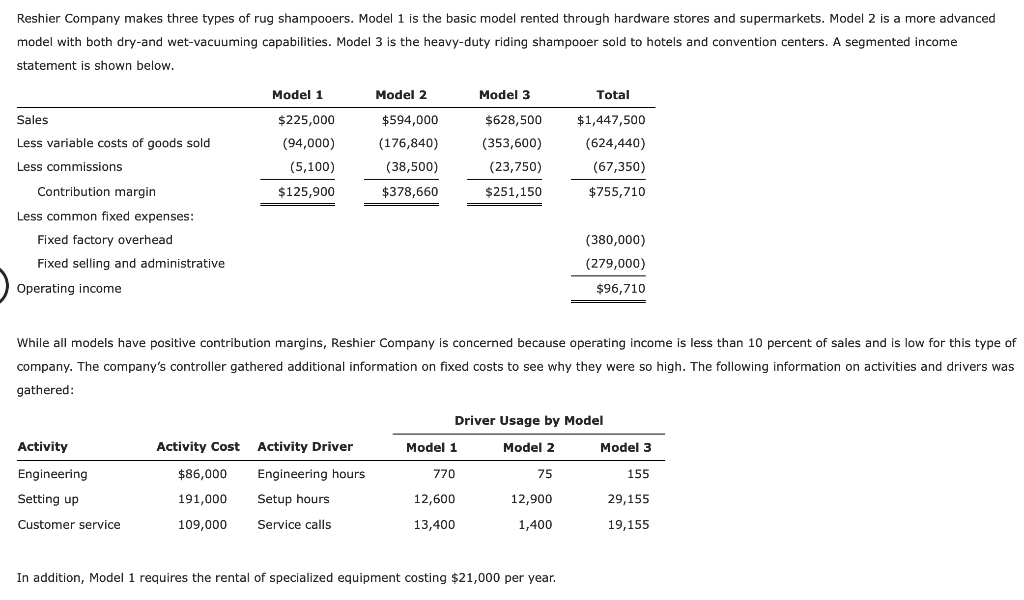

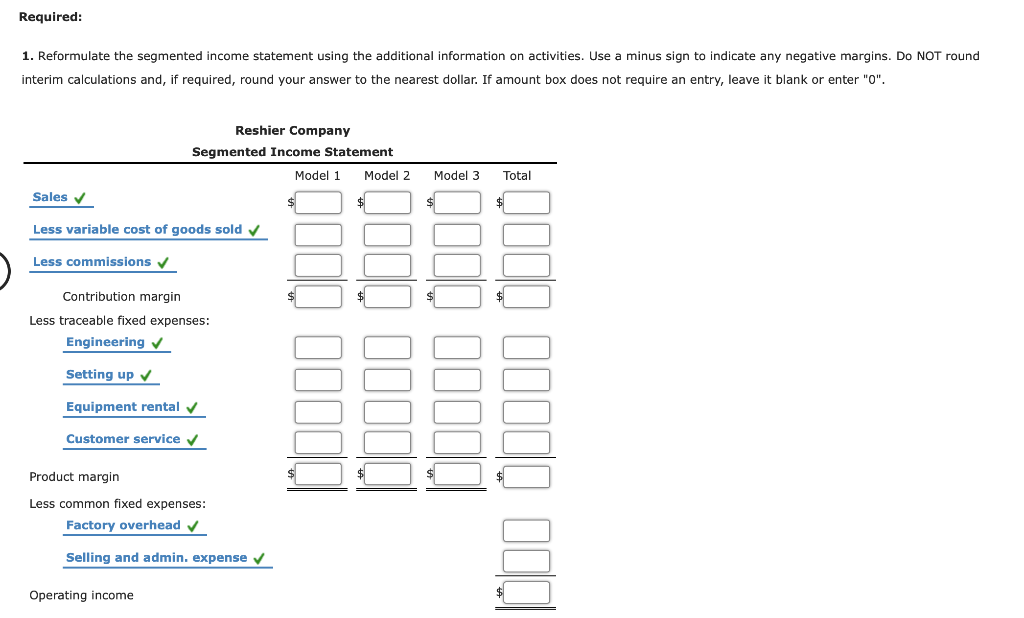

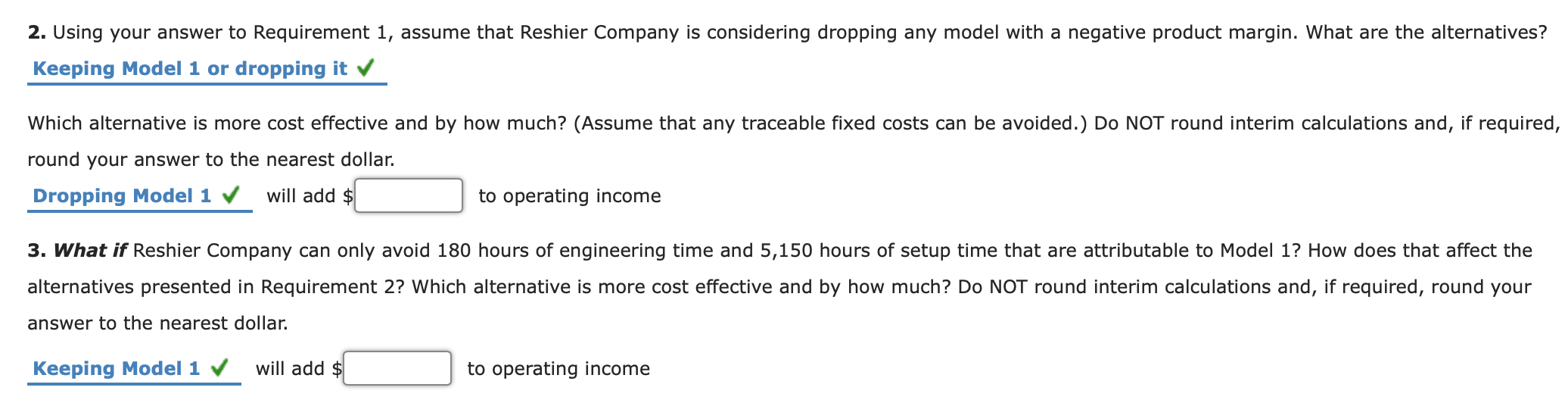

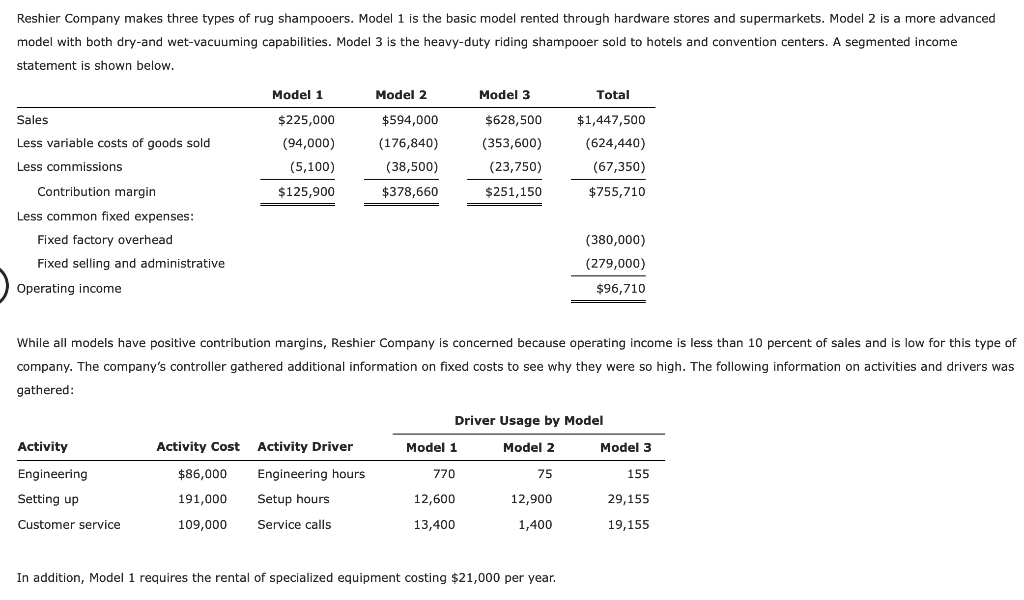

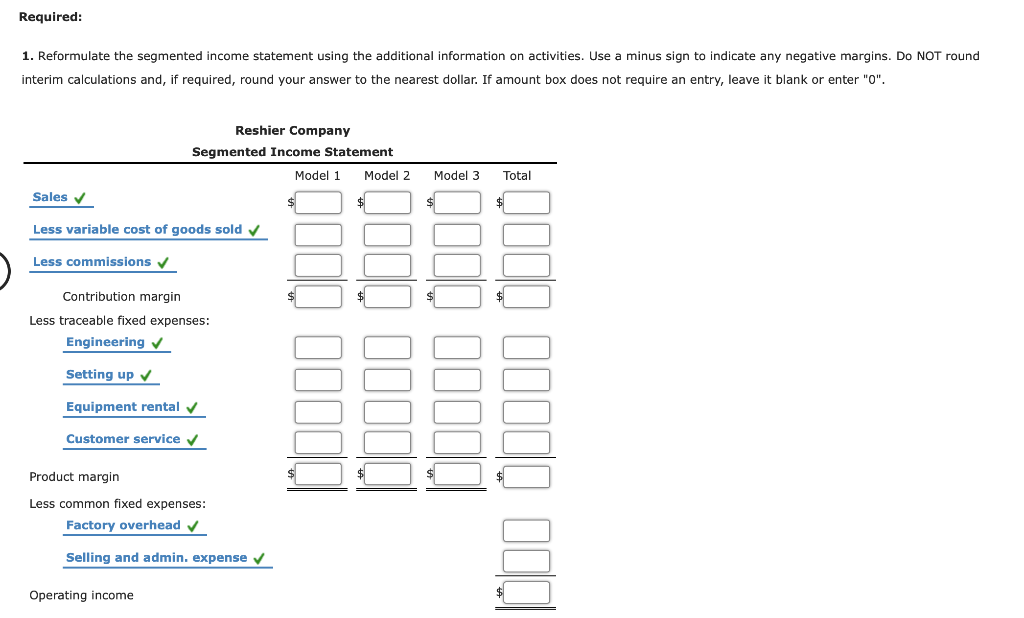

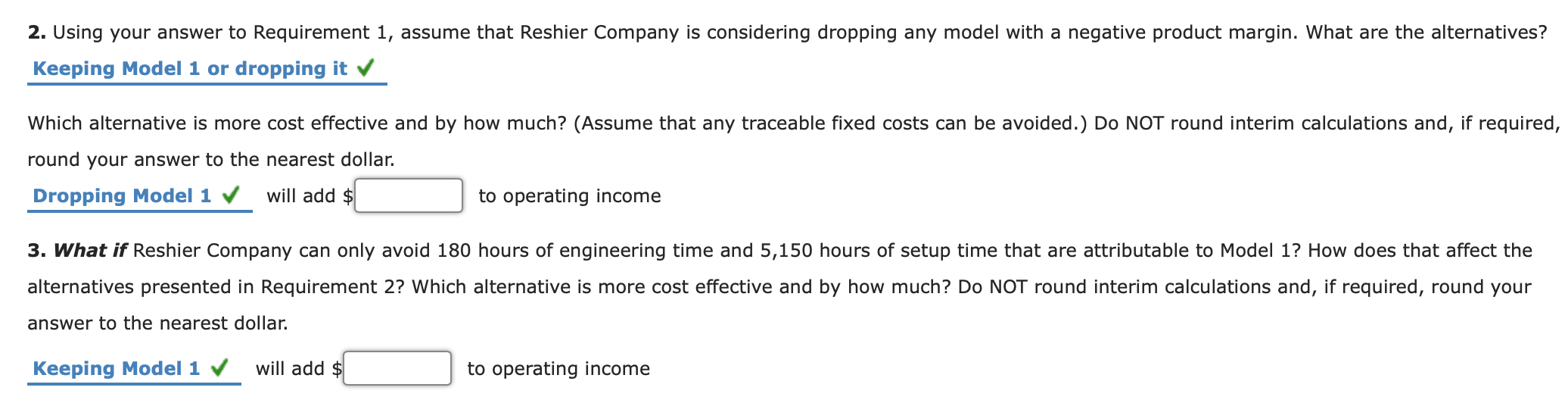

Reshier Company makes three types of rug shampooers. Model 1 is the basic model rented through hardware stores and supermarkets. Model 2 is a more advanced model with both dry-and wet-vacuuming capabilities. Model 3 is the heavy-duty riding shampooer sold to hotels and convention centers. A segmented income statement is shown below. Model 1 Model 2 Model 3 Total Sales Less variable costs of goods sold Less commissions Contribution margin $225,000 (94,000) (5,100) $594,000 (176,840) (38,500) $378,660 $628,500 (353,600) (23,750) $251,150 $1,447,500 (624,440) (67,350) $755,710 $125,900 Less common fixed expenses: Fixed factory overhead Fixed selling and administrative Operating income (380,000) (279,000) $96,710 While all models have positive contribution margins, Reshier Company is concerned