Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RESEARCH CASE: CELGENE'S STEP ACQUISITION OF JUNO THERAPEUTICS Prior to 2 0 1 8 , Celgene Corporation, a biopharmaceutical company ( with specialities in oncology,

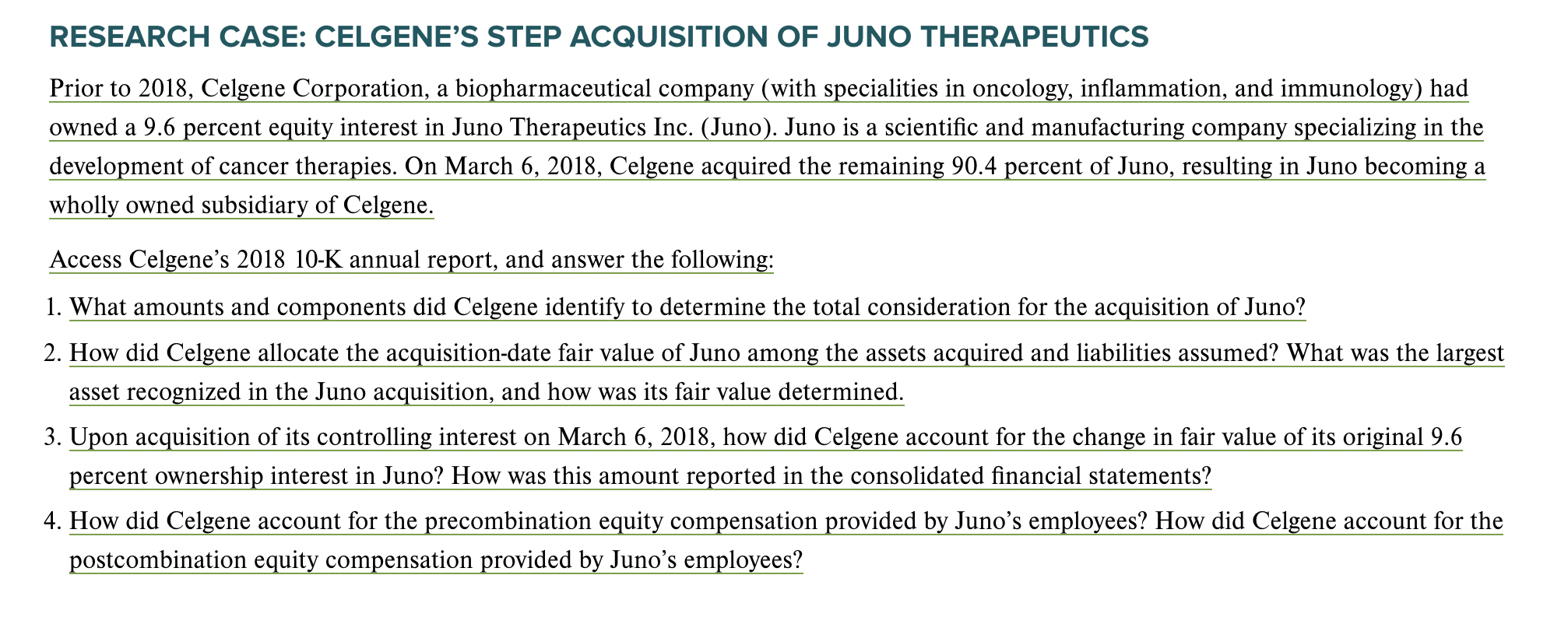

RESEARCH CASE: CELGENE'S STEP ACQUISITION OF JUNO THERAPEUTICS

Prior to Celgene Corporation, a biopharmaceutical company with specialities in oncology, inflammation, and immunology had

owned a percent equity interest in Juno Therapeutics Inc. Juno Juno is a scientific and manufacturing company specializing in the

development of cancer therapies. On March Celgene acquired the remaining percent of Juno, resulting in Juno becoming a

wholly owned subsidiary of Celgene.

Access Celgene's K annual report, and answer the following:

What amounts and components did Celgene identify to determine the total consideration for the acquisition of Juno?

How did Celgene allocate the acquisitiondate fair value of Juno among the assets acquired and liabilities assumed? What was the largest

asset recognized in the Juno acquisition, and how was its fair value determined.

Upon acquisition of its controlling interest on March how did Celgene account for the change in fair value of its original

percent ownership interest in Juno? How was this amount reported in the consolidated financial statements?

How did Celgene account for the precombination equity compensation provided by Juno's employees? How did Celgene account for the

postcombination equity compensation provided by Juno's employees?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started