Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Research Case_Performance Measures. (L013-5 m) Go to the Internet websites of any five of the charitable organizations listed in Illustration 138 Q and search for

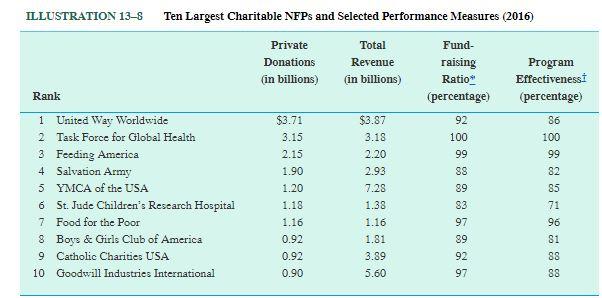

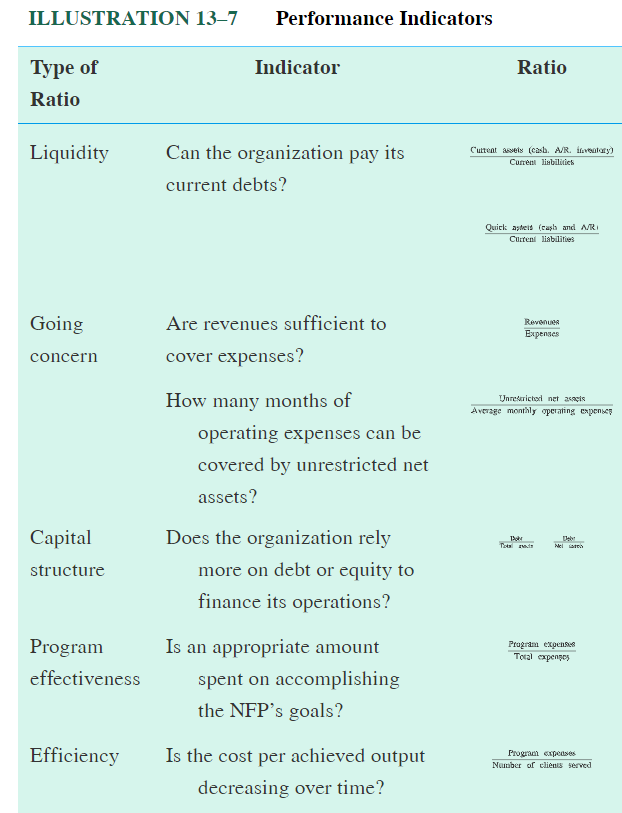

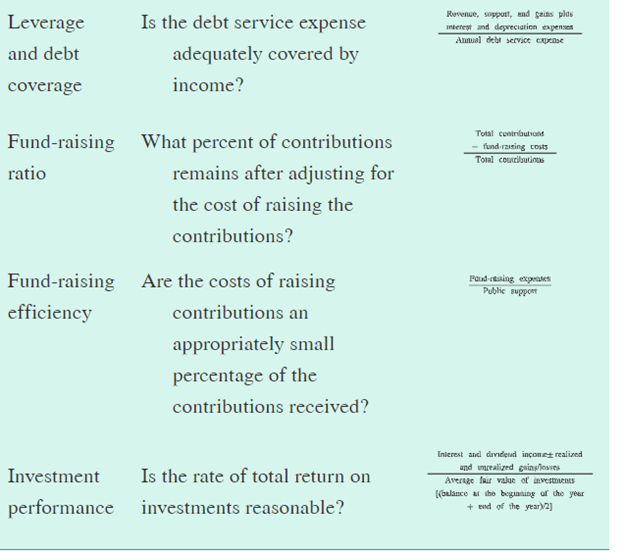

Research Case_Performance Measures. (L013-5 m) Go to the Internet websites of any five of the charitable organizations listed in Illustration 138 Q and search for financial information and performance measures they may disclose on their websites. Required a. For the most recent year provided on the organization's website, calculate the program effectiveness ratio for each organization (as a percentage of total expenses) as well as the fund-raising ratio [(contributions - fund-raising costs)/contributions]. How do the ratios you calculated compare to the values provided in Illustration 138 @ ? b. Select other financial performance measures from Illustration 137 and calculate those measures. c. How many years of financial information are provided by each organization? Why is it valuable to have multiple years of financial data available? d. Prepare a table showing the five charities and the performance measures calculated for each. Which charity would you consider the most efficient and effective? Why? ILLUSTRATION 13-8 Ten Largest Charitable NFPs and Selected Performance Measures (2016) Private Total Fund- Donations Revenue raising Program (in billions) (in billions) Ratio* Effectiveness Rank (percentage) (percentage 1 United Way Worldwide $3.71 $3.87 92 86 2 Task Force for Global Health 3.15 3.18 100 100 3 Feeding America 2.15 2.20 99 99 4 Salvation Army 1.90 2.93 88 82 5 YMCA of the USA 1.20 7.28 89 85 6 St. Jude Children's Research Hospital 1.18 1.38 83 71 7 Food for the Poor 1.16 1.16 97 96 8 Boys & Girls Club of America 0.92 1.81 89 81 9 Catholic Charities USA 0.92 3.89 92 88 10 Goodwill Industries International 0.90 5.60 97 88 ILLUSTRATION 137 Performance Indicators Indicator Ratio Type of Ratio Liquidity Cuttent avels (cash. A/Rivolaty Current limbilus Can the organization pay its current debts? Quick ateis (cuph and AB Curreni liabilities Going Revenue Expenses Are revenues sufficient to cover expenses? concern Unne richal net acacis Average monthly operating expenses How many months of operating expenses can be covered by unrestricted net assets? The To Nil Capital structure Does the organization rely more on debt or equity to finance its operations? Program expenses Total expenses Program effectiveness Is an appropriate amount spent on accomplishing the NFP's goals? Efficiency Program cxpenses Number of clients served Is the cost per achieved output decreasing over time? Revenge, sport, and sais plus interest and depreciation expenses Amul de service croche Leverage and debt coverage Is the debt service expense adequately covered by income? Fund-raising ratio Total contratos - fundraising costs Total courcibutions What percent of contributions remains after adjusting for the cost of raising the contributions? Fund-raising efficiency Poud.casing expres Publie support Are the costs of raising contributions an appropriately small percentage of the contributions received? Investment performance Is the rate of total return on investments reasonable? Interest