because operating income is less than 10 percent of sales and is low for this type of company. The company's controller gathered additional information on fixed costs to see why they were so high. The following information on activities and drivers was gathered: Driver Usage by Model Activity Model 1 Model 2 Model 3 770 75 155 Engineering Setting up Activity Cost Activity Driver $86,000 Engineering hours 191,000 Setup hours 109,000 Service calls 12,600 12,900 29,155 Customer service 13,400 1,400 19,155 In addition, Model 1 requires the rental of specialized equipment costing $21,000 per year. Required: 1. Reformulate the segmented income statement using the additional information on activities. Use a minus sign to indicate any negative margins. Do NOT round interim calculations and, if required, round your answer to the nearest dollar. If amount box does not require an entry, leave it blank or enter" Reshier Company Segmented Income Statement Model 1 Model 2 Model 3 Total Sales Less variable cost of goods sold Less commissions $ Contribution margin Less traceable fixed expenses: Engineering Setting up Equipment rental Q000 0000 000 Customer service Product margin Less common fixed expenses: Factory overhead Selling and admin. expense Operating income 2. Using your answer to Requirement 1, assume that Reshier Company is considering dropping any model with a negative product margin. What are the alternatives? Keeping Model 1 or dropping it Which alternative is more cost effective and by how much? (Assume that any traceable fixed costs can be avoided.) Do NOT round interim calculations and, if required, round your answer to the nearest dollar. Dropping Model 1 will add $ to operating income 3. What if Reshier Company can only avoid 180 hours of engineering time and 5,150 hours of setup time that are attributable to Model 1? How does that affect the alternatives presented in Requirement 2? Which alternative is more cost effective and by how much? Do NOT round interim calculations and, if required, round your answer to the nearest dollar. Keeping Model 1 will add $ to operating income