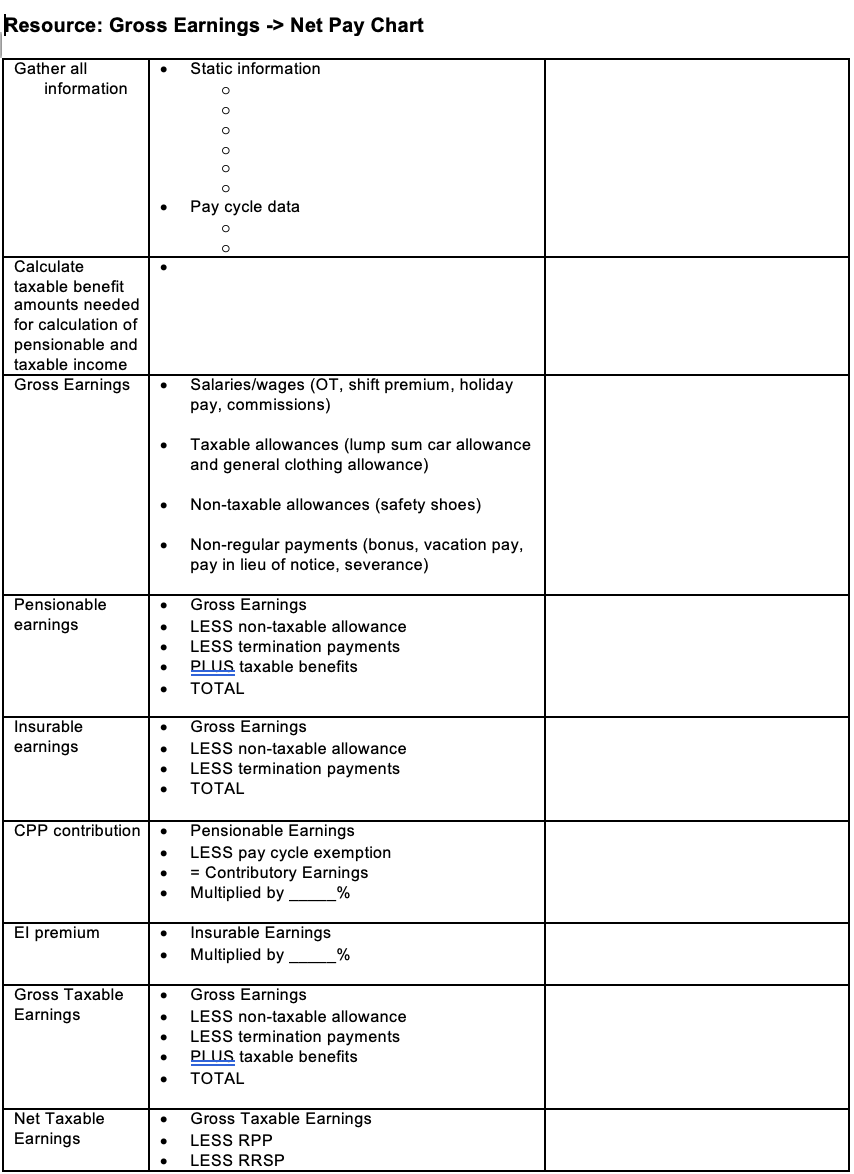

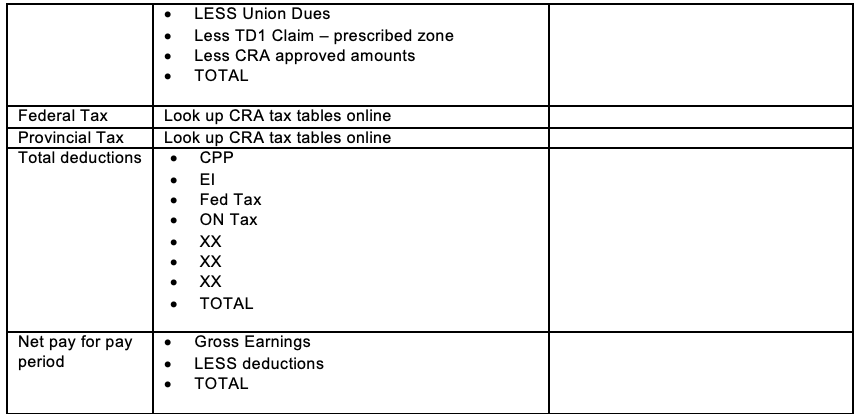

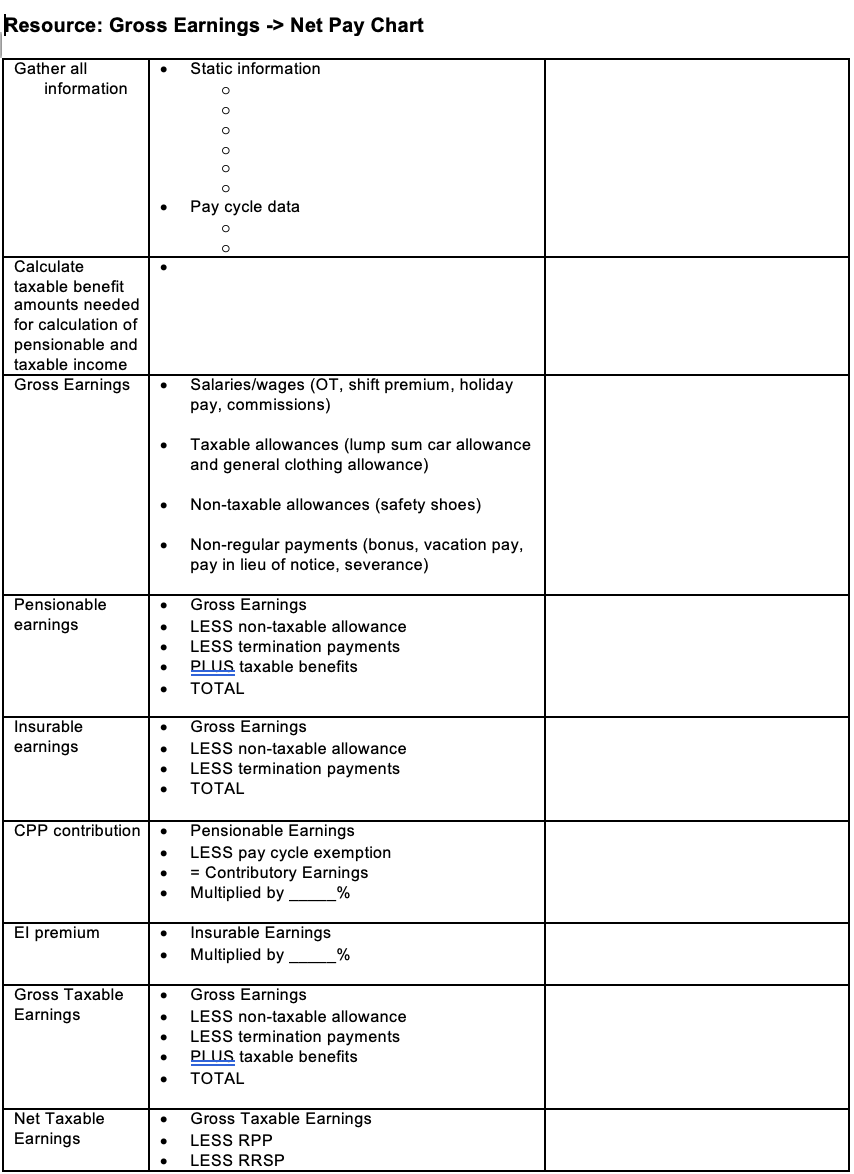

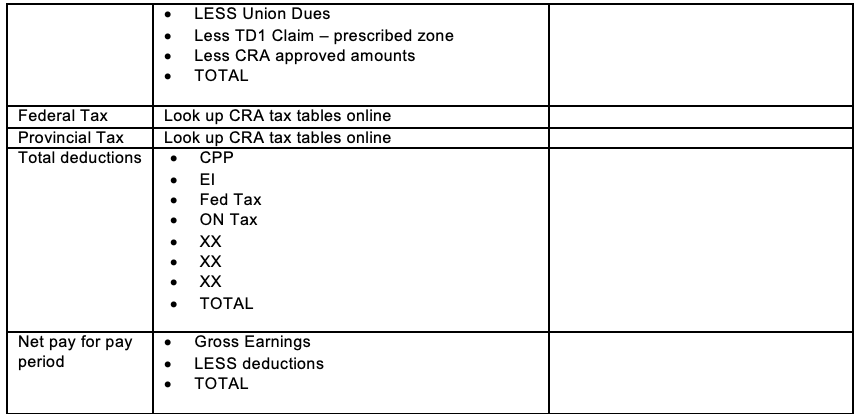

Resource: Gross Earnings -> Net Pay Chart . Static information Gather all information O O O o . Pay cycle data O Calculate taxable benefit amounts needed for calculation of pensionable and taxable income Gross Earnings Salaries/wages (OT, shift premium, holiday pay, commissions) . Taxable allowances (lump sum car allowance and general clothing allowance) . Non-taxable allowances (safety shoes) . Non-regular payments (bonus, vacation pay, pay in lieu of notice, severance) Pensionable earnings . Gross Earnings LESS non-taxable allowance LESS termination payments PLUS taxable benefits TOTAL . . Insurable earnings Gross Earnings LESS non-taxable allowance LESS termination payments TOTAL . CPP contribution . Pensionable Earnings LESS pay cycle exemption = Contributory