Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Research indicates that the desired expansion would require an immediate outlay of $60,000 and an outlay of a further $60,000 in 5 years. Net returns

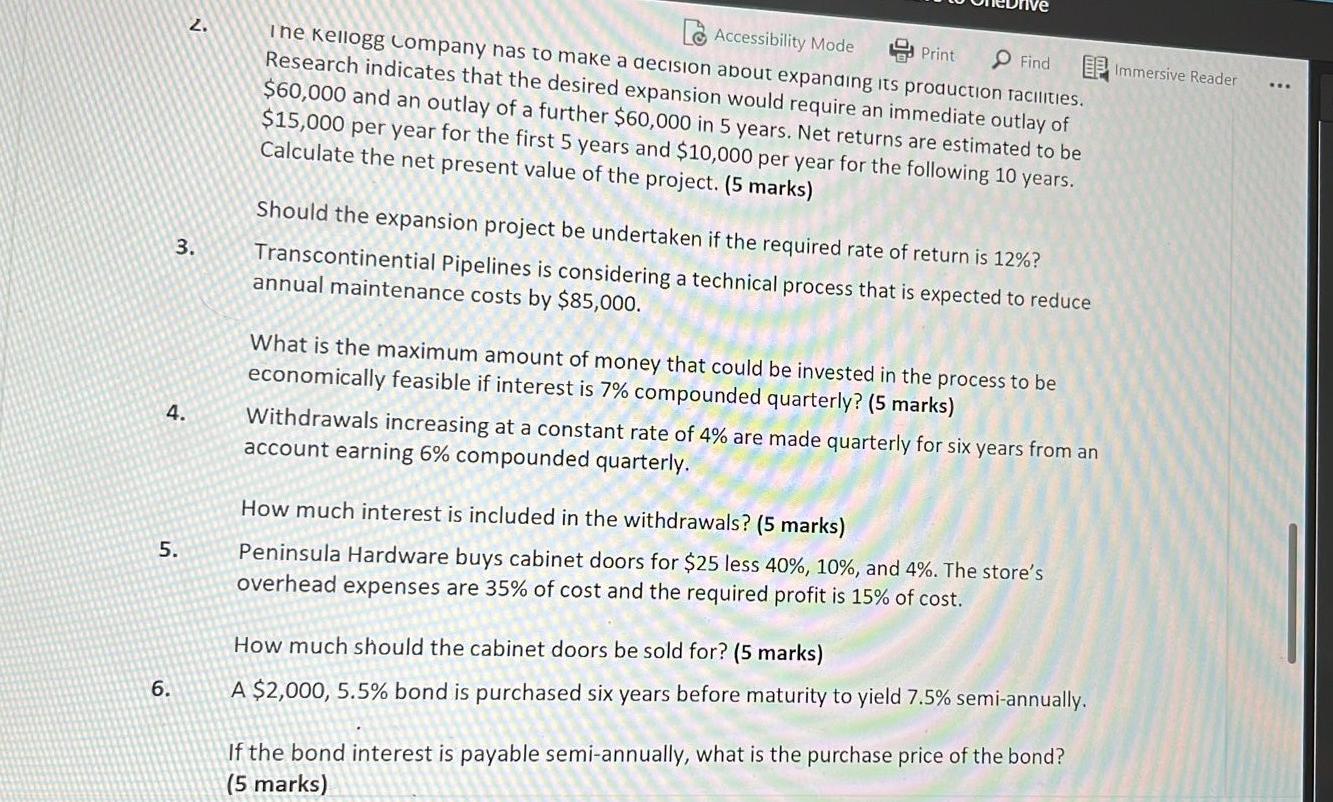

Research indicates that the desired expansion would require an immediate outlay of $60,000 and an outlay of a further $60,000 in 5 years. Net returns are estimated to be $15,000 per year for the first 5 years and $10,000 per year for the following 10 years. Calculate the net present value of the project. (5 marks) Should the expansion project be undertaken if the required rate of return is 12% ? 3. Transcontinential Pipelines is considering a technical process that is expected to reduce annual maintenance costs by $85,000. What is the maximum amount of money that could be invested in the process to be economically feasible if interest is 7% compounded quarterly? (5 marks) 4. Withdrawals increasing at a constant rate of 4% are made quarterly for six years from an account earning 6% compounded quarterly. How much interest is included in the withdrawals? (5 marks) 5. Peninsula Hardware buys cabinet doors for $25 less 40%,10%, and 4%. The store's overhead expenses are 35% of cost and the required profit is 15% of cost. How much should the cabinet doors be sold for? (5 marks) 6. A $2,000,5.5% bond is purchased six years before maturity to yield 7.5% semi-annually. If the bond interest is payable semi-annually, what is the purchase price of the bond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started