Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Residency Of Individuals The following independent Cases describe situations in which income has been earned by an individual. In each of the Cases, indicate

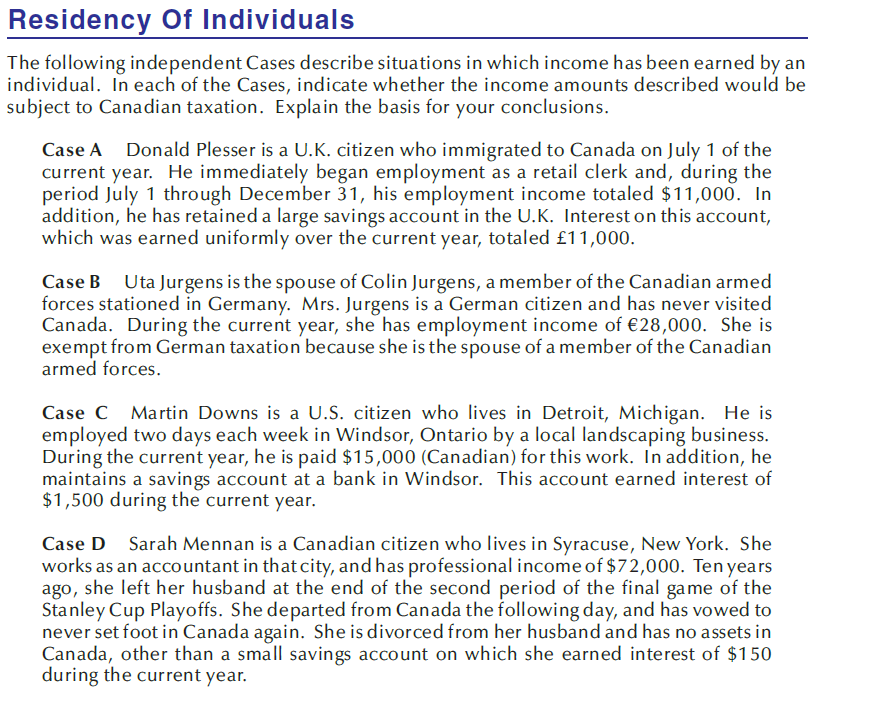

Residency Of Individuals The following independent Cases describe situations in which income has been earned by an individual. In each of the Cases, indicate whether the income amounts described would be subject to Canadian taxation. Explain the basis for your conclusions. Case A Donald Plesser is a U.K. citizen who immigrated to Canada on July 1 of the current year. He immediately began employment as a retail clerk and, during the period July 1 through December 31, his employment income totaled $11,000. In addition, he has retained a large savings account in the U.K. Interest on this account, which was earned uniformly over the current year, totaled 11,000. Case B Uta Jurgens is the spouse of Colin Jurgens, a member of the Canadian armed forces stationed in Germany. Mrs. Jurgens is a German citizen and has never visited Canada. During the current year, she has employment income of 28,000. She is exempt from German taxation because she is the spouse of a member of the Canadian armed forces. Martin Downs is a U.S. citizen who lives in Detroit, Michigan. He is employed two days each week in Windsor, Ontario by a local landscaping business. During the current year, he is paid $15,000 (Canadian) for this work. In addition, he maintains a savings account at a bank in Windsor. This account earned interest of $1,500 during the current year. Case D Sarah Mennan is a Canadian citizen who lives in Syracuse, New York. She works as an accountant in that city, and has professional income of $72,000. Ten years ago, she left her husband at the end of the second period of the final game of the Stanley Cup Playoffs. She departed from Canada the following day, and has vowed to never set foot in Canada again. She is divorced from her husband and has no assets in Canada, other than a small savings account on which she earned interest of $150 during the current year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started