Earnings Multiplied by ____% . . El premium . Insurable Earnings Multiplied by ___% . Gross Taxable Earnings . Gross Earnings LESS non-taxable allowance LESS termination payments PLUS taxable benefits TOTAL . . Net Taxable Earnings . Gross Taxable Earnings LESS RPP LESS RRSP . LESS Union Dues Less TD1 Claim - prescribed zone Less CRA approved amounts TOTAL Federal Tax Provincial Tax Total deductions Look up CRA tax tables online Look up CRA tax tables online CPP EI Fed Tax ON Tax XX XX XX TOTAL . Net pay for pay period Gross Earnings LESS deductions TOTAL Resource: Gross Earnings -> Net Pay Chart . Static information Gather all information O O O o . Pay cycle data O Calculate taxable benefit amounts needed for calculation of pensionable and taxable income Gross Earnings Salaries/wages (OT, shift premium, holiday pay, commissions) . Taxable allowances (lump sum car allowance and general clothing allowance) . Non-taxable allowances (safety shoes) . Non-regular payments (bonus, vacation pay, pay in lieu of notice, severance) Pensionable earnings . Gross Earnings LESS non-taxable allowance LESS termination payments PLUS taxable benefits TOTAL . . Insurable earnings Gross Earnings LESS non-taxable allowance LESS termination payments TOTAL . CPP contribution . Pensionable Earnings LESS pay cycle exemption = Contributory Earnings Multiplied by ____% . . El premium . Insurable Earnings Multiplied by ___% . Gross Taxable Earnings . Gross Earnings LESS non-taxable allowance LESS termination payments PLUS taxable benefits TOTAL . . Net Taxable Earnings . Gross Taxable Earnings LESS RPP LESS RRSP . LESS Union Dues Less TD1 Claim - prescribed zone Less CRA approved amounts TOTAL Federal Tax Provincial Tax Total deductions Look up CRA tax tables online Look up CRA tax tables online CPP EI Fed Tax ON Tax XX XX XX TOTAL . Net pay for pay period Gross Earnings LESS deductions TOTAL