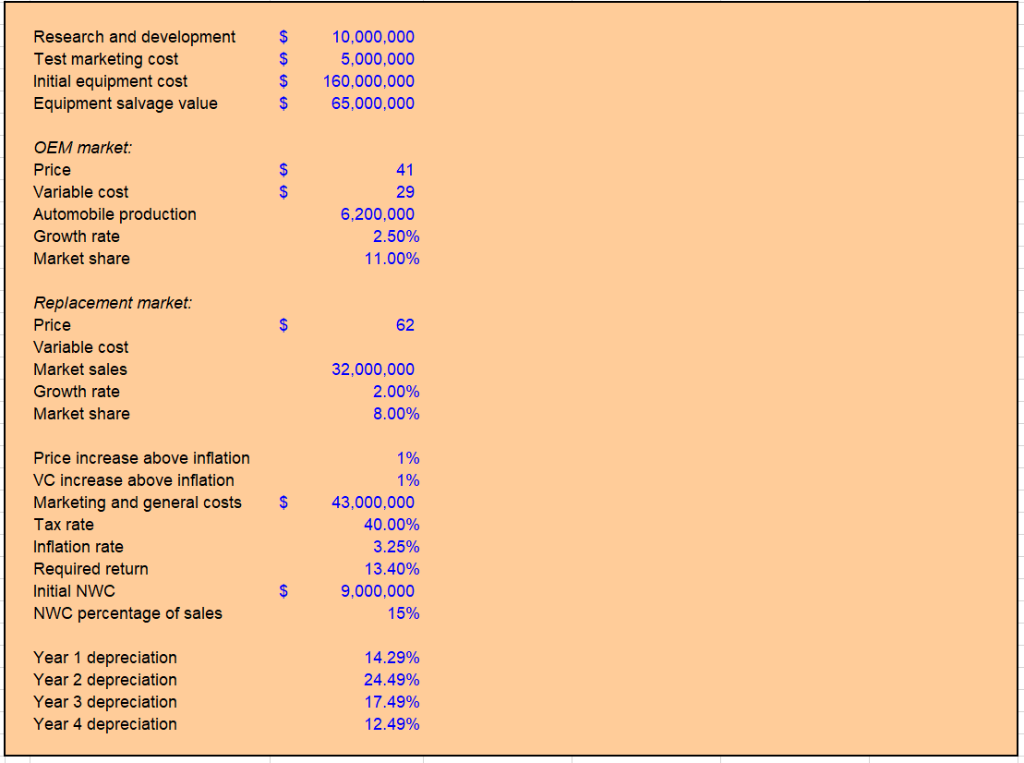

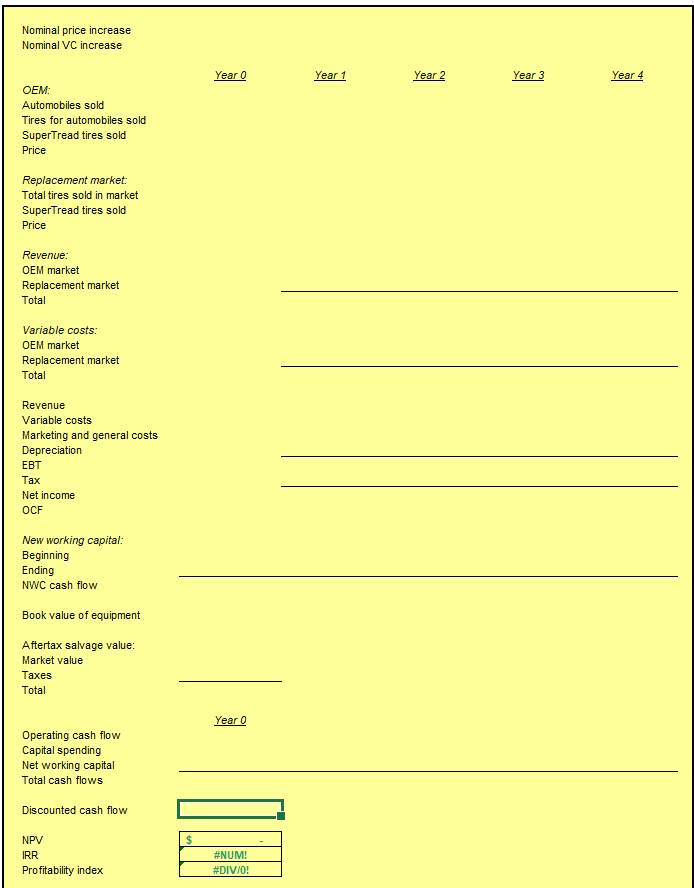

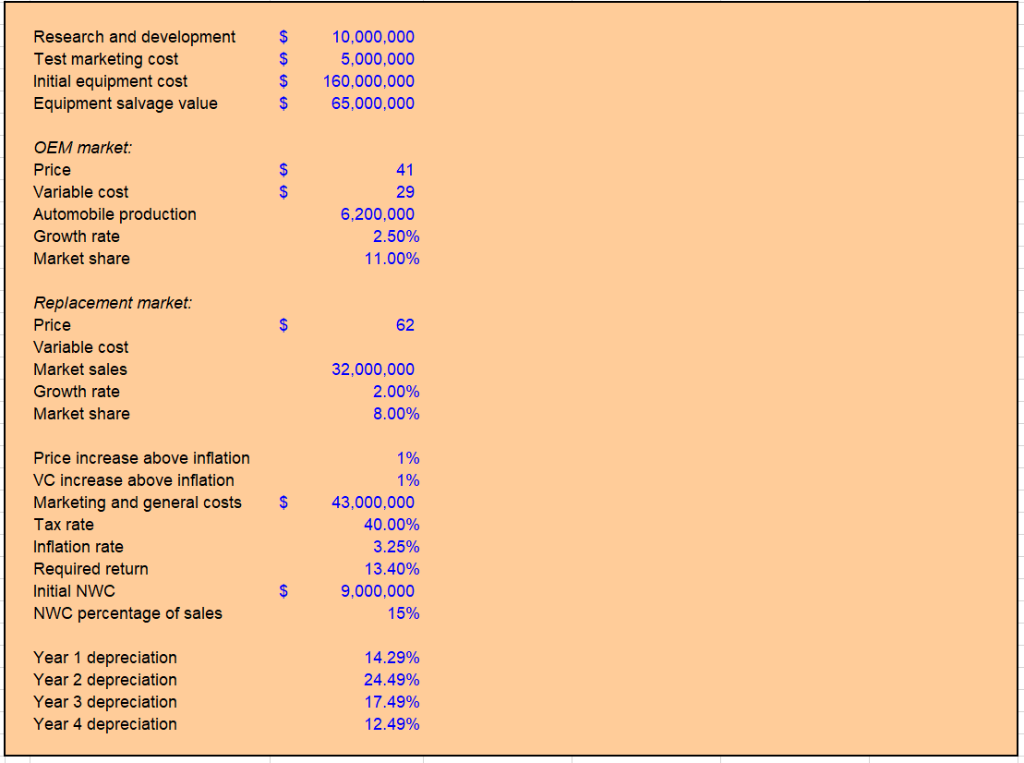

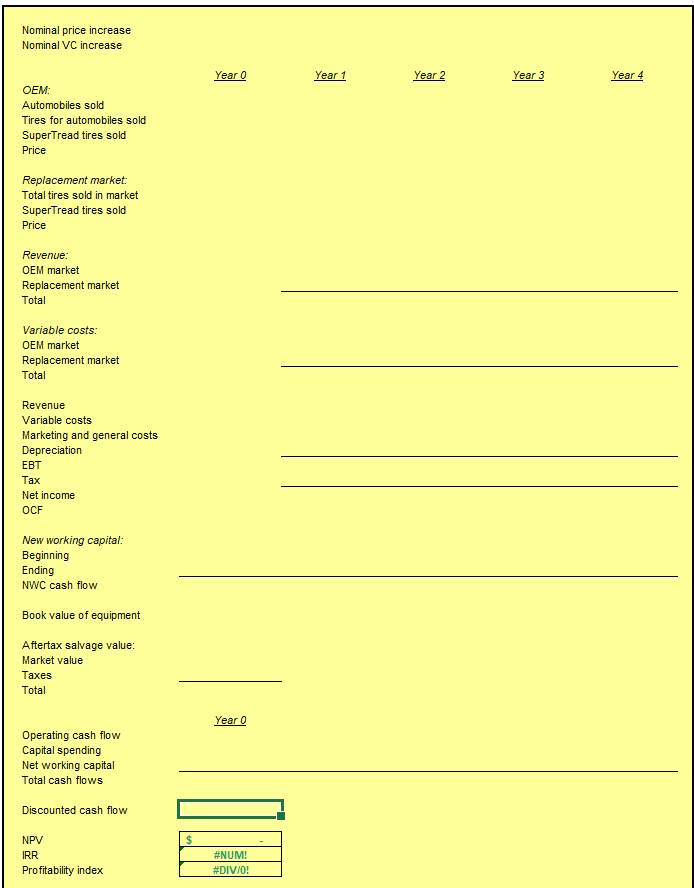

Research and development 10,000,000 5,000,000 160,000,000 Test marketing cost Initial equipment cost Equipment salvage value $ S 65,000,000 OEM market: Price 41 Variable cost S 29 Automobile production 6,200,000 2.50% Growth rate Market share 11.00% Replacement market: 62 Price Variable cost Market sales 32,000,000 Growth rate 2.00% Market share 8.00% 1% Price increase above inflation VC increase above inflation 1% 43,000,000 Marketing and general costs Tax rate 40.00% Inflation rate 3.25% 13.40% Required return Initial NWC $ 9,000,000 15% NWC percentage of sales Year 1 depreciation Year 2 depreciation Year 3 depreciation Year 4 depreciation 14.29% 24.49% 17.49% 12.49% Nominal price increase Nominal VC increase Year 2 Year 3 Year 4 Year 0 Year 1 OEM: Automobiles sold Tires for