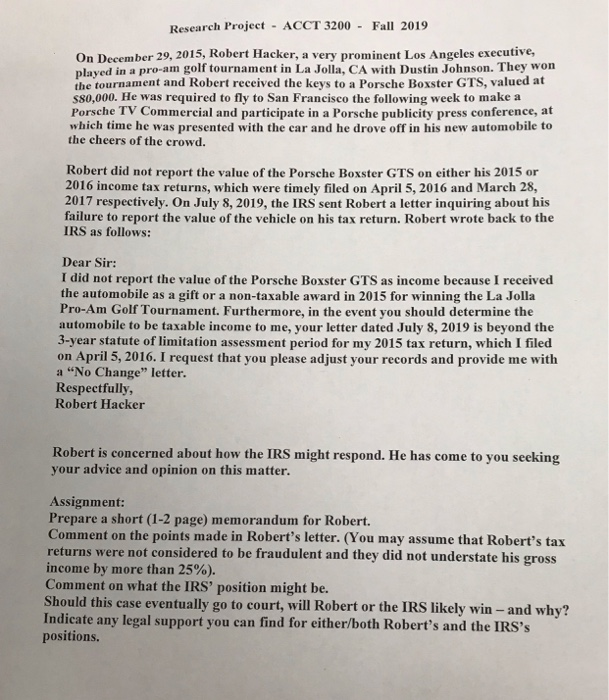

Research Project ACCT 3200 Fall 2019 On December 29, 2015, Robert Hacker, a very prominent Los Angeles executive played in a pro-am golf tournament in La Jolla, CA with Dustin Johnson. They won the tournament and Robert received the keys to a Porsche Boxster GTS, valued at s80,000. He was required to fly to San Francisco the following week to make a Porsche TV Commercial and participate in a Porsche publicity press conference, at which time he was presented with the car and he drove off in his new automobile to the cheers of the crowd. Robert did not report the value of the Porsche Boxster GTS on either his 2015 or 2016 income tax returns, which were timely filed on April 5, 2016 and March 28, 2017 respectively. On July 8, 2019, the IRS sent Robert a letter inquiring about his failure to report the value of the vehicle on his tax return. Robert wrote back to the IRS as follows: Dear Sir: I did not report the value of the Porsche Boxster GTS as income because I received the automobile as a gift or a non-taxable award in 2015 for winning the La Jolla Pro-Am Golf Tournament. Furthermore, in the event you should determine the automobile to be taxable income to me, your letter dated July 8, 2019 is beyond the 3-year statute of limitation assessment period for my 2015 tax return, which I filed on April 5, 2016. I request that you please adjust your records and provide me with a "No Change" letter. Respectfully, Robert Hacker Robert is concerned about how the IRS might respond. He has come to you seeking your advice and opinion on this matter. Assignment: Prepare a short (1-2 page) memorandum for Robert. Comment on the points made in Robert's letter. (You may assume that Robert's tax returns were not considered to be fraudulent and they did not understate his gross income by more than 25% ) . Comment on what the IRS' position might be. Should this case eventuallygo to court, will Robert or the IRS likely win - and why? Indicate any legal support you can find for either/both Robert's and the IRS's positions. Research Project ACCT 3200 Fall 2019 On December 29, 2015, Robert Hacker, a very prominent Los Angeles executive played in a pro-am golf tournament in La Jolla, CA with Dustin Johnson. They won the tournament and Robert received the keys to a Porsche Boxster GTS, valued at s80,000. He was required to fly to San Francisco the following week to make a Porsche TV Commercial and participate in a Porsche publicity press conference, at which time he was presented with the car and he drove off in his new automobile to the cheers of the crowd. Robert did not report the value of the Porsche Boxster GTS on either his 2015 or 2016 income tax returns, which were timely filed on April 5, 2016 and March 28, 2017 respectively. On July 8, 2019, the IRS sent Robert a letter inquiring about his failure to report the value of the vehicle on his tax return. Robert wrote back to the IRS as follows: Dear Sir: I did not report the value of the Porsche Boxster GTS as income because I received the automobile as a gift or a non-taxable award in 2015 for winning the La Jolla Pro-Am Golf Tournament. Furthermore, in the event you should determine the automobile to be taxable income to me, your letter dated July 8, 2019 is beyond the 3-year statute of limitation assessment period for my 2015 tax return, which I filed on April 5, 2016. I request that you please adjust your records and provide me with a "No Change" letter. Respectfully, Robert Hacker Robert is concerned about how the IRS might respond. He has come to you seeking your advice and opinion on this matter. Assignment: Prepare a short (1-2 page) memorandum for Robert. Comment on the points made in Robert's letter. (You may assume that Robert's tax returns were not considered to be fraudulent and they did not understate his gross income by more than 25% ) . Comment on what the IRS' position might be. Should this case eventuallygo to court, will Robert or the IRS likely win - and why? Indicate any legal support you can find for either/both Robert's and the IRS's positions