, human resources manager at Covington State University, has just explained that newly hired assistant professors must choose between two retirement plan options. "Yes, I'm afraid so," Martina concedes. "But you do have a week to decide." Martina's explanation was that your two alternatives are (1) the state's defined benefit plan and (2) a defined contribution plan under which the university will contribute each year an amount equal to 8% of your salary. The defined benefit plan will provide annual retirement benefits determined by the following formula: 1.5% years of service salary at retirement. "It's a good thing I studied pensions in my accounting program," you tell Martina. "Now let's see. You say the state is currently assuming our salaries will rise about 3% a year, and the interest rate they use in their calculations is 6% ? And, for someone my age, you say they assume l'll retire after 40 years and draw retirement pay for 20 years. l'll do some research and get back to you." Note: Use tables, Excel, or a flnenclel celculetor. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1 ) Hint: The calculations are greatly simplified using an electronic spreadsheet such as Excel. There are many ways to set up the spreadsheet. One relatively easy way is to set up the first few rows with the formulas as shown below, then use the "fill down" function to fill in the remaining 38 rows, and use the Insert: Name: Define: function to name column B "n". Since contributions are assumed made at the end of each year, there are 39 years remaining to maturity at the end of 2024 . Note that multiplying each contribution by (1.06)n, where n equals the remaining number of years to retirement, calculates the future value of each contribution invested at 6% until retirement. 4. What other factors must you also consider in making the choice? Note: You may select more than one answer. Slngle cllek the box wlth the questlon merk to produce a check mark for a correct answer and double cllck the box wlth the questlon mark to empty the box for a wrong answer. Any boxes left wlth a questlon mark will be automatleally graded as lncorrect. Very often, defined contrlbution plans provide benefits only untll you and/or your spouse dies with no benefits to other beneficlarles. Greater uncertainty is assoclated wth defined contrbutlon plans, In general. In a defined benefit plan, the employer is responsible for making up the dlfference when investment performance is less than expected. Defined benefit plans pay benefits from retirement to death. Assets accumulated under defined contrlbution plans are a fixed amount Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started