Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Residents of Mill River have fond memories of ice skating at a local park. An artist has captured the experience in a drawing and is

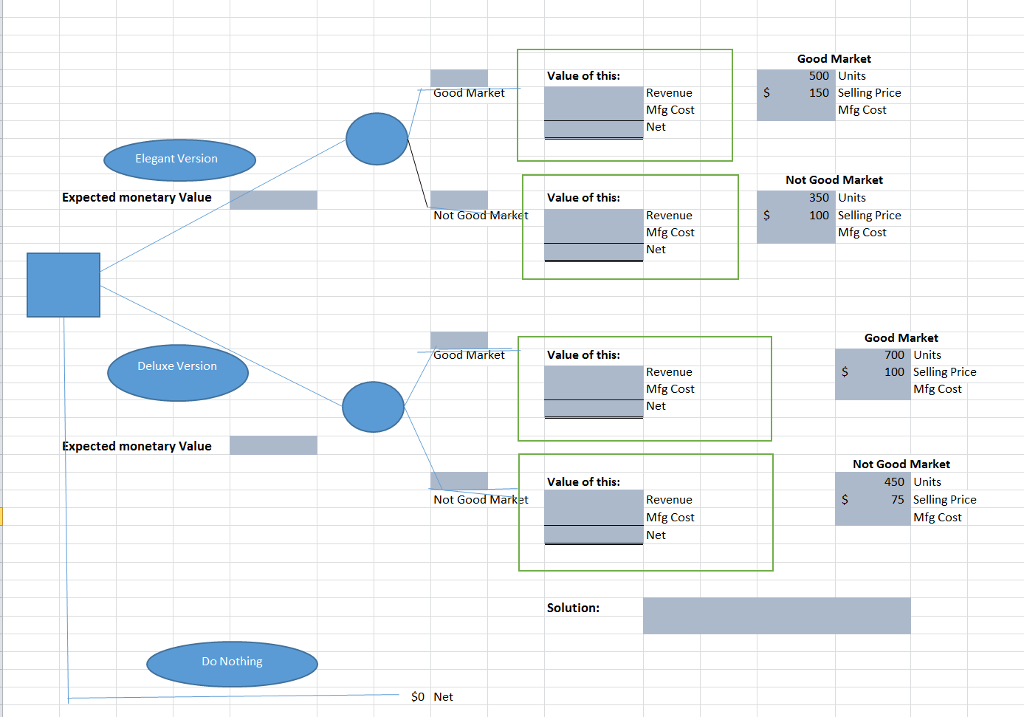

| Residents of Mill River have fond memories of ice skating at a local park. An artist has captured the experience in a drawing and is hoping to reproduce it and see framed copes to current and former residents. He thinks that if the market is good he can sell 500 copies of the elegant version at $150 each. If the market is not good, he will sell only 350 at $100 each. He can make a deluxe version of the same drawing instead. He feels that if the market is good he can sell 700 copies of the deluxe version at $100 each. If the market is not good, he will sell only 450 copies at $75 each. In either case, total manufacturing costs will be approximately $30,000. He can also choose to do nothing. If he believes there is a 60% probability of a good market, what should he do? Why? |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started