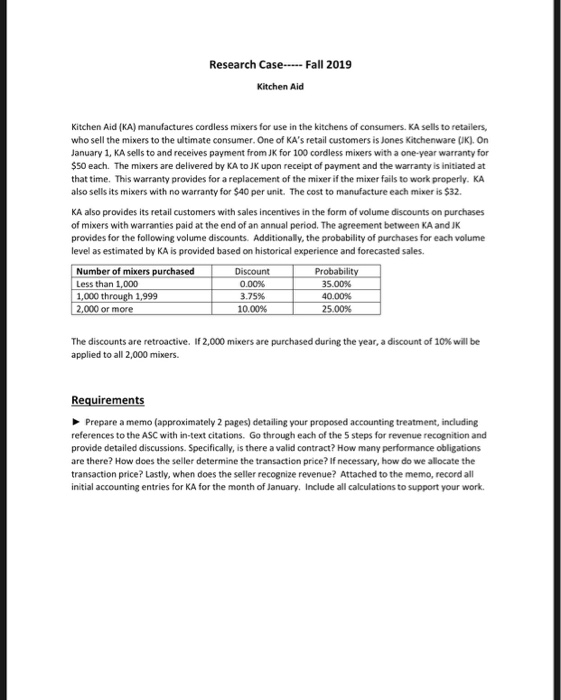

Research Case----- Fall 2019 Kitchen Aid Kitchen Aid (KA) manufactures cordless mixers for use in the kitchens of consumers. KA sells to retailers, who sell the mixers to the ultimate consumer. One of KA's retail customers is Jones Kitchenware UK. On January 1, KA sells to and receives payment from JK for 100 cordless mixers with a one-year warranty for $50 each. The mixers are delivered by KA to JK upon receipt of payment and the warranty is initiated at that time. This warranty provides for a replacement of the mixer if the mixer fails to work properly. KA also sells its mixers with no warranty for $40 per unit. The cost to manufacture each mixer is $32. KA also provides its retail customers with sales incentives in the form of volume discounts on purchases of mixers with warranties paid at the end of an annual period. The agreement between KA and JK provides for the following volume discounts. Additionally, the probability of purchases for each volume level as estimated by KA is provided based on historical experience and forecasted sales. Number of mixers purchased Less than 1,000 1,000 through 1,999 2,000 or more Discount 0.00% 3.75% 10.00% Probability 35.00% 40.00% 25.00% The discounts are retroactive. If 2,000 mixers are purchased during the year, a discount of 10% will be applied to all 2,000 mixers. Requirements Prepare a memo (approximately 2 pages) detailing your proposed accounting treatment, including references to the ASC with in-text citations. Go through each of the 5 steps for revenue recognition and provide detailed discussions. Specifically, is there a valid contract? How many performance obligations are there? How does the seller determine the transaction price? If necessary, how do we allocate the transaction price? Lastly, when does the seller recognize revenue? Attached to the memo, record all initial accounting entries for KA for the month of January. Include all calculations to support your work. Research Case----- Fall 2019 Kitchen Aid Kitchen Aid (KA) manufactures cordless mixers for use in the kitchens of consumers. KA sells to retailers, who sell the mixers to the ultimate consumer. One of KA's retail customers is Jones Kitchenware UK. On January 1, KA sells to and receives payment from JK for 100 cordless mixers with a one-year warranty for $50 each. The mixers are delivered by KA to JK upon receipt of payment and the warranty is initiated at that time. This warranty provides for a replacement of the mixer if the mixer fails to work properly. KA also sells its mixers with no warranty for $40 per unit. The cost to manufacture each mixer is $32. KA also provides its retail customers with sales incentives in the form of volume discounts on purchases of mixers with warranties paid at the end of an annual period. The agreement between KA and JK provides for the following volume discounts. Additionally, the probability of purchases for each volume level as estimated by KA is provided based on historical experience and forecasted sales. Number of mixers purchased Less than 1,000 1,000 through 1,999 2,000 or more Discount 0.00% 3.75% 10.00% Probability 35.00% 40.00% 25.00% The discounts are retroactive. If 2,000 mixers are purchased during the year, a discount of 10% will be applied to all 2,000 mixers. Requirements Prepare a memo (approximately 2 pages) detailing your proposed accounting treatment, including references to the ASC with in-text citations. Go through each of the 5 steps for revenue recognition and provide detailed discussions. Specifically, is there a valid contract? How many performance obligations are there? How does the seller determine the transaction price? If necessary, how do we allocate the transaction price? Lastly, when does the seller recognize revenue? Attached to the memo, record all initial accounting entries for KA for the month of January. Include all calculations to support your work