automobiles sold SuperTread tires sold Price Replacement market Total tires sold in market SuperTread tires sold Price Revenue: OEM market Replacement market Total Variable costs: OEM market Replacement market Total Revenue Variable costs Marketing and general costs Depreciation Tax Net income OCF New working capital: Beginning Ending NWC cash flow Book value of equipment Aftertax salvage value: Market value Taxes Total Year 0 Operating cash flow Capital spending Net working capital Total cash flows Discounted cash flow NPV IRR #NUM! #DIV/ 0 ! Profitability index Research and development 10,000,000 5,000,000 160,000,000 Test marketing cost Initial equipment cost Equipment salvage value $ S 65,000,000 OEM market: Price 41 Variable cost S 29 Automobile production 6,200,000 2.50% Growth rate Market share 11.00% Replacement market: 62 Price Variable cost Market sales 32,000,000 Growth rate 2.00% Market share 8.00% 1% Price increase above inflation VC increase above inflation 1% 43,000,000 Marketing and general costs Tax rate 40.00% Inflation rate 3.25% 13.40% Required return Initial NWC $ 9,000,000 15% NWC percentage of sales Year 1 depreciation Year 2 depreciation Year 3 depreciation Year 4 depreciation 14.29% 24.49% 17.49% 12.49% Nominal price increase Nominal VC increase Year 2 Year 3 Year 4 Year 0 Year 1 OEM: Automobiles sold Tires for automobiles sold SuperTread tires sold Price Replacement market Total tires sold in market SuperTread tires sold Price Revenue: OEM market Replacement market Total Variable costs: OEM market Replacement market Total Revenue Variable costs Marketing and general costs Depreciation Tax Net income OCF New working capital: Beginning Ending NWC cash flow Book value of equipment Aftertax salvage value: Market value Taxes Total Year 0 Operating cash flow Capital spending Net working capital Total cash flows Discounted cash flow NPV IRR #NUM! #DIV/ 0 ! Profitability index