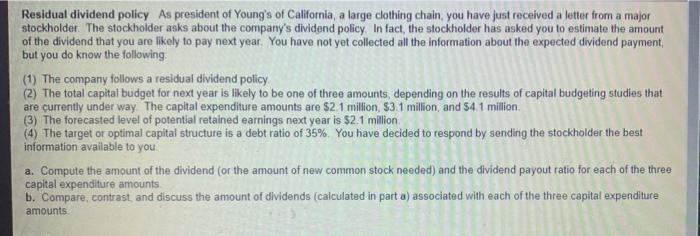

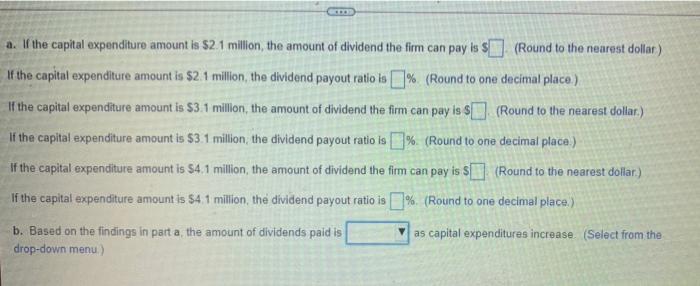

Residual dividend policy As president of Young's of California, a large clothing chain, you have just received a letter from a major stockholder. The stockholder asks about the company's dividend policy In fact, the stockholder has asked you to estimate the amount of the dividend that you are likely to pay next year. You have not yet collected all the information about the expected dividend payment, but you do know the following (1) The company follows a residual dividend policy (2) The total capital budget for next year is likely to be one of three amounts, depending on the results of capital budgeting studies that are currently under way The capital expenditure amounts are $2 1 million, $3.1 million, and 54 1 million (3) The forecasted level of potential retained earnings next year is $2.1 million (4) The target or optimal capital structure is a debt ratio of 35%. You have decided to respond by sending the stockholder the best information available to you a. Compute the amount of the dividend (or the amount of new common stock needed) and the dividend payout ratio for each of the three capital expenditure amounts b. Compare, contrast and discuss the amount of dividends (calculated in part a) associated with each of the three capital expenditure amounts a. If the capital expenditure amount is $2.1 million, the amount of dividend the firm can pay is $(Round to the nearest dollar) If the capital expenditure amount is $2.1 million, the dividend payout ratio is % (Round to one decimal place.) If the capital expenditure amount is $3.1 million, the amount of dividend the firm can pay is $ (Round to the nearest dollar.) If the capital expenditure amount is $3.1 million, the dividend payout ratio is % (Round to one decimal place) If the capital expenditure amount is $4.1 million, the amount of dividend the firm can pay is $(Round to the nearest dollar) If the capital expenditure amount is $4.1 million, the dividend payout ratio is % (Round to one decimal place.) b. Based on the findings in part a, the amount of dividends paid is drop-down menu.) as capital expenditures increase. (Select from the