Research Article Critique, Part Two

Relationship of Hospitalized Elders' Perceptions of Nurse Caring Behaviors, Type of Care Unit, Satisfaction with Nursing Care, and Health Outcome of Functional Status (Dey, 2016)

1) What is the acceptance rate for this study?

a. 100%

b. 182/180 x 100% = 99%

c. 2/180 x 100% = 1%

d. unknown/cannot be calculated

2) Which of the following would be accurate for the attrition rate for this study?

a. 1/78 x 100% = 1%

b. 0%

c. 77/78 x 100% = 98%

d. unknown/cannot be calculated

The doi for this article is 10.20467/1091-5710.20.3.134

This is all the information I have pertaining to these 2 questions

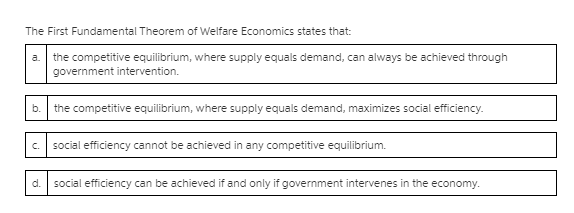

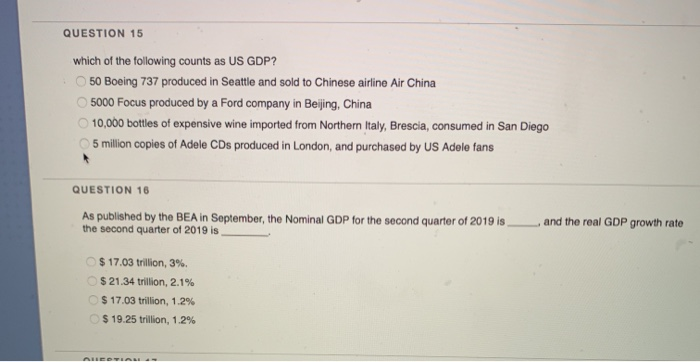

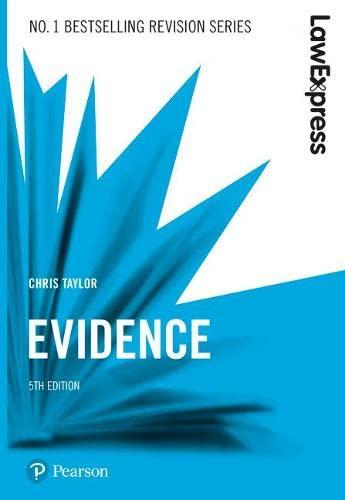

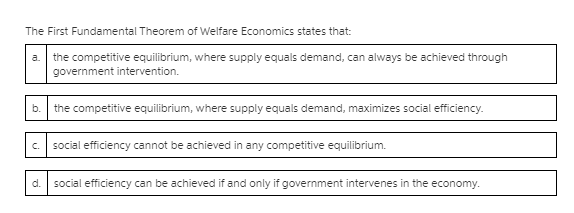

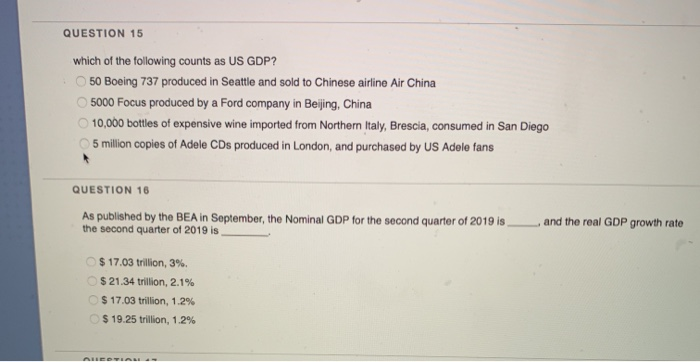

LONG-TERM ASSETS 121 REQUIRED Income statement questions: 1. Are total revenues higher or lower over the three-year period? 2. What is the percent change in total revenues from 2007 to 2009? 3. Is the percent of cost of goods sold to total revenues increasing or decreasing over the three- year period? As a result, is the gross margin percent increasing or decreasing" 4. Is the percent of total operating expenses to total revenues increasing or decreasing over the three-year period? As a result, is the operating income percent increasing or decreasing? 5. Is the percent of net income to total revenue increasing or decreasing over the three-year period? Balance sheet questions: 6. Are total assets higher or lower over the three-year period? 7. What is the percent change in total assets from 2007 to 2009? 8. What are the largest asset investments for the company over the three-year period? 9. Are the inventories increasing faster or slower than the percent change in total revenues? 10. Is the percent of total liabilities to total liabilities + owners' equity increasing or decreasing? As a result, is there more or less risk that the company could not pay its debts? Integrative income statement and balance sheet question: 1 1. Is the company operating more or less efficiently by using the least amount of asset investment to generate a given level of total revenues? Note that the "total asset turnover" ratio is computed and included in the "ratio analysis summary". Ratio analysis questions: 12. Is the current ratio better or worse in the most current year compared to prior years? 13. Is the quick ratio better or worse in the most current year compared to prior years? 14. Is the accounts receivable turnover ratio I (based on average receivables) better or worse in the most current year compared to prior years? 15. Is the 2009 accounts receivable turnover ratio 2 (based on year-end receivables) better or worse than the 2009 ratio based on an average? 16. Is the inventory turnover ratio I (based on average inventory) better or worse in the most current year compared to prior years? 17. Is the 2009 inventory turnover ratio 2 (based on year-end inventory) better or worse than the 2009 ratio based on an average? 18. Is the return on total assets (ROA) ratio better or worse in the most current year compared to prior years?\fQUESTION 15 which of the following counts as US GDP? 50 Boeing 737 produced in Seattle and sold to Chinese airline Air China 5000 Focus produced by a Ford company in Beijing, China O 10,000 bottles of expensive wine imported from Northern Italy, Brescia, consumed in San Diego 5 million copies of Adele CDs produced in London, and purchased by US Adele fans QUESTION 16 As published by the BEA in September, the Nominal GDP for the second quarter of 2019 is and the real GDP growth rate the second quarter of 2019 is O $ 17.03 trillion, 3% O $ 21.34 trillion, 2.1% C $ 17.03 trillion, 1.2% O $ 19.25 trillion, 1.2%QUESTION 25 An underperforming economy is one where O A. Actual real GDP is below the full employment level of GDP. O B. Workers' job performance lags due to slow changes in technology. O C. Actual real GDP is higher than the full employment level of GDP. O D. The full employment level of GDP is almost equal to actual real GDP.D Question 9 1 pts AD AS AS 120 100 Price level 80 CPI) 60 40 AD 20 0 1 2 3 4 4 5 6 Real GDP (billions of dollars per year) In the graph above, the change in equilibrium from E1 to Ez represents: O deflation. O demand-pull inflation. O price-push inflation. O cost-push inflation. D Question 10 1 pts AS 150 125 Price level 100 (CPD) 75 50 25 AD, 0 2 4 6 8 10 12 Real GDP (billions of dollars per year) In the graph above, which of the following is not consistent with a shift in the aggregate demand curve from AD, to AD2? O A decrease in income tax rates. O An increase in business investment. O An increase in government spending. O An increase in interest rates