Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Residual land value from hypothetical development You are working for a developer who develops residential investment property. She has asked you to determine how much

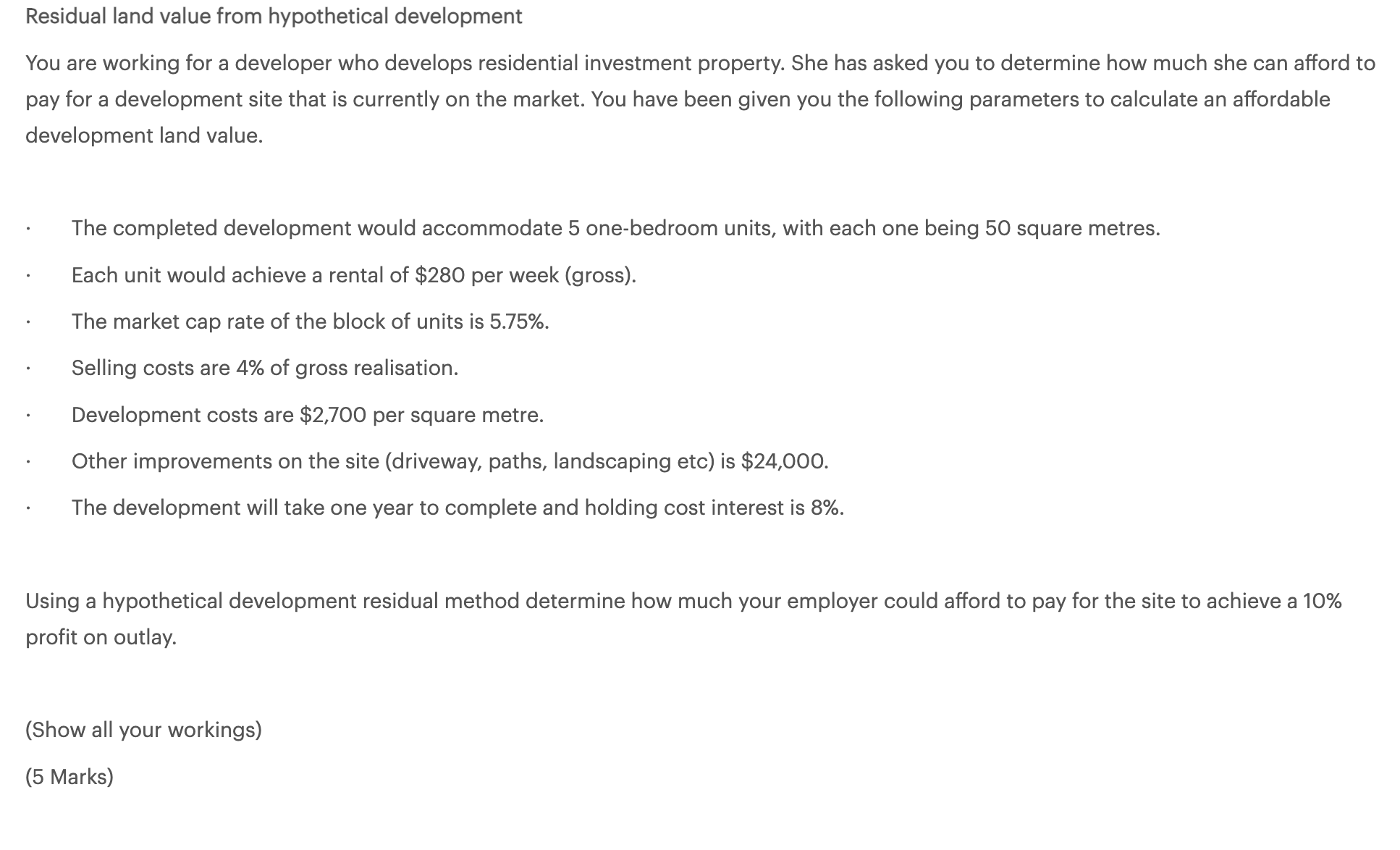

Residual land value from hypothetical development You are working for a developer who develops residential investment property. She has asked you to determine how much she can afford to pay for a development site that is currently on the market. You have been given you the following parameters to calculate an affordable development land value. The completed development would accommodate 5 one-bedroom units, with each one being 50 square metres. Each unit would achieve a rental of $280 per week (gross). The market cap rate of the block of units is 5.75%. Selling costs are 4% of gross realisation. Development costs are $2,700 per square metre. Other improvements on the site (driveway, paths, landscaping etc) is $24,000. The development will take one year to complete and holding cost interest is 8%. Using a hypothetical development residual method determine how much your employer could afford to pay for the site to achieve a 10% profit on outlay. (Show all your workings)

Residual land value from hypothetical development You are working for a developer who develops residential investment property. She has asked you to determine how much she can afford to pay for a development site that is currently on the market. You have been given you the following parameters to calculate an affordable development land value. The completed development would accommodate 5 one-bedroom units, with each one being 50 square metres. Each unit would achieve a rental of $280 per week (gross). The market cap rate of the block of units is 5.75%. Selling costs are 4% of gross realisation. Development costs are $2,700 per square metre. Other improvements on the site (driveway, paths, landscaping etc) is $24,000. The development will take one year to complete and holding cost interest is 8%. Using a hypothetical development residual method determine how much your employer could afford to pay for the site to achieve a 10% profit on outlay. (Show all your workings) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started