Answered step by step

Verified Expert Solution

Question

1 Approved Answer

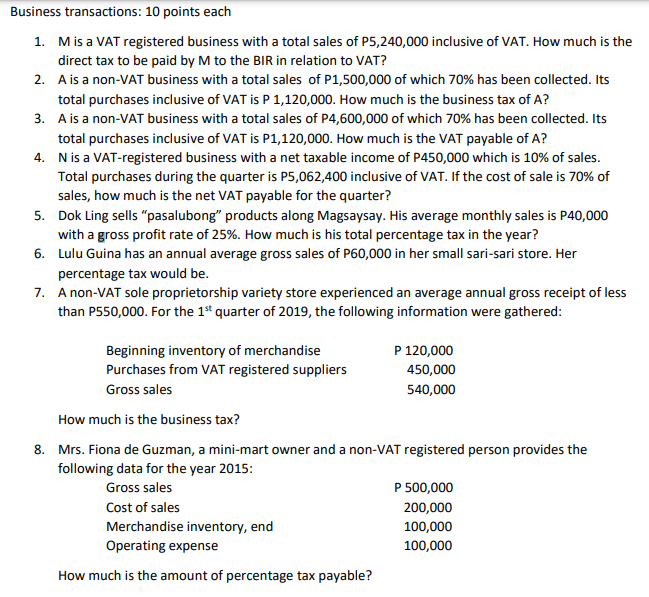

**RESEARCH THE TAX COMPUTATIONS BASED ON LATEST BIR RULES/TRAIN LAW TO ANSWER THE GIVEN PROBLEMS. Business transactions: 10 points each 1. M is a VAT

**RESEARCH THE TAX COMPUTATIONS BASED ON LATEST BIR RULES/TRAIN LAW TO ANSWER THE GIVEN PROBLEMS.

Business transactions: 10 points each 1. M is a VAT registered business with a total sales of P5,240,000 inclusive of VAT. How much is the direct tax to be paid by M to the BIR in relation to VAT? 2. A is a non-VAT business with a total sales of P1,500,000 of which 70% has been collected. Its total purchases inclusive of VAT is P 1,120,000. How much is the business tax of A? 3. A is a non-VAT business with a total sales of P4,600,000 of which 70% has been collected. Its total purchases inclusive of VAT is P1,120,000. How much is the VAT payable of A? 4. Nis a VAT-registered business with a net taxable income of P450,000 which is 10% of sales. Total purchases during the quarter is P5,062,400 inclusive of VAT. If the cost of sale is 70% of sales, how much is the net VAT payable for the quarter? 5. Dok Ling sells "pasalubong" products along Magsaysay. His average monthly sales is P40,000 with a gross profit rate of 25%. How much is his total percentage tax in the year? 6. Lulu Guina has an annual average gross sales of P60,000 in her small sari-sari store. Her percentage tax would be. 7. A non-VAT sole proprietorship variety store experienced an average annual gross receipt of less than P550,000. For the 1st quarter of 2019, the following information were gathered: Beginning inventory of merchandise P 120,000 Purchases from VAT registered suppliers 450,000 Gross sales 540,000 How much is the business tax? 8. Mrs. Fiona de Guzman, a mini-mart owner and a non-VAT registered person provides the following data for the year 2015: Gross sales P 500,000 Cost of sales 200,000 Merchandise inventory, end 100,000 Operating expense 100,000 How much is the amount of percentage tax payable? Business transactions: 10 points each 1. M is a VAT registered business with a total sales of P5,240,000 inclusive of VAT. How much is the direct tax to be paid by M to the BIR in relation to VAT? 2. A is a non-VAT business with a total sales of P1,500,000 of which 70% has been collected. Its total purchases inclusive of VAT is P 1,120,000. How much is the business tax of A? 3. A is a non-VAT business with a total sales of P4,600,000 of which 70% has been collected. Its total purchases inclusive of VAT is P1,120,000. How much is the VAT payable of A? 4. Nis a VAT-registered business with a net taxable income of P450,000 which is 10% of sales. Total purchases during the quarter is P5,062,400 inclusive of VAT. If the cost of sale is 70% of sales, how much is the net VAT payable for the quarter? 5. Dok Ling sells "pasalubong" products along Magsaysay. His average monthly sales is P40,000 with a gross profit rate of 25%. How much is his total percentage tax in the year? 6. Lulu Guina has an annual average gross sales of P60,000 in her small sari-sari store. Her percentage tax would be. 7. A non-VAT sole proprietorship variety store experienced an average annual gross receipt of less than P550,000. For the 1st quarter of 2019, the following information were gathered: Beginning inventory of merchandise P 120,000 Purchases from VAT registered suppliers 450,000 Gross sales 540,000 How much is the business tax? 8. Mrs. Fiona de Guzman, a mini-mart owner and a non-VAT registered person provides the following data for the year 2015: Gross sales P 500,000 Cost of sales 200,000 Merchandise inventory, end 100,000 Operating expense 100,000 How much is the amount of percentage tax payableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started