and dividend income realized and realized ginslosses Average fair value of investments alance at the beginning of the year + end of the year)2] Research Case_Performance Measures. (L013-5 m) Go to the Internet websites of any five of the charitable organizations listed in Illustration 138 Q and search for financial information and performance measures they may disclose on their websites. Required a. For the most recent year provided on the organization's website, calculate the program effectiveness ratio for each organization (as a percentage of total expenses) as well as the fund-raising ratio [(contributions - fund-raising costs)/contributions]. How do the ratios you calculated compare to the values provided in Illustration 138 @ ? b. Select other financial performance measures from Illustration 137 and calculate those measures. c. How many years of financial information are provided by each organization? Why is it valuable to have multiple years of financial data available? d. Prepare a table showing the five charities and the performance measures calculated for each. Which charity would you consider the most efficient and effective? Why? ILLUSTRATION 13-8 Ten Largest Charitable NFPs and Selected Performance Measures (2016) Private Total Fund- Donations Revenue raising Program (in billions) (in billions) Ratio* Effectiveness Rank (percentage) (percentage 1 United Way Worldwide $3.71 $3.87 92 86 2 Task Force for Global Health 3.15 3.18 100 100 3 Feeding America 2.15 2.20 99 99 4 Salvation Army 1.90 2.93 88 82 5 YMCA of the USA 1.20 7.28 89 85 6 St. Jude Children's Research Hospital 1.18 1.38 83 71 7 Food for the Poor 1.16 1.16 97 96 8 Boys & Girls Club of America 0.92 1.81 89 81 9 Catholic Charities USA 0.92 3.89 92 88 10 Goodwill Industries International 0.90 5.60 97 88 ILLUSTRATION 137 Performance Indicators Indicator Ratio Type of Ratio Liquidity Cuttent avels (cash. A/Rivolaty Current limbilus Can the organization pay its current debts? Quick ateis (cuph and AB Curreni liabilities Going Revenue Expenses Are revenues sufficient to cover expenses? concern Unne richal net acacis Average monthly operating expenses How many months of operating expenses can be covered by unrestricted net assets? The To Nil Capital structure Does the organization rely more on debt or equity to finance its operations? Program expenses Total expenses Program effectiveness Is an appropriate amount spent on accomplishing the NFP's goals? Efficiency Program cxpenses Number of clients served Is the cost per achieved output decreasing over time? Revenge, sport, and sais plus interest and depreciation expenses Amul de service croche Leverage and debt coverage Is the debt service expense adequately covered by income? Fund-raising ratio Total contratos - fundraising costs Total courcibutions What percent of contributions remains after adjusting for the cost of raising the contributions? Fund-raising efficiency Poud.casing expres Publie support Are the costs of raising contributions an appropriately small percentage of the contributions received? Investment performance Is the rate of total return on investments reasonable? Interest and dividend income realized and realized ginslosses Average fair value of investments alance at the beginning of the year + end of the year)2]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started